Daily review of urea: Factory quotations continue to fall, market transaction atmosphere is weak (March 18)

China Urea Price Index:

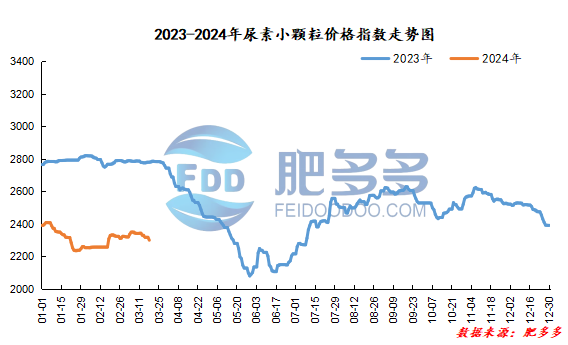

According to Feiduo data, the urea small pellet price index on March 18 was 2,299.68, a decrease of 17.86 from last Friday, a month-on-month decrease of 0.77% and a year-on-year decrease of 17.27%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2096, the highest price is 2096, the lowest price is 2019, the settlement price is 2049, and the closing price is 2029. The closing price is 94 lower than the settlement price of the previous trading day, down 4.43% month-on-month. The fluctuation range of the whole day is 2019-2096; the basis of the 05 contract in Shandong is 211; the 05 contract has increased its position by 8158 lots today, and so far, it has held 184496 lots.

Spot market analysis:

Today, China's urea market prices continued to decline, manufacturers 'quotations were lowered, downstream demand was slow to follow up, and market transactions were small.

Specifically, prices in Northeast China fell to 2,270 - 2,330 yuan/ton. Prices in North China fell to 2,090 - 2,380 yuan/ton. Prices in East China fell to 2,230 - 2,280 yuan/ton. Prices in South China fell to 2,340 - 2,380 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,210 - 2,380 yuan/ton, and the price of large particles fell to 2,280 - 2,350 yuan/ton. Prices in the northwest region are stable at 2,270 - 2,280 yuan/ton. Prices in Southwest China are stable at 2,280 - 2,600 yuan/ton.

Market outlook forecast:

In terms of factories, advance orders from factories have basically remained at about one week. Currently, factory quotations continue to decline, actual market transactions are weak, and the market is weak. In terms of the market, the overall transaction atmosphere in the market is sluggish, operators lack confidence in trading, and the market is mostly deadlocked. On the supply side, early maintenance equipment has been restored, Nissan has improved, and market supply pressure has emerged. On the demand side, demand is slowly advancing, and most downstream purchases are maintained on bargain hunting, and trading sentiment continues to be cautious and wait-and-see. Internationally, India has released a new round of urea import tenders. The bid opening date is set on the 27th of this month, and the shipping date is set to May 20. The current export policy is strictly controlled, and it is difficult for China to participate in this printed export.

On the whole, the current price of urea plants continues to fall, the market transaction atmosphere is weak, and the demand side is difficult to support. It is expected that the urea market price will continue to be weak in the short term.