PVC: Futures lows are approaching the middle track, but transactions on the market are open more, and spot prices are adjusted within a narrow range.

PVC futures analysis: March 6th V2405 contract opening price: 5903, highest price: 5950, lowest price: 5893, position: 832543, settlement price: 5928, yesterday settlement: 5929, down: 1, daily trading volume: 656835 lots, precipitated capital: 3.461 billion, capital inflow: 113 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March fifth |

March sixth |

Rise and fall |

Remarks |

|

North China |

5580-5630 |

5590-5650 |

10/20 |

Send to cash remittance |

|

East China |

5650-5720 |

5650-5720 |

0/0 |

Cash out of the warehouse |

|

South China |

5660-5740 |

5660-5700 |

0/-40 |

Cash out of the warehouse |

|

Northeast China |

5510-5670 |

5510-5670 |

0/0 |

Send to cash remittance |

|

Central China |

5590-5650 |

5590-5630 |

0/-20 |

Send to cash remittance |

|

Southwest |

5500-5650 |

5500-5650 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices are mainly arranged in a narrow range, and prices in various regions are adjusted flexibly. Compared with the valuation, the North China region rose 10-20 yuan / ton, the East China region was stable, the South China region fell 40 yuan / ton, the Northeast region was stable, the Central China region fell 20 yuan / ton, and the Southwest region was stable. The ex-factory price of upstream PVC production enterprises began to be reduced by 10-20-50 yuan / ton, and some remained stable. The low point of narrow range volatility of futures has declined somewhat. Traders' morning price offer was slightly lower than that of yesterday, but the transaction of high-price supply was blocked, and spot market price offer and one-mouth price offer coexisted. East China basis offer 05 contract-(230-250), South China 05 contract-(200), North 05 contract-(550), Southwest 05 contract-(300). On the whole, the downstream mentality of today's spot market is cautious, there is a certain rigid demand transaction at a low price, the order is on the low side, part of it is below 5900 points, and the terminal procurement enthusiasm is not good.

From a futures point of view: & the night futures price of the nbsp; PVC2405 contract rebounded slightly higher from the low price, but the overall increase was small. Futures prices fell after the start of morning trading, followed by a V-shaped rise, and the afternoon high and narrow range was sorted out to the end. 2405 contracts range from 5893 to 5950 throughout the day, with a price spread of 57. 05 contracts with an increase of 22655 positions and 832543 positions so far. The 2409 contract closed at 6071, with 148811 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures low close to the middle track position, the technical level shows that the Bollinger belt (13, 13, 2) three-track opening continues to open, the overall futures price is operating between the middle and upper tracks, in terms of transaction, the opening is 26.2% higher than the empty opening 22.1%. The KD line at the daily line level shows a dead-fork trend. From the point of view of the current time node, although the fluctuation of the trading volume is relatively narrow, there is often a trend of more opening than empty opening in the near future, gradually fulfilling the expectation of the middle line, but from the high point of fluctuation, although there is more support in part, however, the weak fundamentals are difficult to show a long-term sustained upward trend on the current basis. In the short term, the operation of the futures price will observe how to break through the prefix 6 at the top, and continue to observe the support in the range of 5850-5900 below.

Spot: current PVC fundamentals, supply is temporarily stable, current enterprise maintenance has not been opened, so supply is still in a high position, demand is currently in rigid demand procurement, downstream products enterprises are hoarding goods in the early low range, so the post-holiday procurement pace still does not see a big change, high inventory under the game of supply and demand is still not well digested. At present, the volatility and direction of the two cities are not enough to attract speculative demand, so although there are expectations, there is no clear turning point. However, whether it is the futures market or the spot market, even if there is a certain return test, the range is not too large. Prices in the international crude oil futures market fell for the second day in a row as investors assessed the outlook for global oil demand after data showed a slowdown in service sector activity in the United States in February and the Chinese government's economic growth targets and plans for 2024. On the whole, in the short term, the PVC market still continues to be mainly narrowly arranged.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March fifth |

March sixth |

Rate of change |

|

V2405 collection |

5906 |

5939 |

33 |

|

|

Average spot price in East China |

5685 |

5685 |

0 |

|

|

Average spot price in South China |

5700 |

5680 |

-20 |

|

|

PVC2405 basis difference |

-221 |

-254 |

-33 |

|

|

V2409 collection |

6041 |

6071 |

30 |

|

|

V2405-2409 close |

-135 |

-132 |

3 |

|

|

PP2405 collection |

7418 |

7451 |

33 |

|

|

Plastic L2405 collection |

8153 |

8166 |

13 |

|

|

V--PP basis difference |

-1512 |

-1512 |

0 |

|

|

Vmure-L basis difference of plastics |

-2247 |

-2227 |

20 |

|

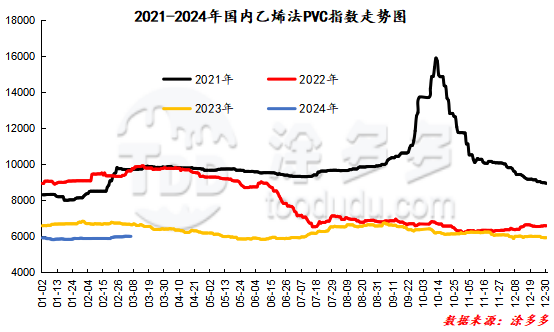

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 2.54, or 0.045%, to 5645.53 on March 6. The ethylene PVC spot index was 5994.63, down 2.66, or 0.044%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 349.1.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.5 warehouse order volume |

3.6 warehouse order volume |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,936 |

1,936 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

414 |

414 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,040 |

1,803 |

-2,237 |

|

Polyvinyl chloride |

Peak supply chain |

2,673 |

2,673 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,590 |

4,229 |

-361 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,500 |

21,500 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,678 |

3,678 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,642 |

3,642 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

1 |

-297 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

686 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

765 |

165 |

-600 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

481 |

-100 |

|

PVC subtotal |

|

55,325 |

51,730 |

-3,595 |

|

Total |

|

55,325 |

51,730 |

-3,595 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.