PVC: Futures broke through the middle track and continued to push up slightly, with the market slightly reducing positions, and the spot market operating slightly stronger

PVC futures analysis: February 23rd V2405 contract opening price: 5845, highest price: 5886, lowest price: 5836, position: 781025, settlement price: 5863, yesterday settlement: 5833, up: 30, daily trading volume: 608673 lots, precipitated capital: 3.213 billion, capital outflow: 18.99 million.

List of comprehensive prices by region: yuan / ton

|

Area |

February 22nd |

February twenty _ third |

Rise and fall |

Remarks |

|

North China |

5520-5600 |

5550-5620 |

30/20 |

Send to cash remittance |

|

East China |

5570-5650 |

5620-5690 |

50/40 |

Cash out of the warehouse |

|

South China |

5670-5700 |

5670-5750 |

0/50 |

Cash out of the warehouse |

|

Northeast China |

5400-5600 |

5450-5600 |

50/0 |

Send to cash remittance |

|

Central China |

5530-5590 |

5540-5590 |

10/0 |

Send to cash remittance |

|

Southwest |

5460-5630 |

5460-5630 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices slightly increased, the spot market slightly stronger consolidation. Compared with the valuation, it rose 20-30 yuan / ton in North China, 40-50 yuan / ton in East China, 50 yuan / ton in South China, 50 yuan / ton in Northeast China, 10 yuan / ton in Central China, and stable in Southwest China. Upstream PVC production enterprises ex-factory prices of some enterprises slightly raised 50 yuan / ton, some enterprises continue to stabilize prices wait and see. Futures rose slightly, the morning price offer of traders in various regions was higher than that of yesterday, the supply of low-price goods in the spot market decreased, and the spot price and point price coexisted, but the spot price advantage decreased after the futures price went up. Among them, East China basis offer 05 contract-(230-250), South China 05 contract-(150-200), North 05 contract-(500-550), Southwest 05 contract-(250). It coincides with the poor turnover in the spot market on Friday, and there is a certain deal in the order price in the early low range, so after the price in the two cities has risen slightly, the transaction has weakened somewhat.

Futures point of view: PVC2405 contract night prices open with a narrow range of fluctuations, late trading prices rose slightly. After the start of morning trading, the futures price rose slightly further, and the afternoon futures price was narrowly arranged to the end within the high range of the overall trading day. 2405 contracts range from 5836 to 5886 throughout the day, with a spread of 50,05.05 and a reduction of 8917 positions, with 781025 positions so far. The 2409 contract closed at 6000, with 98156 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2405 contract futures shows a small upward breakthrough trend, and the market shows a certain position reduction. The operation characteristics of the futures price in a week after the return of the Spring Festival are as follows: 1. The fluctuation range tends to be narrow. 2. It still continues the trend of low horizontal plate in the early stage. 3. Continue to test the low range, but can not effectively break it. Today Friday futures market rose slightly, the technical level shows that the Bollinger belt (13, 13, 2) three tracks narrowed significantly, because the distance between the three tracks is shortened, so the range between the upper and lower tracks is also narrowed. Daily-level KD line and MACD line show a golden fork trend, as a whole, the operation of futures prices in the short term may still be in the range of 5780-5950.

Spot aspect: coincides with the relatively flat performance of the spot market on Friday, although the price shows a small upward trend, but the transaction is not ideal. At present, the volatility of the two cities is insufficient, resulting in the spot market still maintaining a low hanging order transaction model. And the current two cities have few variable factors, no matter long or short or rise or fall, it is difficult to have a big breakthrough. The supply of the fundamentals of PVC is stable, and the middle line is expected to be overhauled in spring, but when demand is relatively weak, social inventory is still high. And at present, the restriction of real estate leads to the empty distribution of PVC products. In the outer disk, international oil prices rose as hostilities in the Red Sea continued and the Houthi allied with Iran intensified their attacks near Yemen, but the sharp increase in US crude oil stocks curbed the rise in oil prices to some extent. On the whole, the PVC spot market continues to maintain the trend of small shock finishing.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 2.22 |

Price 2.23 |

Rate of change |

|

V2405 collection |

5845 |

5877 |

32 |

|

|

Average spot price in East China |

5610 |

5655 |

45 |

|

|

Average spot price in South China |

5685 |

5710 |

25 |

|

|

PVC2405 basis difference |

-235 |

-222 |

13 |

|

|

V2409 collection |

5970 |

6000 |

30 |

|

|

V2405-2409 close |

-125 |

-123 |

2 |

|

|

PP2405 collection |

7400 |

7404 |

4 |

|

|

Plastic L2405 collection |

8183 |

8199 |

16 |

|

|

V--PP basis difference |

-1555 |

-1527 |

28 |

|

|

Vmure-L basis difference of plastics |

-2338 |

-2322 |

16 |

|

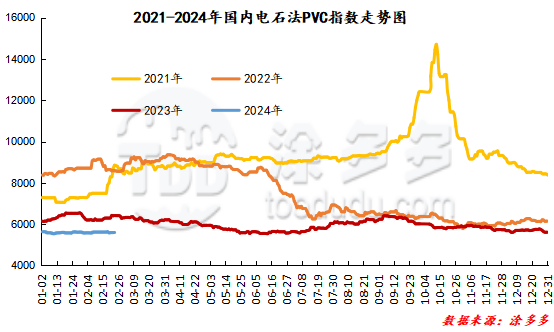

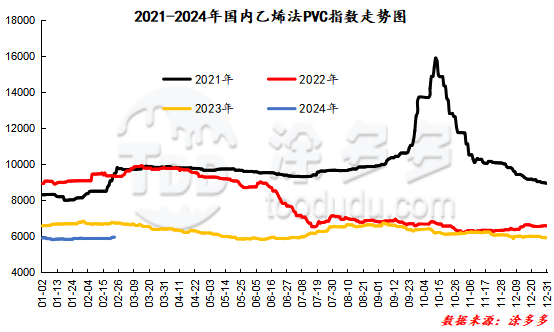

China PVC Index: according to Tudou data, the China calcium Carbide PVC spot Index rose 26.27, or 0.469%, to 5623.73 on February 23. The ethylene PVC spot index was 5970.45, up 15.48, or 0.26%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 346.72.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

2.22 warehouse orders |

2.23 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,425 |

2,425 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

903 |

903 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,326 |

5,152 |

-174 |

|

Polyvinyl chloride |

Peak supply chain |

2,723 |

2,723 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,790 |

4,790 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,600 |

21,600 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,678 |

3,678 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

686 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,494 |

1,494 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

32 |

32 |

0 |

|

PVC subtotal |

|

58,251 |

58,077 |

-174 |

|

Total |

|

58,251 |

58,077 |

-174 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.