PVC: Futures highs have been refreshed, but the highs cannot support taking gains, and the spot market is slightly flexible.

PVC futures analysis: February 26th V2405 contract opening price: 5875, highest price: 5899, lowest price: 5832, position: 800686, settlement price: 5863, yesterday settlement: 5863, up: 0, daily trading volume: 762785 lots, precipitated capital: 3.27 billion, capital inflow: 57.34 million.

List of comprehensive prices by region: yuan / ton

|

Area |

February twenty _ third |

February twenty _ sixth |

Rise and fall |

Remarks |

|

North China |

5550-5620 |

5550-5620 |

0/0 |

Send to cash remittance |

|

East China |

5620-5690 |

5600-5690 |

-20/0 |

Cash out of the warehouse |

|

South China |

5670-5750 |

5650-5750 |

-20/0 |

Cash out of the warehouse |

|

Northeast China |

5450-5600 |

5450-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5540-5590 |

5540-5590 |

0/0 |

Send to cash remittance |

|

Southwest |

5460-5630 |

5460-5630 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price range collation, small flexible adjustment. The comparison of valuation shows that North China is stable, East China is down 20 yuan / ton, South China is down 20 yuan / ton, and Northeast, Central China and Southwest China are stable. Most of the upstream PVC production enterprises'ex-factory prices remain stable, and there is no obvious trace of adjustment, and the production enterprises also have a certain wait-and-see mentality. Futures first high and then low, poor performance in the daytime trading day, resulting in the spot market price in the early stage of the offer part of the price slightly lower than last Friday, some areas also appeared temporary stable adjustment of the phenomenon, the spot market slightly depressed. After the weakening of the futures price, the market point price and one price coexist, including the basis offer 05 contract in East China-(230-250), the 05 contract in South China-(150-200), the 05 contract in North China-(480-560), and the 05 contract in Southwest China-(250). It coincides with the lack of enthusiasm for wait-and-see purchases downstream on Monday.

From a futures point of view: & the price of the nbsp; PVC2405 contract opened slightly higher on Friday night, with a refresh of highs. Futures prices fell sharply after the start of early trading on Monday, followed by a slight V-shaped rebound. Afternoon prices are once again facing a weakening trend, giving up their morning gains. 2405 contracts range from 5832 to 5899 throughout the day, with a spread of 67. 05 contracts with an increase of 19661 positions and 800686 positions so far. The 2409 contract closed at 5961, with 107492 positions.

PVC Future Forecast:

Futures: & the operating high of nbsp; PVC2405 contract futures showed a slight upward breakthrough, but Monday's weakness once again showed a slightly suppressed situation of short opening, which opened 26.4% more than Cangyu by 22.3% in terms of trading. Judging from the recent trend, PVC is still in an empty position, weak fundamentals, high inventory if stable demand and supply has led to the continued poor performance of the two cities in the PVC period. The technical level shows that the third track of the Bollinger belt (13, 13, 2) narrows obviously, and the price shows a positive pillar with slightly longer shadow line. We still maintain the previous point of view, and the operation of futures prices will continue to observe the performance in the range of 5780-5950 in the short term.

Spot: the spot market performed poorly on Monday. The current decline in futures prices since their highs and the performance range of futures prices have led to a small number of spot price transactions and most single-point positions tend to be low. In terms of price, the inquiry is also light, and the overall spot market on Monday is slightly weak. The current PVC fundamentals lead to the persistence of the empty distribution of the futures market, the poor disk reacts to the spot market, and the performance of the two markets is low in the overall 3P plate. Although there are certain expectations in the midline from March to April to May, there is a great uncertainty about how to break the situation and what factors take the initiative to break it. Or are more inclined to consider following the overall commodity index adjustment, which depends on their own fundamental fluctuations are limited. On the whole, the spot market in the short term may still maintain a trend of small and flexible adjustment, and the two cities need to wait for a turnaround.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 2.23 |

Price 2.26 |

Rate of change |

|

V2405 collection |

5877 |

5835 |

-42 |

|

|

Average spot price in East China |

5655 |

5645 |

-10 |

|

|

Average spot price in South China |

5710 |

5700 |

-10 |

|

|

PVC2405 basis difference |

-222 |

-190 |

32 |

|

|

V2409 collection |

6000 |

5961 |

-39 |

|

|

V2405-2409 close |

-123 |

-126 |

-3 |

|

|

PP2405 collection |

7404 |

7382 |

-22 |

|

|

Plastic L2405 collection |

8199 |

8173 |

-26 |

|

|

V--PP basis difference |

-1527 |

-1547 |

-20 |

|

|

Vmure-L basis difference of plastics |

-2322 |

-2338 |

-16 |

|

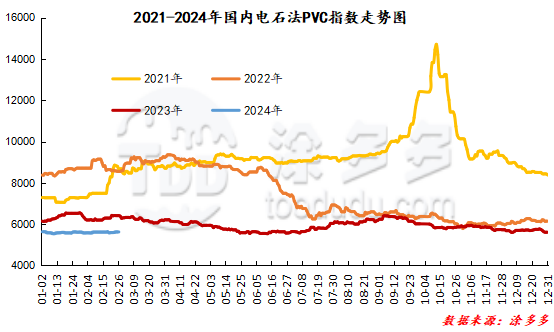

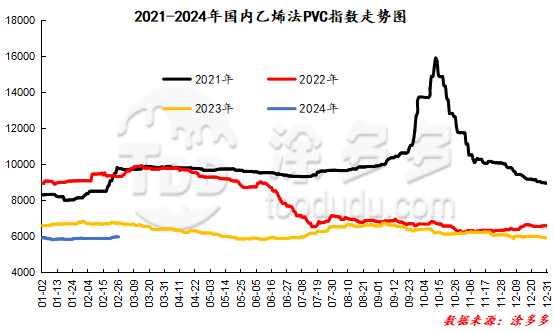

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 5.19, or 0.092%, to 5618.54 on February 26. The ethylene PVC spot index was 5974.57, up 4.12, with a range of 0.069%, while the calcium carbide index decreased, the ethylene index rose, and the ethylene-calcium carbide index spread was 356.03.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

2.23 warehouse orders |

2.24 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,425 |

2,425 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

903 |

903 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,152 |

5,152 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,723 |

2,723 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,790 |

4,790 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,600 |

21,600 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,678 |

3,678 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

686 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,494 |

1,494 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

32 |

32 |

0 |

|

PVC subtotal |

|

58,077 |

58,077 |

0 |

|

Total |

|

58,077 |

58,077 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.