Daily review of urea: Low-end market transactions increase, factory quotations are slightly adjusted (March 26)

China Urea Price Index:

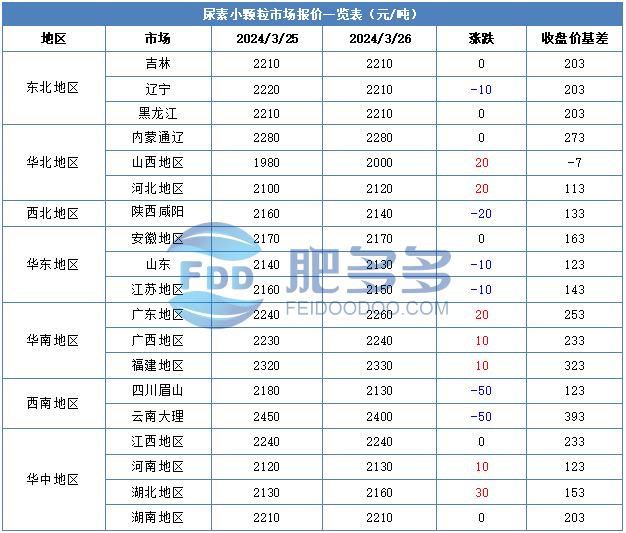

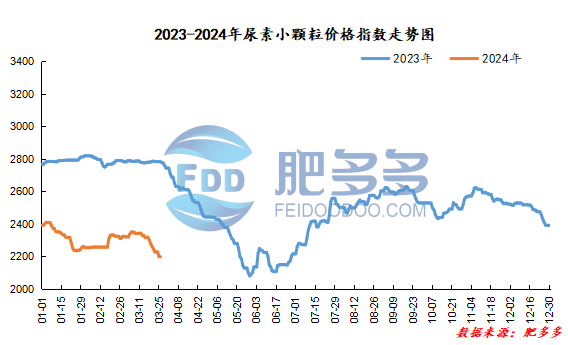

According to Feiduo data, the urea small pellet price index on March 26 was 2,196.95, a decrease of 1.05 from yesterday, a month-on-month decrease of 0.05% and a year-on-year decrease of 20.95%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2010, the highest price is 2045, the lowest price is 1999, the settlement price is 2022, and the closing price is 2007. The closing price has increased by 31 compared with the settlement price of the previous trading day, up 1.57% month-on-month. The fluctuation range of the whole day is 1999-2045; the basis of the 05 contract in Shandong is 123; the 05 contract has reduced its position by 11356 lots today, and so far, it has held 166622 lots.

Spot market analysis:

Today, China's urea market prices continued to decline. Recently, transactions at the low-end market have increased. Some mainstream companies have slightly raised their prices after receiving orders, and prices have fluctuated within a narrow range.

Specifically, prices in Northeast China fell to 2,200 - 2,220 yuan/ton. Prices in North China rose to 2,000 - 2,290 yuan/ton. Prices in East China rose to 2,120 - 2,170 yuan/ton. Prices in South China rose to 2,230 - 2,340 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,130 - 2,320 yuan/ton, and the price of large particles rose to 2,180 - 2,250 yuan/ton. Prices in Northwest China fell to 2,140 - 2,150 yuan/ton. Prices in Southwest China fell to 2,100 - 2,450 yuan/ton.

Market outlook forecast:

In terms of factories, factory ex-factory quotations continue to be lowered. After some manufacturers cut prices, low-end transactions have improved, orders have gradually increased, and quotations have increased slightly. However, the overall high-priced transactions are still weak, and factories have adjusted prices cautiously. In terms of the market, the on-site operation was deadlocked, the industry had a strong wait-and-see attitude, and the market was gradually stabilizing. Recently, transactions at the low-end market increased, but the overall price operation was difficult to support, and the market was operating in a weak position for a short time. On the supply side, most of the early maintenance equipment has been restored, and Nissan has risen in a narrow range. Industry supply continues to operate at a high level, with supply exceeding demand. On the demand side, downstream demand continues in the early stage, with a small amount of replenishment just needed, and the demand side is operating in a weak position.

On the whole, the current supply-demand relationship in the urea market is weak, and there is no good news to support high prices. It is expected that the urea market price will be stable and consolidated in a short period of time.