Methanol: Futures continue to rise, regional trend of Chinese quotations

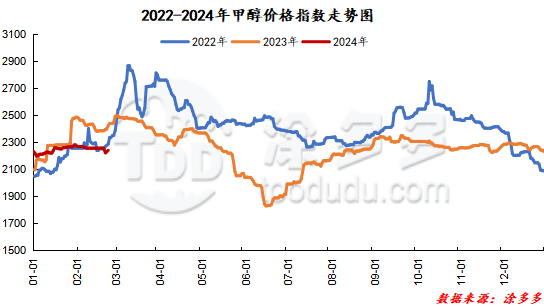

On February 23, the methanol market price index was 2239.94, up 9.96 from yesterday and 0.45 per cent higher than the previous month.

Outer disk dynamics:

Methanol closed on February 22nd:

China CFR 302-306 US dollars / ton, up 3 US dollars / ton

Us FOB 102-104 cents per gallon, up 2 cents per gallon

Southeast Asia CFR 363.5-364.5 US dollars / ton, Ping

European FOB 305.75-306.75 euros / ton, up 8.75 euros / ton.

Summary of today's prices:

Guanzhong: 2120-2200 (0), North Line: 1960-2000 (20), Lunan: 2400 (0), Henan: 2280-2295 (0), Shanxi: 2060-2200 (0), Port: 2645-2660 (50)

Freight:

North Route-Northern Shandong 290-400 (0amp 0), Southern Route-Northern Shandong 330-420 (0amp 0), Shanxi-Northern Shandong 210-240 (0max 0), Guanzhong-Southwest Shandong 250-300 (0max 0)

Spot market: today, the price trend of methanol market is different, the futures market continues to rise, and the spot quotation of the port continues to rise. At present, the recovery of downstream demand in China is limited, and the market turnover is general under rigid demand. Specifically, the market prices in the main producing areas have been raised narrowly, with prices on the southern line around 2000 yuan / ton, and those on the northern line around 1960-2000 yuan / ton, with a low-end increase of 20 yuan / ton. Downstream operators are not enthusiastic about entering the market to replenish goods, and most of them are in a wait-and-see mood. The overall trading atmosphere in the market is limited. The market price in Shandong, the main consumer area, was adjusted in a narrow range, with 2400 yuan / ton in southern Shandong, maintaining yesterday, the recovery of downstream demand was relatively slow, and the downstream replenishment sentiment was more general, 2020-2340 yuan / ton in northern Shandong. The market quotation in North China is adjusted narrowly. Hebei quotation is 2280-2300 yuan / ton today, 30 yuan / ton higher than yesterday, and Shanxi quotation is 2060-2200 yuan / ton today. Recently, the Chinese market has ushered in snowfall, and the circulation of goods in the region is limited. But at present, the inventory pressure in the downstream market is still there, and the enthusiasm of operators to enter the market to pick up goods is poor.

Port market: methanol futures fluctuated in a narrow range today. In recent months, hold the price to sell, buy on demand purchase, the basis is too strong. Forward arbitrage and exchange of goods are given priority to, the basis has stabilized, and the price difference between far and near months has widened. The overall transaction throughout the day is not bad. Taicang main port transaction price: 2 transaction price: 2645-2660, base difference 05 "132max" 135 position 3 transaction: 2650-2655, base difference 05 "130pm" 135x transaction 3 transaction: 2615-2625, basis difference 05x100 "105x 4 transaction: 2555-2570, basis difference 05x50.09x 110.

|

Area |

2024/2/23 |

2024/2/22 |

Rise and fall |

|

The whole country |

2239.94 |

2229.98 |

9.96 |

|

Northwest |

1960-2200 |

1940-2200 |

20/0 |

|

North China |

2060-2300 |

2060-2300 |

0/0 |

|

East China |

2645-2730 |

2595-2690 |

50/40 |

|

South China |

2540-2680 |

2530-2660 |

10/20 |

|

Southwest |

2380-2500 |

2380-2500 |

0/0 |

|

Northeast China |

2250-2400 |

2250-2400 |

0/0 |

|

Shandong |

2320-2400 |

2300-2400 |

20/0 |

|

Central China |

2280-2620 |

2280-2620 |

0/0 |

Future forecast: in the Chinese market, the recovery of demand in the terminal downstream market is relatively slow, and the demand for methanol is mediocre, and during the Spring Festival holiday, the inventory of most manufacturers in the main producing areas has increased to a relatively high level due to transport restrictions. Manufacturers have to reduce inventory and freight charges, and factory quotations have to be lowered, but at present, the follow-up of downstream market demand is limited, coupled with the fact that the Chinese market is mostly affected by snowfall. The transportation restriction has not been alleviated, and the manufacturer's shipment is not smooth. At present, the downstream market demand may improve next week, and the transportation situation on some sections of the field may be alleviated. If the downstream demand increases steadily, the inventory pressure of manufacturers may be alleviated, and it is expected that the short-term methanol market price may rebound slightly, but the rebound range may be relatively limited, but in the later stage, we still need to pay close attention to the macro, coal prices, the operation of on-site equipment and downstream pre-festival stock.