PVC: Futures encountered a correction. Whether to backtest and final range, the spot market fell slightly.

PVC futures analysis: March 5th V2405 contract opening price: 5960, highest price: 5960, lowest price: 5902, position: 809888, settlement price: 5929, yesterday settlement: 5962, down: 33, daily trading volume: 659353 lots, precipitated capital: 3.348 billion, capital outflow: 109 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March fourth |

March fifth |

Rise and fall |

Remarks |

|

North China |

5590-5650 |

5580-5630 |

-10/-20 |

Send to cash remittance |

|

East China |

5660-5750 |

5650-5720 |

-10/-30 |

Cash out of the warehouse |

|

South China |

5680-5780 |

5660-5740 |

-20/-40 |

Cash out of the warehouse |

|

Northeast China |

5510-5670 |

5510-5670 |

0/0 |

Send to cash remittance |

|

Central China |

5590-5650 |

5590-5650 |

0/0 |

Send to cash remittance |

|

Southwest |

5530-5670 |

5500-5650 |

-30/-20 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price weakens slightly, the spot market operation is light. Compared with the valuation, it fell by 10-20 yuan / ton in North China, 10-30 yuan / ton in East China, 20-40 yuan / ton in South China, stable in Northeast and Central China, and 20-30 yuan / ton in Southwest China. Most of the ex-factory prices of upstream PVC production enterprises remain stable, although the futures market is weak, but the upstream production enterprises have not adjusted the price, the wait-and-see mentality is relatively strong. With the weakening of the futures price on the spot market, the price offered by traders in the spot market in the morning is slightly lower than that of yesterday, and the supply of high-priced goods is difficult to close a deal. Although the current futures price has declined, it has not reached the psychological price range of the point price, so the basis offer has a general advantage. Among them, East China basis offer 05 contract-(230-250), South China 05 contract-(200), North 05 contract-(550), Southwest 05 contract-(300). On the whole, the market point price offer and a mouthful price offer coexist, the downstream mentality is cautious, and the point price hanging order is generally on the low side.

Futures point of view: PVC2405 contract night trading opening narrow volatility, intraday futures prices slightly weaker. After the start of morning trading, futures prices fell further slightly, futures prices began to weaken, and afternoon prices moved in a relatively narrow range at a low level. 2405 contracts range from 5902 to 5960 throughout the day, with a spread of 58. 05. The position of the contract has been reduced by 19163 hands, and 809888 positions have been held so far. The 2409 contract closed at 6041, with 141386 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures showed a trend of weak callback. First of all, the market showed a multi-position reduction and multiple departures, of which Duoping was 26.5% higher than empty 23.4%. The futures price reached a peak of 5993 yesterday after a continuous small push and did not break through the prefix of 6. Today's market is facing a situation of multi-order profit understanding, and the downside of the position reduction confirms this trend. The technical level shows that the opening of the third rail of the Bolin belt (13,13,2) is open, and the lower rail slightly turns to the lower middle rail, and the upper rail also has a turn-around trend. The KD line at the daily line level crosses the two lines, and the distance between the MACD lines is shortened. Looking at the futures price as a whole, we may test the range of the middle track and observe the support performance in the range of 5850-5900 in the short term.

Spot: first of all today's overall cultural goods index callback collation, the afternoon closing trend is slightly differentiated, but most commodities weakened obviously, PVC also followed the overall commodity environment for callback collation, giving back some of the cumulative gains. On the other hand, the spot market still maintains rigid demand procurement, and there is a certain profit-making behavior in a single price order, and the point price does not reach a reasonable procurement range, so the purchase transaction is slightly deadlocked. In terms of PVC fundamentals, the price of calcium carbide rose slightly by 50 yuan / ton, with few other variables. Prices in the international crude oil futures market fell in the outer disk as some analysts believed that OPEC+ oil-producing countries extended the implementation of the production reduction agreement to the second quarter, suggesting that they were pessimistic about the outlook for global oil demand. The chairman of the Federal Reserve in Atlanta said the Fed is expected to cut interest rates for the first time in the third quarter and then stand still to assess the impact of the policy shift on the economy. Fed interest rate cuts could create the risk of "releasing new demand and fuelling inflation". On the whole, the PVC market may withdraw and sort out in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March fourth |

March fifth |

Rate of change |

|

V2405 collection |

5957 |

5906 |

-51 |

|

|

Average spot price in East China |

5705 |

5685 |

-20 |

|

|

Average spot price in South China |

5730 |

5700 |

-30 |

|

|

PVC2405 basis difference |

-252 |

-221 |

31 |

|

|

V2409 collection |

6093 |

6041 |

-52 |

|

|

V2405-2409 close |

-136 |

-135 |

1 |

|

|

PP2405 collection |

7496 |

7418 |

-78 |

|

|

Plastic L2405 collection |

8256 |

8153 |

-103 |

|

|

V--PP basis difference |

-1539 |

-1512 |

27 |

|

|

Vmure-L basis difference of plastics |

-2299 |

-2247 |

52 |

|

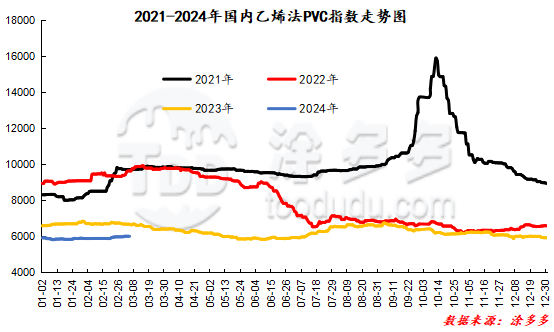

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 17.92% to 5648.07 on March 5, a range of 0.316%. The ethylene method PVC spot index was 5997.94, down 3.39, with a range of 0.056%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 349.87.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.4 warehouse receipt quantity |

3.5 warehouse order volume |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,425 |

1,936 |

-489 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

903 |

414 |

-489 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,040 |

4,040 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,673 |

2,673 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,790 |

4,590 |

-200 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,500 |

21,500 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,678 |

3,678 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,642 |

-40 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

686 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,494 |

765 |

-729 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

56,783 |

55,325 |

-1,458 |

|

Total |

|

56,783 |

55,325 |

-1,458 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.