Polyester: Costs remain high and the market moves forward with heavy burdens

Since mid-March, polyester raw material PTA market continues to be in a strong shock pattern. Geopolitical instability continued, Ukrainian drones continued to attack Russian refineries, Saudi and Iraqi crude oil exports fell, China and the United States grew and demand was strong, and European and American crude oil futures rose to their highest level since late October. The continued rise in the cost side has boosted the mentality of China's commodity market, and the PTA spot market has strengthened slightly. So far, East China PTA spot market negotiations reference 5930 yuan / ton. This week and next week, the main port delivery 05 discount 33-40 near the transaction and negotiations. From the supply side, there are fewer PTA maintenance devices in the short term, so the overall start-up of the PTA industry maintains a high level of more than 80%. In addition, with the commissioning of new devices in the later stage, the market supply remains abundant, and the inventory pressure of the industry itself is greater, so it is difficult for the market to form a sustained upward trend. Downstream polyester load continues to pick up, coupled with the pick-up in terminal textile weaving demand, the market demand side will continue to improve. The international crude oil market fluctuates at a high level, and the cost supports the market. Therefore, the short-term PTA spot market will be mainly high adjustment.

Polyester raw material ethylene glycol market recently maintained a high level of shock. High-end cost support, ethylene glycol market talks about the adjustment of the center of gravity, East China quotation in 4505-4510 yuan / ton. On the supply side, the performance of the demand side is low, the recent delivery of ethylene glycol port is slow, and the East China port is expected to be burdened, while from March to April, the centralized overhaul of China's ethylene glycol plant has increased, the industry has gradually declined, and the market supply expectation has been reduced. form a certain support to the market; demand: downstream polyester load continues to pick up, demand is increasing steadily. Recently, the international crude oil market has maintained a high level, and the cost side has promoted the market. In the short term, the price of ethylene glycol in China maintains a volatile pattern.

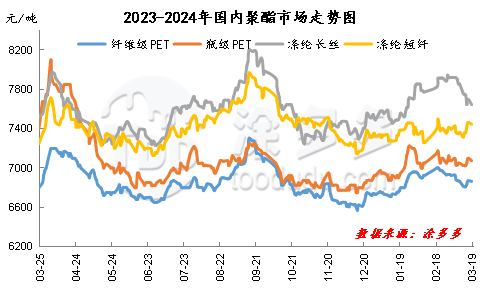

Facing the high raw material cost in China's polyester market, the production cost pressure of polyester enterprises is gradually increasing, but due to the drag of weak demand, the fluctuation range of polyester market is small, so the profits of polyester enterprises begin to shrink continuously. Among them, the profit of polyester chip production fell to the profit-loss line, polyester filament production also began to drop to a loss, polyester bottle chips and polyester staple fiber enterprises continued to lose money. As of Thursday, the profit of sliced products is-8 yuan / ton, bottle chip products is-198 yuan / ton, polyester filament products profit is-128 yuan / ton, polyester staple fiber products profit is-78 yuan / ton.

At present, the overall start-up load of China's polyester enterprises has risen to a high level of 89%, and there will still be a number of maintenance devices to recover in the short term, so the polyester load is expected to rise to more than 90% by the end of the month, close to the high level of the same period last year. In the accelerated recovery of terminal weaving enterprises, the start-up of terminal weaving enterprises has risen to more than 80%, the start-up of texturing enterprises has risen to 93%, and the start-up of printing and dyeing enterprises has risen to around 87%. At present, foreign trade orders in the textile market have increased, mostly for rigid demand procurement, and orders have increased in spring and summer, while weaving manufacturers mainly consume raw material inventory, and the purchase intention of raw materials is not good, so the production and sales of polyester enterprises are relatively low recently. The production and marketing of Chinese polyester enterprises has been maintained at about 30-60% in the near future, so polyester enterprises will face greater inventory pressure.

The high fluctuation of the international crude oil market promotes the formation of the market, the supply and demand side of the polyester raw material PTA and ethylene glycol market is promoted, it is expected that the short-term market will be high-level adjustment, polyester raw material end support, polyester market offer will mainly adjust slightly with the cost, downstream demand follow-up insufficient, market production and sales downturn. Short-term polyester market prices are expected to fluctuate within a narrow range. In the later stage, we should pay close attention to the changes of the raw material market and the supply and demand of polyester itself.