Daily review of urea: Factory quotations continue to be lowered, mainly for downstream procurement and market observation (March 25)

China Urea Price Index:

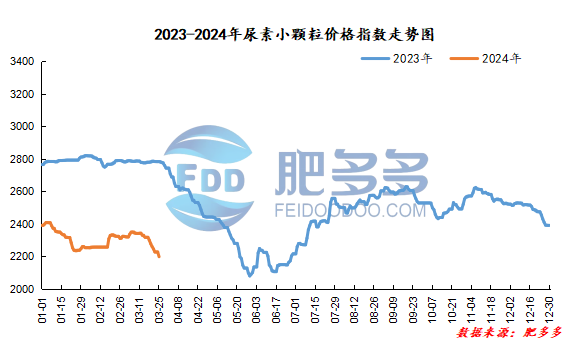

According to Feiduo data, the urea small pellet price index on March 25 was 2,198.00, a decrease of 29.09 from last Friday, a month-on-month decrease of 1.31% and a year-on-year decrease of 21.03%.

Urea futures market:

Today, the opening price of urea UR405 contract is 1971, the highest price is 2000, the lowest price is 1946, the settlement price is 1976, the closing price is 1996, the closing price is 2 higher than the settlement price of the previous trading day, up 0.10% month-on-month, and the fluctuation range throughout the day is 1946-2000; the basis of the 05 contract in Shandong is 144; the 05 contract has reduced its position by 13668 lots today, and so far, it has held 177978 lots.

Spot market analysis:

Today, China's urea market prices continued to fall and were operating in a weak position. Most market transactions remained low-end, and high-priced transactions were weak.

Specifically, prices in Northeast China have stabilized at 2,200 - 2,230 yuan/ton. Prices in North China fell to 1,980 - 2,290 yuan/ton. Prices in East China fell to 2,110 - 2,170 yuan/ton. Prices in South China fell to 2,220 - 2,330 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,120 - 2,320 yuan/ton, and the price of large particles fell to 2,140 - 2,250 yuan/ton. Prices in Northwest China fell to 2,160 - 2,170 yuan/ton. Prices in Southwest China fell to 2,150 - 2,500 yuan/ton.

Market outlook forecast:

In terms of factories, factories have followed up a small number of new orders, resulting in poor shipments, and accumulated inventory. In order to receive new orders, the ex-factory quotations of most manufacturers have continued to fluctuate and be lowered, and many low-end goods have been received in a short period of time. In terms of the market, the positive export news is still unclear, and the mentality of the industry is pessimistic. There is currently a lack of substantial positive supporting news in the market, and the market is operating in a weak position. Recently, low-end transactions in some regions have shown signs of increasing, and the industry has maintained a cautious wait-and-see mentality. In terms of supply, the industry's supply side remains high and continues to be in a relatively affluent state, temporarily negative on the supply side. On the demand side, downstream demand has not followed up sufficiently. Purchasing at high prices is cautious, and making up for orders at low prices is weak, so for the time being, we will mainly wait and see market trends.

On the whole, the current operation of the urea market is weak, and new orders are followed up in a small number of low-end orders, which is difficult to support price increases. It is expected that the urea market price will have difficulty rising in a short period of time, and there will be many shocks and downward consolidation.