PVC: Futures highs are approaching the upper track, but the pressure level is effective, and the market reduces positions, and the spot rises slightly

PVC futures analysis: March 1st V2405 contract opening price: 5950, highest price: 5965, lowest price: 5929, position: 824064, settlement price: 5948, yesterday settlement: 5918, up: 30, daily trading volume: 625390 lots, precipitated capital: 3.435 billion, capital outflow: 20.58 million.

List of comprehensive prices by region: yuan / ton

|

Area |

February twenty _ ninth |

March 1st |

Rise and fall |

Remarks |

|

North China |

5560-5650 |

5580-5650 |

20/0 |

Send to cash remittance |

|

East China |

5640-5730 |

5660-5730 |

20/0 |

Cash out of the warehouse |

|

South China |

5630-5720 |

5630-5730 |

0/10 |

Cash out of the warehouse |

|

Northeast China |

5500-5670 |

5500-5670 |

0/0 |

Send to cash remittance |

|

Central China |

5560-5620 |

5590-5650 |

30/30 |

Send to cash remittance |

|

Southwest |

5480-5670 |

5530-5670 |

30/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices rose slightly, flexible arrangement in some areas. Compared with the valuation, it rose 20 yuan / ton in North China, 20 yuan / ton in East China, 10 yuan / ton in South China, stable in Northeast China, 30 yuan / ton in Central China and 30 yuan / ton in Southwest China. Upstream PVC production enterprises began to tentatively increase the ex-factory price by 20-30-50 yuan / ton, some enterprises are still stable prices wait and see. The operation of the futures market is slightly stronger, and the market price range of each region is arranged. With the upward price of the futures price, the price center of gravity in each region moves up slightly, and the point price and one price coexist, but there is no market for the basis quotation. East China basis offer 05 contract-(270), South China 05 contract-(200), North 05 contract-(550), Southwest 05 contract-(300). On the whole, the high-priced supply of goods in today's spot market is still difficult to close a deal, there is more room for negotiation, the enthusiasm of purchasing spot in the lower reaches is not high, the trading atmosphere in the spot market is light, and a small number of transactions are mainly done at one price.

Futures point of view: PVC2405 contract night futures prices have recently run the highest point of 5965, the overall night market high shock. Futures prices weakened slightly after the start of morning trading, but not by much, and continued to finish at a high and narrow range in the afternoon. 2405 contracts range from 5929 to 5965 throughout the day, with a spread of 36. 05. The position of the contract has been reduced by 6613 positions and 824063 positions have been held so far. The 2409 contract closed at 6088, with 134082 positions.

PVC Future Forecast:

Futures: & the operating range of the nbsp; PVC05 contract price is relatively narrow, but the overall range runs in the recent high range, and the highest point is successfully refreshed again by 5965, approaching the previous high of 5970 but not beyond. The technical level shows that the third track (13, 13, 2) of the Bolin belt turns upward, and the operating high point of the futures price is twice close to the pressure position on the upper track. The trend of golden fork of KD line and MACD line at daily level continues, and the trend of golden fork of MACD line expands. The futures price has formed a pattern of five consecutive small increases during the week. from the current time node, the futures price may show a high level to continue to sort out, and continue to observe the performance of the high range of 5900-5980 in the short term, and how to break through the six-word integer mark.

At present, there are not many fundamental variables in PVC, and there is a gradual review of stable supply and demand, but today, an enterprise in Shandong has suddenly reduced its load for three days, and the supply side may be expected to shrink. From the current time node, it is expected that the recovery in March-April will gradually enter the midline. Therefore, whether it is futures or spot disk, even if the correction, the range is not too large. The price of crude oil futures fell on the outside as US inflation data suggested that a weak US economy could be a drag on crude oil demand. In addition, OPEC's rising production also weighed on crude oil futures prices. However, OPEC+ extended the voluntary production reduction agreement to expectations for the second quarter and the conflict in the Middle East to limit the decline. On the whole, the spot market continues to observe the market stability after the relative rise in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

February twenty _ ninth |

March 1st |

Rate of change |

|

V2405 collection |

5942 |

5954 |

12 |

|

|

Average spot price in East China |

5685 |

5695 |

10 |

|

|

Average spot price in South China |

5675 |

5680 |

5 |

|

|

PVC2405 basis difference |

-257 |

-259 |

-2 |

|

|

V2409 collection |

6075 |

6088 |

13 |

|

|

V2405-2409 close |

-133 |

-134 |

-1 |

|

|

PP2405 collection |

7493 |

7497 |

4 |

|

|

Plastic L2405 collection |

8266 |

8260 |

-6 |

|

|

V--PP basis difference |

-1551 |

-1543 |

8 |

|

|

Vmure-L basis difference of plastics |

-2324 |

-2306 |

18 |

|

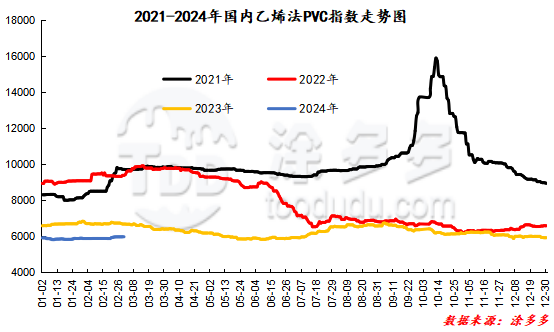

China PVC Index: according to Tudoduo data, the Chinese calcium carbide PVC spot index rose 12.08, or 0.214%, to 5650.64 on March 1. The ethylene method PVC spot index was 6003.61, up 28.41, with a range of 0.475%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 336.64.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

2.29 warehouse orders |

3.1 warehouse receipt volume |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,425 |

2,425 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

903 |

903 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,752 |

4,220 |

-532 |

|

Polyvinyl chloride |

Peak supply chain |

2,673 |

2,673 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,790 |

4,790 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,600 |

21,600 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,678 |

3,678 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

686 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,494 |

1,494 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

57,595 |

57,063 |

-532 |

|

Total |

|

57,595 |

57,063 |

-532 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.