PVC: Futures rose in the late session and broke through the rise. There were more open positions on the market, and the low spot prices decreased.

PVC futures analysis: February 27th V2405 contract opening price: 5835, highest price: 5907, lowest price: 5825, position: 824401, settlement price: 5868, yesterday settlement: 5863, up: 5, daily trading volume: 627010 lots, precipitated capital: 3.408 billion, capital inflow: 137 million.

List of comprehensive prices by region: yuan / ton

|

Area |

February twenty _ sixth |

February twenty _ seventh |

Rise and fall |

Remarks |

|

North China |

5550-5620 |

5540-5620 |

-10/0 |

Send to cash remittance |

|

East China |

5600-5690 |

5620-5700 |

20/10 |

Cash out of the warehouse |

|

South China |

5650-5750 |

5610-5700 |

-40/-50 |

Cash out of the warehouse |

|

Northeast China |

5450-5600 |

5450-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5540-5590 |

5540-5590 |

0/0 |

Send to cash remittance |

|

Southwest |

5460-5630 |

5480-5650 |

20/20 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices continue to be mainly narrow collation, the spot market rose slightly in the afternoon. Compared with the valuation, North China fell by 10 yuan / ton, East China rose by 10-20 yuan / ton, South China fell by 40-50 yuan / ton, Northeast and Central China were stable, and southwest China rose by 20 yuan / ton. The ex-factory prices of upstream PVC production enterprises continued to remain stable, with individual enterprises slightly reducing 50 yuan / ton in order to reduce the inventory price in the factory area. Futures fell first and then rose, and the price trend in different regions of the spot market was divergent. In some areas, the price quotation decreased slightly in the morning, but the price recovered the decline in the afternoon. Low prices decreased in some areas, and spot market prices rose slightly after futures prices rose in late trading. At present, the market order price and one-bite price still coexist, including East China basis offer 05 contract-(230-250), South China 05 contract-(150-200), North 05 contract-(480-550), Southwest 05 contract-(250). Downstream cautious wait-and-see, bargain replenishment-based.

From the perspective of futures: & the night price of the nbsp; PVC2405 contract rose slightly at the start of the day. Although the overall night trading rose, the range was small. Prices rose further after the start of morning trading, followed by a trend of narrow volatility. The price rose significantly in late afternoon trading and continued to rise in late afternoon trading. 2405 contracts range from 5825 to 5907 throughout the day, with a spread of 82. 05 contracts with an increase of 23715 positions and 824401 positions so far. The 2409 contract closed at 6034, with 111823 positions.

PVC Future Forecast:

Futures: The futures market of PVC2405 contract showed a trend of small breakthrough, with the highest point rising through the 5900 gate of 5907, and the market also showed a certain increase of 23700 hands. The transaction opened 24.9% more than the empty opening of 23.8%, which basically belongs to the rare situation of increasing the price of the futures market. The technical level shows that the three-track opening of the Bollinger belt (13, 13, 2) is open, and the high point of the futures price is close to the upper track position after rising through the middle track. And the KD line and MACD line at the daily level show a golden fork trend. Although there are still few variables from fundamentals and macro policies, a small rise in futures prices is still good for the spot market. In the short term, the operation of futures prices observes the pressure performance in the upper range of 5900-5950.

Spot: first overall cultural goods index showed a certain rise in the afternoon, the main Chinese futures contract rose more or less, lithium carbonate rose more than 3%, glass, coking coal, coke, No. 20 rubber (NR) rose more than 2%, butadiene rubber (BR), thread, rubber rose nearly 2%. PVC futures market also follows the overall commodity market showed a certain upward performance. At present, the supply and demand level of PVC is still good and productive, downstream enterprises purchase orders on bargain, the current working load of PVC production enterprises is stable, and the supply digestion of the spot market has not yet formed a normal de-warehousing. On the outer disk, international oil prices have risen, as possible disruptions in shipping will affect global supply. In addition, traders continue to weigh the outlook for crude oil supply and demand. Concerns about the economy and oil demand led to the fall in oil prices last week. On the whole, although there is a small rise in the two cities, the range above may show a certain degree of pressure.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 2.26 |

Price 2.27 |

Rate of change |

|

V2405 collection |

5835 |

5905 |

70 |

|

|

Average spot price in East China |

5645 |

5660 |

15 |

|

|

Average spot price in South China |

5700 |

5655 |

-45 |

|

|

PVC2405 basis difference |

-190 |

-245 |

-55 |

|

|

V2409 collection |

5961 |

6034 |

73 |

|

|

V2405-2409 close |

-126 |

-129 |

-3 |

|

|

PP2405 collection |

7382 |

7486 |

104 |

|

|

Plastic L2405 collection |

8173 |

8257 |

84 |

|

|

V--PP basis difference |

-1547 |

-1581 |

-34 |

|

|

Vmure-L basis difference of plastics |

-2338 |

-2352 |

-14 |

|

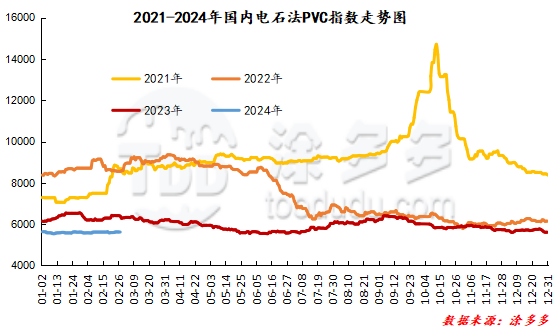

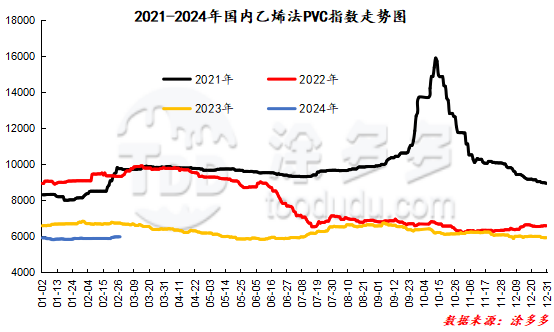

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 4.69 or 0.083% to 5613.85 on February 27th. The ethylene PVC spot index was 5968.59, down 5.98, or 0.1%, while the calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 354.74.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

2.24 warehouse orders |

2.25 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,425 |

2,425 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

903 |

903 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,152 |

5,152 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,723 |

2,723 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,790 |

4,790 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,600 |

21,600 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,678 |

3,678 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

686 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,494 |

1,494 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

32 |

32 |

0 |

|

PVC subtotal |

|

58,077 |

58,077 |

0 |

|

Total |

|

58,077 |

58,077 |

0 |

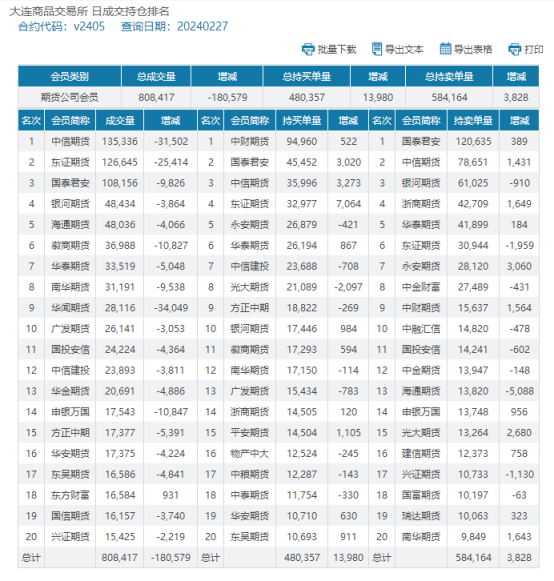

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.