PVC: The rise in futures prices came to an abrupt end, encountered a correction and left the market for short-term profits, and the spot market weakened and went downward.

PVC futures analysis: March 22nd V2405 contract opening price: 5977, highest price: 6003, lowest price: 5925, position: 838312, settlement price: 5961, yesterday settlement: 6017, down: 56, daily trading volume: 893373 lots, precipitated capital: 3.485 billion, capital outflow: 155 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March 21 |

March 22nd |

Rise and fall |

Remarks |

|

North China |

5590-5670 |

5580-5640 |

-10/-30 |

Send to cash remittance |

|

East China |

5690-5790 |

5630-5720 |

-60/-70 |

Cash out of the warehouse |

|

South China |

5750-5790 |

5680-5750 |

-70/-40 |

Cash out of the warehouse |

|

Northeast China |

5550-5700 |

5550-5700 |

0/0 |

Send to cash remittance |

|

Central China |

5650-5700 |

5610-5660 |

-40/-40 |

Send to cash remittance |

|

Southwest |

5530-5720 |

5510-5680 |

-20/-40 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price center of gravity has moved down, the spot market atmosphere has weakened. Compared with the valuation, it fell by 10-30 yuan / ton in North China, 60-70 yuan / ton in East China, 40-70 yuan / ton in South China, stable in Northeast China, 40 yuan / ton in Central China and 20-40 yuan / ton in Southwest China. Upstream PVC production enterprises factory prices began to reduce 20-50 yuan / ton, but there are still some enterprises to maintain a stable wait-and-see, coinciding with the Friday generation of contracts signed not much. The price of futures fell significantly on the spot market, and the price offered by traders in the spot market was generally lower than that of yesterday, and the prices of some urgent delivery sources in the South China market were slightly lower, and some actual orders were still slightly negotiated. After the futures price went down, the spot price advantage increased, and the basis offer changed little, including 05 contract in East China-(250), 05 contract in South China-(200), 05 contract in North China-(540-580), and 05 contract in Southwest China-(300). After the futures price goes down, some downstream products enterprises have a rigid demand for replenishment at low order prices, while some wait and see temporarily.

From the perspective of futures: & the fluctuation range of night futures price of nbsp; PVC2405 contract is relatively narrow, and the fluctuation direction of futures price is unknown. After the beginning of morning trading, the price fell obviously, the intraday returned to the previous range, and the afternoon price fluctuated in the low range of the whole day. 2405 the contract fluctuates from 5925 to 6003 throughout the day, with a spread of 78. 05. The contract reduced its position by 30470 hands, and has held 838312 positions so far. The 2409 contract closed at 6087, with 308956 positions.

PVC Future Forecast:

Futures: & the operation of the nbsp; PVC2405 contract futures price dropped significantly from the high price, from the upper position down to the middle rail position, the technical level shows that the Bollinger belt (13, 13, 2) three-track opening is still divergent, but the downward price gives up a continuous increase, leading to re-weakening, and the daily KD line ends a short golden fork trend, and the two lines begin to cross. The market showed a state of reducing positions, partly because it happened to be out of the market on Friday, and on the other hand, it has been profitable since yesterday. The correction of futures prices has hit the confidence of some participants. In the short term, we think that the operation of futures prices will observe the entanglement performance of the middle track and observe the performance in the range of 5880-5980.

Spot aspect: & the operation of the two cities' prices in the nbsp; period does not show persistence in the high range. We have been referring to the persistence of the high range in our recent forecasts. Today's Friday session, the prices of the two cities have fallen back to the previous range, giving up the gains of Wednesday and Thursday. The overall commodity performance closed at midday, while the main contract of Chinese futures fell more and rose less. Rubber fell by more than 4%. NR fell by more than 3%, lithium carbonate by more than 2%, and Shanghai silver, Shanghai nickel, bean 2, soybean meal, rapeseed meal, red jujube and industrial silicon by more than 1.5%. PVC also weakened, and the brief speculative demand in the spot market came to an abrupt end. International oil prices closed lower on the outer disk, affected by weak US gasoline demand data and reports of a draft UN resolution calling for a ceasefire in Gaza. As a whole, the PVC spot market may return to the stage of pre-shock consolidation in the short term, and the price fluctuations may be relatively limited.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March 21 |

March 22nd |

Rate of change |

|

V2405 collection |

5984 |

5938 |

-46 |

|

|

Average spot price in East China |

5740 |

5675 |

-65 |

|

|

Average spot price in South China |

5770 |

5715 |

-55 |

|

|

PVC2405 basis difference |

-244 |

-263 |

-19 |

|

|

V2409 collection |

6126 |

6087 |

-39 |

|

|

V2405-2409 close |

-142 |

-149 |

-7 |

|

|

PP2405 collection |

7593 |

7533 |

-60 |

|

|

Plastic L2405 collection |

8341 |

8238 |

-103 |

|

|

V--PP basis difference |

-1609 |

-1595 |

14 |

|

|

Vmure-L basis difference of plastics |

-2357 |

-2300 |

57 |

|

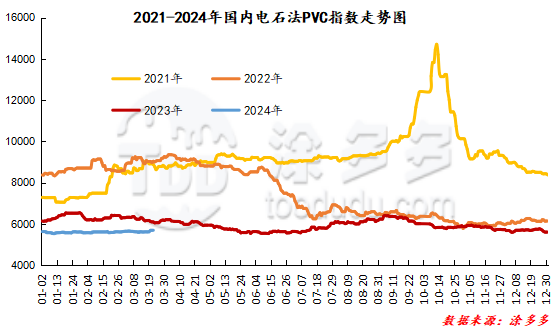

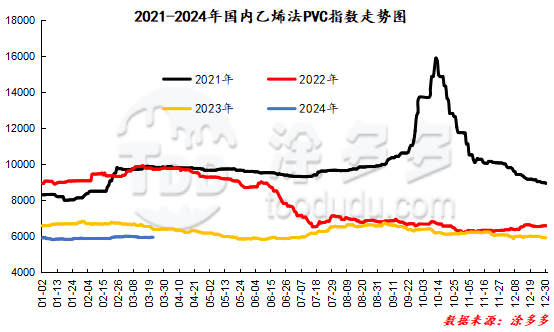

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 43.28, or 0.759%, to 5655.21 on March 22. The ethylene PVC spot index was 5922.31, down 25.72, with a range of 0.432%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 267.1.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.21 warehouse receipts |

3.22 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,325 |

1,325 |

0 |

|

|

China Central Reserve Nanjing |

1,325 |

1,325 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,726 |

1,706 |

-20 |

|

|

Zhenjiang Middle and far Sea |

1,372 |

1,366 |

-6 |

|

|

Middle and far sea in Jiangyin |

354 |

340 |

-14 |

|

Polyvinyl chloride |

Peak supply chain |

1,988 |

1,988 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,837 |

1,632 |

-205 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

7,927 |

7,587 |

-340 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,070 |

1,070 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

0 |

-84 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

220 |

220 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

44 |

44 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

1 |

1 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

120 |

114 |

-6 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

241 |

241 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

249 |

249 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

80 |

80 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,394 |

1,394 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

378 |

10 |

-368 |

|

PVC subtotal |

|

20,222 |

19,199 |

-1,023 |

|

Total |

|

20,222 |

19,199 |

-1,023 |

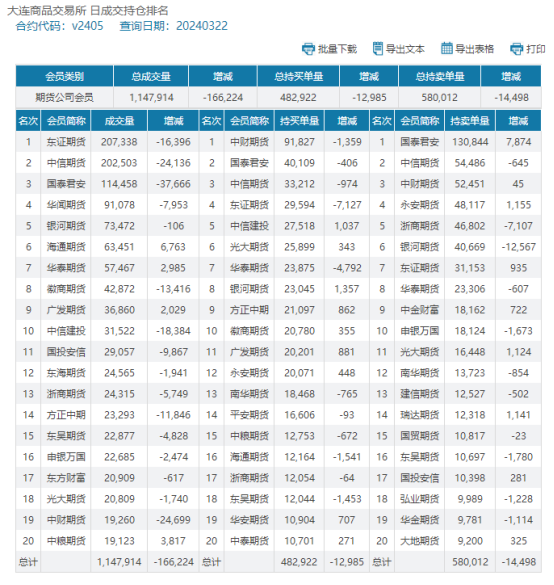

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.