PVC: Futures prices fell below the mid-track position, falling three consecutive times since the high, and the focus of the spot market moved downward

PVC futures analysis: March 25th V2405 contract opening price: 5938, highest price: 5946, lowest price: 5873, position: 824506, settlement price: 5908, yesterday settlement: 5961, down: 53, daily trading volume: 807262 lots, precipitated capital: 3.394 billion, capital outflow: 90.28 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March 22nd |

March twenty _ fifth |

Rise and fall |

Remarks |

|

North China |

5580-5640 |

5530-5600 |

-50/-40 |

Send to cash remittance |

|

East China |

5630-5720 |

5580-5690 |

-50/-30 |

Cash out of the warehouse |

|

South China |

5680-5750 |

5650-5700 |

-30/-50 |

Cash out of the warehouse |

|

Northeast China |

5550-5700 |

5550-5690 |

0/-10 |

Send to cash remittance |

|

Central China |

5610-5660 |

5610-5640 |

0/-20 |

Send to cash remittance |

|

Southwest |

5510-5680 |

5490-5650 |

-20/-30 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices weakened at the beginning of the week, the spot market atmosphere is not good. Compared with the valuation, it fell by 40-50 yuan / ton in North China, 30-50 yuan / ton in East China, 10 yuan / ton in South China, 20 yuan / ton in Northeast China, 20 yuan / ton in Central China and 20-30 yuan / ton in Southwest China. Upstream PVC production enterprises factory prices down 10-50 yuan / ton, some enterprises continue to stabilize prices wait and see. The downward price of futures continued to weaken obviously, and the price quotation part of the spot market traders was slightly lower than that of last Friday. After the futures price went down, the price advantage of the spot market basis offer showed, both the point price source and the one-mouth price offer were available, but there were not many price inquiries. Most of them are inclined to the basis inquiry, including 05 contract in East China-(250), 05 contract in South China-(200), 05 contract in North China-(580). Southwest 05 contract-(300). After the futures price goes down, the lower order purchasing of downstream products enterprises, the spot transaction atmosphere has improved, but the downstream order price is generally on the low side.

From a futures point of view: & the price of the nbsp; PVC2405 contract fluctuated in a narrow range on Friday night trading, and the direction of the price was not clear. Prices fell slightly after the start of morning trading on Monday, and further weakened in the afternoon, falling below 5900 in intraday trading, which is relatively obvious as a whole. 2405 contracts range from 5873 to 5946 throughout the day, with a spread of 73. 05. The contract reduced its position by 13806 positions and has held 824506 positions so far. The 2409 contract closed at 6031, with 314528 positions.

PVC Future Forecast:

Futures: & the operation of the nbsp; PVC2405 contract futures fell below the 5900 position, and the operating range of the futures price, as we expected, continued to weaken below the mid-track position. The technical level shows that the opening of the three tracks of the Bolin belt (13, 13, 2) turns downward, the KD line at the daily line level shows a dead cross, and the futures price falls from the high point to the triple negative point, and has a large downward range from the high point 6048 to the present. At the beginning of the iteration, there is an inverted V-shaped trend, and today's market shows a slight increase in the number of positions leaving the market, and the empty opening is 23.4% compared with 20.0% more. On the whole, the operation of the futures price in the short term may continue to show the trend of winding the middle track, and continue to observe the performance in the low range of 5850-5900. Although there are downward expectations, there is not much room for expected.

Spot: & the downward price of nbsp; futures in the two markets has improved the transaction of the spot market to a certain extent. The spot market mainly buys down but does not buy up. After the futures price goes down, the spot market is active, but it is also limited to rigid demand. Speculative demand has returned to calm after a brief rise in the previous process, and the overall environment is slightly weaker. At present, the two cities of PVC continue to test the low range, the spot market turnover is light, whether upstream production enterprises or middlemen feedback are poor delivery rhythm. Therefore, the spot market is still facing greater pressure. On the outer disk, international oil prices closed lower as the possibility of a ceasefire in Gaza softened oil prices, while the European war and the reduction in the number of US drilling rigs eased the decline in oil prices. At the same time, the stronger dollar is also putting pressure on oil prices. On the whole, the pace of slight adjustment in the spot market remains unchanged in the short term, and it does not have a clear direction at present.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March 22nd |

March twenty _ fifth |

Rate of change |

|

V2405 collection |

5938 |

5881 |

-57 |

|

|

Average spot price in East China |

5675 |

5635 |

-40 |

|

|

Average spot price in South China |

5715 |

5675 |

-40 |

|

|

PVC2405 basis difference |

-263 |

-246 |

17 |

|

|

V2409 collection |

6087 |

6031 |

-56 |

|

|

V2405-2409 close |

-149 |

-150 |

-1 |

|

|

PP2405 collection |

7533 |

7506 |

-27 |

|

|

Plastic L2405 collection |

8238 |

8219 |

-19 |

|

|

V--PP basis difference |

-1595 |

-1625 |

-30 |

|

|

Vmure-L basis difference of plastics |

-2300 |

-2338 |

-38 |

|

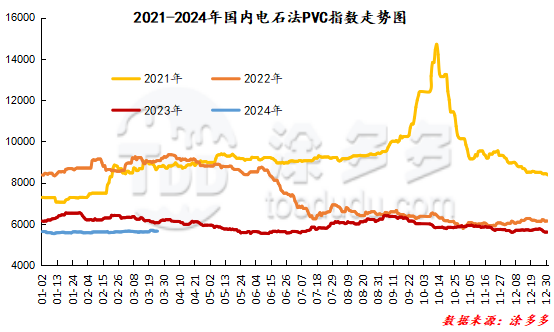

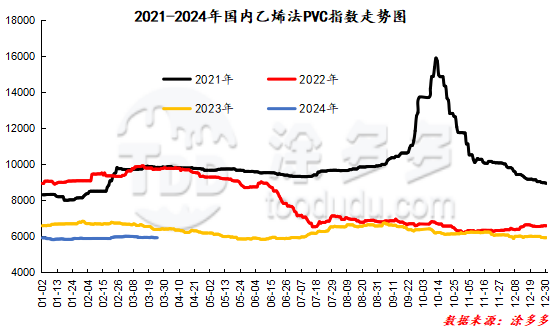

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 33.85% to 5621.36 on March 25, a range of 0.599%. The ethylene PVC spot index was 5904.65, down 17.66, or 0.298%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 283.29.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.22 warehouse orders |

3.25 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,325 |

1,254 |

-71 |

|

|

China Central Reserve Nanjing |

1,325 |

1,254 |

-71 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,706 |

522 |

-1,184 |

|

|

Zhenjiang Middle and far Sea |

1,366 |

522 |

-844 |

|

|

Middle and far sea in Jiangyin |

340 |

0 |

-340 |

|

Polyvinyl chloride |

Peak supply chain |

1,988 |

1,988 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,632 |

1,632 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

7,587 |

512 |

-7,075 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,070 |

1,070 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

220 |

220 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

44 |

44 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

41 |

-259 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

1 |

1 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

114 |

114 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

241 |

241 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

249 |

249 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

80 |

80 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,394 |

1,388 |

-6 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

10 |

10 |

0 |

|

PVC subtotal |

|

19,199 |

10,604 |

-8,595 |

|

Total |

|

19,199 |

10,604 |

-8,595 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.