PVC: The upward trend of futures prices is approaching the upper track position. Both long and short sides have opened positions, and the spot market has risen slightly.

PVC futures analysis: March 19th V2405 contract opening price: 5920, highest price: 5977, lowest price: 5902, position: 854522, settlement price: 5939, yesterday settlement: 5906, up: 33, daily trading volume: 925168 lots, precipitated capital: 3.56 billion, capital inflow: 57.17 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March eighteenth |

March nineteenth |

Rise and fall |

Remarks |

|

North China |

5540-5590 |

5540-5630 |

0/40 |

Send to cash remittance |

|

East China |

5590-5680 |

5620-5710 |

30/30 |

Cash out of the warehouse |

|

South China |

5640-5720 |

5640-5730 |

0/10 |

Cash out of the warehouse |

|

Northeast China |

5500-5650 |

5500-5650 |

0/0 |

Send to cash remittance |

|

Central China |

5590-5630 |

5590-5650 |

0/20 |

Send to cash remittance |

|

Southwest |

5480-5650 |

5510-5700 |

30/50 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices rose slightly, market sentiment warmed up. Compared with the valuation, North China rose 40 yuan / ton, East China 30 yuan / ton, South China 10 yuan / ton, Northeast China stable, Central China 20 yuan / ton, Southwest China 30-50 yuan / ton. The ex-factory price of upstream PVC production enterprises tentatively increased by 10-20-50 yuan / ton, the price adjustment range of production enterprises in different regions is different, and there are still some enterprises wait and see price stability. Futures rose strongly, the spot market atmosphere improved, traders offered a higher price than yesterday, but there was still resistance to the completion of the high-price offer, the spot price advantage decreased after the price went up, the two offers still coexisted, and the basis adjustment was small. Among them, East China basis offer 05 contract-(250), South China 05 contract-(150-200), North 05 contract-(500-550), Southwest 05 contract-(300). On the whole, the spot market is still dominated by rigid demand today, and most of the transactions are concentrated before the price rise.

Futures point of view: PVC2405 contract night trading price opening narrow collation, to the end of the night market did not see an obvious fluctuation direction. After the start of morning trading, it continued on the basis of night trading, but the price rose significantly in the late morning and fell slightly in the afternoon. 2405 contracts range from 5902 to 5977 throughout the day, with a spread of 75. 05. The contract reduced its position by 9320 hands and has held 854522 positions so far. The 2409 contract closed at 6102, with 252760 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures after a long period of volatility, the high point rose, the range of price fluctuations as we expected, the high began to gradually approach the upper track position. And the overall operating range of the futures price is above the MA combination line. In terms of trading, there was a slight increase in positions, with both sides of the long and short positions showing a balance of 23.7%. There is a partial short opening under the high futures price, while there is more entry at the low futures price to carry out short-term speculation. The technical level shows the opening trend of the three-track opening of the Bolin belt (13, 13, 2), and the KD line at the daily level shows a golden fork trend. Short-term futures price fluctuations observe the performance of the high range of 5950-6000, and continue to observe the breakthrough of the prefix 6.

Spot: real estate data released yesterday did not have a greater impact on the market, the overall cultural goods index operation is also close to the track, and PVC followed commodity sentiment also showed a certain push up performance, but the current volatility of the two cities in PVC is still framed in a relatively narrow range. There is a certain degree of pressure on the upside and a certain range of support for the decline, and the factors of breaking the situation at the current stage are insufficient. Taiwan Formosa Plastics PVC In April, the export shipping date is quoted by US $10, Taiwan FOB FOB is quoted at US $760, India CIF CFR is quoted at US $830, mainland CIF CFR is quoted at US $805, and Southeast Asia CFR is quoted at US $800. The performance of the two markets is in a dilemma of relative ups and downs. In the outer disk, international oil prices climbed to a four-month high as Ukrainian drones continued to attack Russian refineries, crude oil exports from Iraq and Saudi Arabia fell, and there were signs of stronger economic growth and demand in China and the United States. On the whole, the trend of slight adjustment in the PVC spot market in the short term is maintained.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March eighteenth |

March nineteenth |

Rate of change |

|

V2405 collection |

5920 |

5951 |

31 |

|

|

Average spot price in East China |

5635 |

5665 |

30 |

|

|

Average spot price in South China |

5680 |

5685 |

5 |

|

|

PVC2405 basis difference |

-285 |

-286 |

-1 |

|

|

V2409 collection |

6070 |

6102 |

32 |

|

|

V2405-2409 close |

-150 |

-151 |

-1 |

|

|

PP2405 collection |

7610 |

7617 |

7 |

|

|

Plastic L2405 collection |

8312 |

8326 |

14 |

|

|

V--PP basis difference |

-1690 |

-1666 |

24 |

|

|

Vmure-L basis difference of plastics |

-2392 |

-2375 |

17 |

|

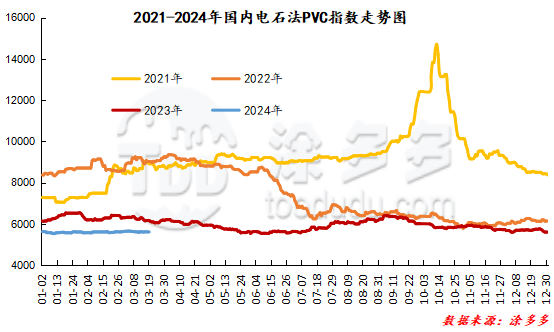

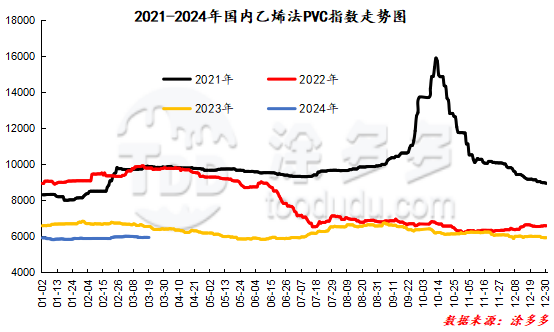

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot index rose 19.01, or 0.338%, to 5636.41 on March 19. The ethylene method PVC spot index was 5926.51, down 10.78%, with a range of 0.182%. The calcium carbide method index rose, the ethylene method index decreased, and the ethylene-calcium carbide index spread was 290.1.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.18 warehouse orders |

3.19 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,602 |

1,561 |

-41 |

|

|

China Central Reserve Nanjing |

1,602 |

1,561 |

-41 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,786 |

1,786 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,372 |

1,372 |

0 |

|

|

Middle and far sea in Jiangyin |

414 |

414 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,020 |

2,020 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,983 |

1,983 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

17,253 |

17,053 |

-200 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,080 |

3,080 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

329 |

329 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

1,555 |

1,555 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

1 |

1 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

120 |

120 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

686 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

165 |

165 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

440 |

440 |

0 |

|

PVC subtotal |

|

38,370 |

38,129 |

-241 |

|

Total |

|

38,370 |

38,129 |

-241 |

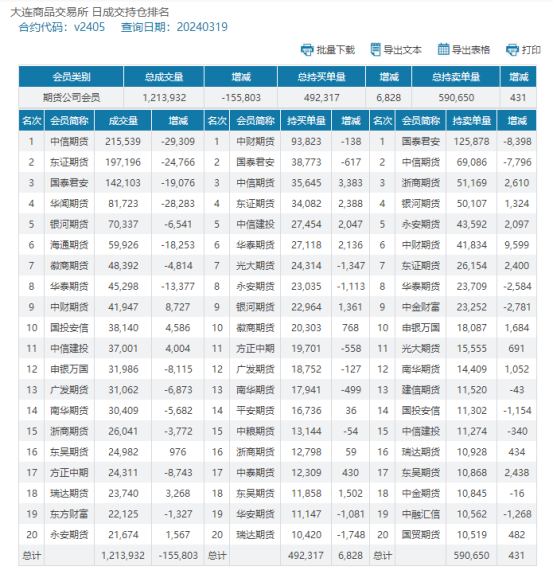

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.