PVC: The futures price successfully broke through the prefix 6, the bullish sentiment was high, and the spot market continued to rise

PVC futures analysis: March 20 V2405 contract opening price: 5959, highest price: 6041, lowest price: 5944, position: 889626, settlement price: 5999, yesterday settlement: 5939, up: 60, daily trading volume: 988376 lots, precipitated capital: 3.753 billion, capital inflow: 194 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March nineteenth |

March 20th |

Rise and fall |

Remarks |

|

North China |

5540-5630 |

5590-5670 |

50/40 |

Send to cash remittance |

|

East China |

5620-5710 |

5700-5790 |

80/80 |

Cash out of the warehouse |

|

South China |

5640-5730 |

5710-5790 |

70/60 |

Cash out of the warehouse |

|

Northeast China |

5500-5650 |

5550-5700 |

50/50 |

Send to cash remittance |

|

Central China |

5590-5650 |

5650-5700 |

60/50 |

Send to cash remittance |

|

Southwest |

5510-5700 |

5530-5720 |

20/20 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices continue to rise, spot market sentiment continues to improve. Compared with the valuation, North China rose 40-50 yuan / ton, East China 80 yuan / ton, South China 60-70 yuan / ton, Northeast China 50 yuan / ton, Central China 50-60 yuan / ton, and Southwest China 20 yuan / ton. The ex-factory price of upstream PVC production enterprises rose by 40-50 yuan / ton, while the more radical enterprises increased by 60-70 yuan / ton, but there are still some enterprises that wait and see to stabilize prices, and there are different mentalities in the upstream. Futures run mainly on the strong side, and prices further break through. The spot market traders offered higher prices than yesterday, and the supply of low-priced goods decreased. With the rise of futures, the point-price offer advantage decreased, but there was still a basis offer, including 05 contracts in East China-(280). South China 05 contract-(200), North 05 contract-(550), Southwest 05 contract-(300). After the prices of the two cities have risen, some traders have the behavior of receiving goods, and the purchasing enthusiasm of the lower reaches is low, and some of them wait and see temporarily.

From the perspective of futures: & the night price of the nbsp; PVC2405 contract is mainly arranged in a narrow range, and the fluctuation range of the futures price is relatively small. At the beginning of early trading, prices rose all the way up, successfully breaking through the 6-word peak and hitting 6041, and afternoon prices were sorted out above 6000 until the end of the day. 2405 contracts range from 5944 to 6041 throughout the day, with a spread of 97. 05 contracts with an increase of 35104 positions and 889626 positions so far. The 2409 contract closed at 6172, with 269936 positions.

PVC Future Forecast:

Futures: & the operation of the nbsp; PVC2405 contract futures price successfully broke through the prefix of 6, the highest point of 6041. And the market appeared to increase the price of the upward phenomenon, long entry is relatively obvious, in terms of transaction, the opening of 27.2% more than the empty opening of 23.1% is in an absolutely suppressed situation. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) is obvious, and the price goes up further after it has been put on the orbit, and the trend of the all-day price shows a cross. The KD line and MACD line at the daily line level show a golden fork trend, because the relative fluctuation range of the recent futures price has narrowed, so the technical level changes greatly after the range of today's futures price is slightly expanded. In the short term, the operation of futures prices continues to observe the position on the track and the persistence of the high range of 6000-6050.

Spot aspect: & the continuous upward price of nbsp; futures in the two markets, especially today's futures prices break through the track to maintain further push up, which triggered part of the speculative demand in the spot market, and some traders are more active in receiving goods than in the previous period. But the downstream demand performance is relatively light, and the wait-and-see mentality is in the majority. PVC fundamentals in which calcium carbide prices rose slightly 50 yuan / ton, the cost port slightly supported, coupled with Formosa Plastics prices rose slightly yesterday. At present, there are not many variables in the supply and demand level, especially after the release of real estate data, the corresponding downstream demand enterprises maintain a wait-and-see attitude towards the upward price of the two cities. International oil prices continued to close higher, reaching their highest level since late October, as traders assessed how Ukraine's recent attack on Russian refineries would affect global oil supplies. On the whole, in the short term, the PVC spot market observes the stability of market prices after the rise.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March nineteenth |

March 20th |

Rate of change |

|

V2405 collection |

5951 |

6027 |

76 |

|

|

Average spot price in East China |

5665 |

5745 |

80 |

|

|

Average spot price in South China |

5685 |

5750 |

65 |

|

|

PVC2405 basis difference |

-286 |

-282 |

4 |

|

|

V2409 collection |

6102 |

6172 |

70 |

|

|

V2405-2409 close |

-151 |

-145 |

6 |

|

|

PP2405 collection |

7617 |

7635 |

18 |

|

|

Plastic L2405 collection |

8326 |

8355 |

29 |

|

|

V--PP basis difference |

-1666 |

-1608 |

58 |

|

|

Vmure-L basis difference of plastics |

-2375 |

-2328 |

47 |

|

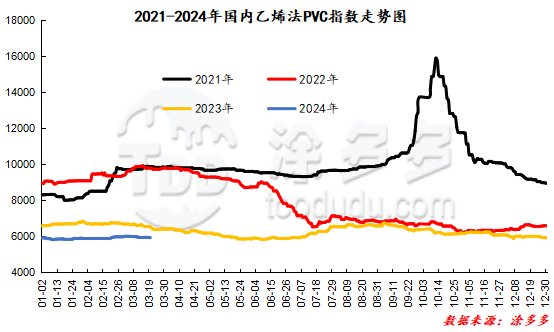

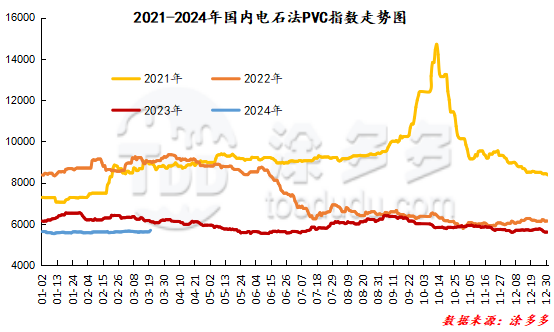

China PVC Index: according to Tudoduo data, the spot index of China's calcium carbide PVC rose 59.16, or 1.05%, to 5695.57 on March 20. The ethylene method PVC spot index is 5948.03, Zhang 21.52, the range is 0.363%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 252.46.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.19 warehouse orders |

3.20 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,561 |

1,466 |

-95 |

|

|

China Central Reserve Nanjing |

1,561 |

1,466 |

-95 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,786 |

1,786 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,372 |

1,372 |

0 |

|

|

Middle and far sea in Jiangyin |

414 |

414 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,020 |

1,988 |

-32 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,983 |

1,837 |

-146 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

17,053 |

11,753 |

-5,300 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,080 |

1,070 |

-2,010 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

329 |

220 |

-109 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

1,555 |

165 |

-1,390 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

0 |

-230 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

1 |

1 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

120 |

120 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

241 |

-445 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

249 |

-51 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

1,712 |

-687 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

165 |

0 |

-165 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

440 |

378 |

-62 |

|

PVC subtotal |

|

38,129 |

27,407 |

-10,722 |

|

Total |

|

38,129 |

27,407 |

-10,722 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.