PVC: The fluctuation range of futures has expanded, showing a V-shaped trend, and the spot market has adjusted within a narrow range

PVC futures analysis: March 18 V2405 contract opening price: 5934, highest price: 5954, lowest price: 5856, position: 845202, settlement price: 5906, yesterday settlement: 5907, down: 1, daily trading volume: 1069870 lots, precipitated capital: 3.503 billion, capital outflow: 7.93 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March fifteenth |

March eighteenth |

Rise and fall |

Remarks |

|

North China |

5550-5600 |

5540-5590 |

-10/-10 |

Send to cash remittance |

|

East China |

5610-5700 |

5590-5680 |

-20/-20 |

Cash out of the warehouse |

|

South China |

5620-5700 |

5640-5720 |

20/20 |

Cash out of the warehouse |

|

Northeast China |

5500-5650 |

5500-5650 |

0/0 |

Send to cash remittance |

|

Central China |

5590-5630 |

5590-5630 |

0/0 |

Send to cash remittance |

|

Southwest |

5480-5650 |

5480-5650 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices are arranged in a narrow range, and merchants in various regions adjust flexibly. Compared with the valuation, it fell 10 yuan / ton in North China, 20 yuan / ton in East China, 20 yuan / ton in South China, and stable in Northeast, Central and Southwest China. Upstream PVC production enterprise factory price most enterprises maintain a stable quotation, individual enterprises in order to reduce inventory slightly reduced 50 yuan / ton, in order to promote the signing of a generation of contracts. The futures market has ups and downs, the fluctuation range has been expanded, the trader price offer has been partially raised compared with last Friday, but the high price offer has little real support, the spot market price and point price coexist, and the basis offer is not adjusted greatly. among them, East China basis offer 05 contract-(250), South China 05 contract-(150-200), North 05 contract-(500-550), Southwest 05 contract-(300). At present, the spot market price and one-mouth price have little basic advantage, the downstream purchasing enthusiasm is low, the wait-and-see intention is strong, and the spot transaction atmosphere is weak.

From the perspective of futures: & the night price of the nbsp; PVC2405 contract began to decline from the high point, and the overall decline in the night market was larger, and the volatility range was extended to repair the upstream part of the late session. After the beginning of early trading, the price formed a V-shaped trend in the afternoon, falling first and then rising slightly. 2405 contracts range from 5856 to 5954 throughout the day, with a spread of 985.05 contracts reduced their positions by 486lots, and so far they have held 845202 positions. The 2409 contract closed at 6070, with 235449 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures show an enlarged volatility range, especially the night market volatility is relatively intense, running from high to low 98 points. On Monday, compared with the period of time, the fluctuation of the futures price tends to be narrow. The technical level shows that the opening of the third rail of the Bollinger belt (13, 13, 2) is still narrowed, and the future price rises further upward from the low point of the lower rail through the middle rail, showing a long shadow column, and the KD line of the daily line shows a dead fork trend. Although the current market volatility range has expanded, but the recent price fluctuations have been upward pressure, falling support, short-term futures prices are expected to maintain a narrow volatility trend, continue to observe fluctuations in the range of 5850-6000, especially how to break through the prefix 6.

Spot: first real estate data: national Bureau of Statistics, from January to February 2024, national real estate development investment was 1.1842 trillion yuan, down 9.0% from the same period last year, of which residential investment was 882.3 billion yuan, down 9.7%. PVC supply and demand level is still maintained in the early stage, chlor-alkali plant start-up load is stable, downstream demand is mainly rigid demand, speculative demand has not been generated, VCM monomer, Taixing Xinpu VCM today reduced 50 factory acceptance by 5100-5150, weekly pricing. Oil prices fell in the outer disk as merchants took profits after oil prices hit a more than four-month high. Under the support of a more optimistic demand outlook, oil prices have risen to more than four-month highs, and US WTI crude oil futures have also stood above $80 per barrel, with investors locking in profits in the face of rapidly rising prices. On the whole, the PVC spot market will continue to adjust narrowly in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March fifteenth |

March eighteenth |

Rate of change |

|

V2405 collection |

5930 |

5920 |

-10 |

|

|

Average spot price in East China |

5655 |

5635 |

-20 |

|

|

Average spot price in South China |

5660 |

5680 |

20 |

|

|

PVC2405 basis difference |

-275 |

-285 |

-10 |

|

|

V2409 collection |

6072 |

6070 |

-2 |

|

|

V2405-2409 close |

-142 |

-150 |

-8 |

|

|

PP2405 collection |

7590 |

7610 |

20 |

|

|

Plastic L2405 collection |

8280 |

8312 |

32 |

|

|

V--PP basis difference |

-1660 |

-1690 |

-30 |

|

|

Vmure-L basis difference of plastics |

-2350 |

-2392 |

-42 |

|

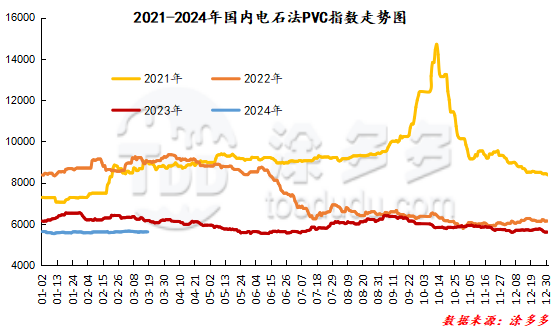

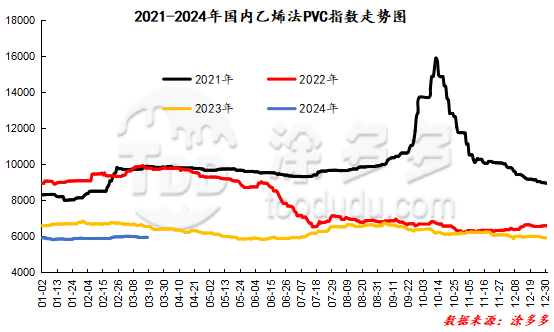

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 3.63 or 0.065% to 5617.4 on March 18. The ethylene method PVC spot index was 5938.47, down 4.12, with a range of 0.069%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 321.07.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.15 warehouse orders |

3.18 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,602 |

1,602 |

0 |

|

|

China Central Reserve Nanjing |

1,602 |

1,602 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,786 |

1,786 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,372 |

1,372 |

0 |

|

|

Middle and far sea in Jiangyin |

414 |

414 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,020 |

2,020 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,983 |

1,983 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

17,253 |

17,253 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,080 |

3,080 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

329 |

329 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

1,839 |

1,555 |

-284 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

1 |

1 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

120 |

120 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

686 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

165 |

165 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

440 |

440 |

0 |

|

PVC subtotal |

|

38,654 |

38,370 |

-284 |

|

Total |

|

38,654 |

38,370 |

-284 |

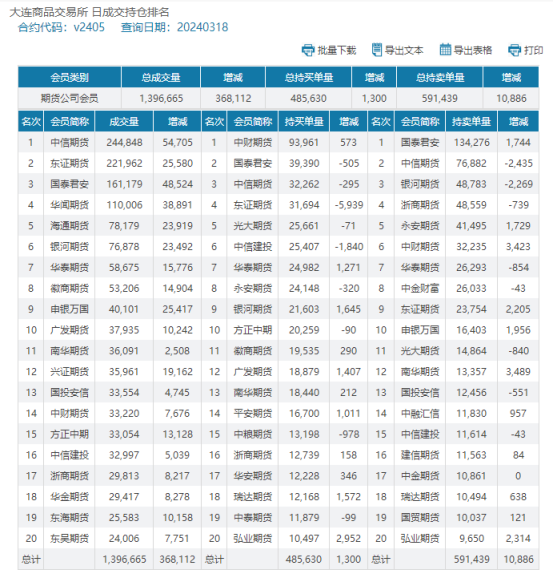

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.