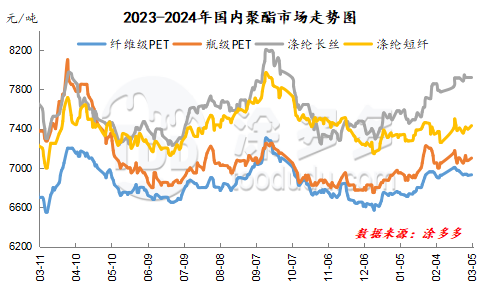

Polyester: High market shocks and terminal demand accelerates recovery

Since late February, China's polyester market has maintained a high volatility pattern, and the market volatility space has narrowed. Polyester raw materials PTA market to maintain range fluctuations, the spot market prices remain in the vicinity of 5850-5950 yuan / ton fluctuations. The international crude oil market maintains a high level, supporting the market mentality, and the PTA futures market fluctuates at a high level. From the supply side, PTA maintenance equipment is less in the short term, so the overall start-up of the PTA industry maintains a high level of more than 80%, and the market supply is more abundant. Downstream polyester load continues to pick up, coupled with the gradual resumption of terminal textile weaving, the market demand picks up, forming a support for the market.

Polyester raw material ethylene glycol market price narrow callback. The commodity market atmosphere weakens, suppresses the market mentality, the ethylene glycol market negotiation center of gravity drops slightly. Up to now, the quotation in East China is around 4520 yuan / ton, and the firm offer is light. The quotation in South China is around 4600 yuan / ton. On the supply side, the recent delivery of ethylene glycol port is good, and the East China port goes to the warehouse slightly. Although the recent start of China's ethylene glycol industry is at a high level during the year, the planned overhaul of ethylene glycol plant increases from March to April, and the market supply is expected to decrease; demand: downstream polyester load continues to pick up, demand is steadily increasing, the demand side will gradually improve, and the market trading atmosphere will be warmed up. Recently, the international crude oil market has maintained a high level, and the cost side has promoted the market. In the short term, the price of ethylene glycol in China maintains a volatile pattern, and in the later stage, we should pay attention to the prices of crude oil and coal as well as the operation of the plant in the field.

Under the high cost support, the polyester market maintains the narrow range fluctuation, the market negotiation center of gravity adjusts slightly. The maintenance equipment of polyester factory is steadily recovering, the market supply is increasing, but the market production and marketing is light, and the inventory pressure of polyester factory is increasing. Terminal textile weaving enterprises gradually resume work, the future demand of terminal textile begins to pick up, and the stock of raw materials in the spinning factory will also increase. Under the cost pressure, the short-term polyester market may be adjusted mainly with the narrow range of costs.

Recently, some polyester maintenance enterprises in China have gradually resumed their start-up, and the start-up of the polyester industry has gradually increased. At present, the start-up of the polyester industry has risen to the level of around 86%. The steady increase in polyester load has also made the market have a certain confidence in the expectation of future demand. In addition, there are still a number of new polyester units put into operation, polyester market supply remains at a relatively high level.

Since late February, the speed of resumption of work and production of terminal textile weaving and printing and dyeing enterprises has gradually speeded up. By the beginning of March, the start-up of China's weaving industry has risen to 63%, that of texturing enterprises has rebounded to 73%, and that of Jiangsu and Zhejiang printing and dyeing industries has rebounded to more than 70%. The starting level of terminal enterprises continues to improve, so there will still be some expectations for the traditional peak season of "gold, silver and silver" in the textile and clothing industry.

As the expectation of the market for the postponement of OPEC+ production reduction becomes more and more obvious, the benefits of the delay may have been digested by the market in advance, the recently released economic data are still weak, the prospect of global crude oil demand is worrying, it suppresses the crude oil market atmosphere, the international crude oil market weakens, and the polyester market forms a certain pressure. The polyester raw material PTA and ethylene glycol market are driven by their own supply and demand, and the short-term market is expected to adjust narrowly. Polyester raw material end support, polyester market offer will be slightly adjusted with the cost, the enthusiasm of terminal weaving preparation is low, and the market production and marketing is light. Short-term polyester market prices are expected to fluctuate within a narrow range. In the later stage, we should pay close attention to the changes of the raw material market and the supply and demand of polyester itself.