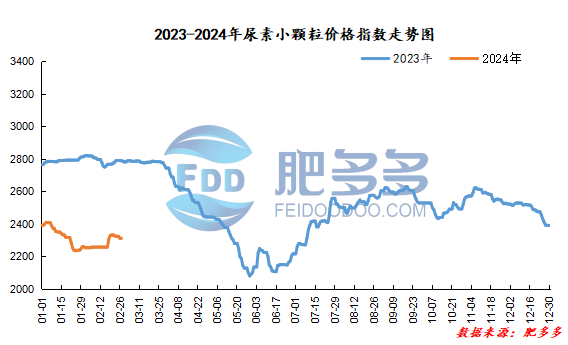

Daily Review of Urea: Low prices in the market, better prices are sorted out in a narrow range (February 27)

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on February 27 was 2,316.95, an increase of 5.91 from yesterday, a month-on-month increase of 0.26% and a year-on-year decrease of 16.89%.

Urea futures market:

Today, the opening price of the Urea UR405 contract: 2140, the highest price: 2169, the lowest price: 2140, the settlement price: 2159, and the closing price increased by 32 compared with the settlement price of the previous trading day, up 1.50% month-on-month. The fluctuation range of the whole day is 2140-2169; the basis of the 05 contract in Shandong is 86; the 05 contract has increased its position by 2859 lots today, and the position held so far is 182,800 lots.

Spot market analysis:

Today, China's urea market prices rose slightly, and corporate quotations were slightly adjusted. Transactions at the low-end of the market were better, and quotations increased tentatively.

Specifically, prices in Northeast China have stabilized at 2,290 - 2,360 yuan/ton. Prices in North China rose to 2,120 - 2,380 yuan/ton. Prices in East China rose to 2,230 - 2,290 yuan/ton. Prices in South China rose to 2,380 - 2,420 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,230 - 2,380 yuan/ton, and the price of large particles has stabilized at 2,300 - 2,400 yuan/ton. Prices in the northwest region are stable at 2,260 - 2,270 yuan/ton. Prices in Southwest China are stable at 2,300 - 2,600 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers have reduced their orders in receipt, sales pressure has appeared, offers have eased slightly, and prices have declined to give profits to collect orders. Currently, transactions with low-end sources have increased, and orders have improved. In terms of the market, the market atmosphere is average. Most transactions remain low-end, and prices may rebound and be adjusted upward. On the supply side, the industry's equipment maintenance increased, start-ups declined, and Nissan fell within a narrow range, but the supply side still showed loose. On the demand side, demand for agricultural greening has slowed down; the construction of downstream industrial compound fertilizer factories continues to increase, and industrial demand will continue to increase.

On the whole, the current low-end price transactions in the urea market are relatively good, coupled with the expected reduction in supply reserves, which may affect the narrow upward adjustment of corporate quotations. Therefore, it is expected that the urea market price will continue to maintain a narrow range of fluctuations in a short period of time.