PVC: Futures have been repaired upwards from low points, Formosa Plastics 'quotation has been raised, and the spot market has been flexibly adjusted

PVC futures analysis: February 20 V2405 contract opening price: 5788, highest price: 5847, lowest price: 5785, position: 776217, settlement price: 5818, yesterday settlement: 5824, down: 6, daily trading volume: 735119 lots, precipitated capital: 3.16 billion, capital outflow: 1.194 billion.

List of comprehensive prices by region: yuan / ton

|

Area |

February nineteenth |

February twentieth |

Rise and fall |

Remarks |

|

North China |

5510-5570 |

5520-5600 |

10/30 |

Send to cash remittance |

|

East China |

5550-5650 |

5570-5680 |

20/30 |

Cash out of the warehouse |

|

South China |

5620-5680 |

5640-5680 |

20/0 |

Cash out of the warehouse |

|

Northeast China |

5400-5550 |

5400-5600 |

0/50 |

Send to cash remittance |

|

Central China |

5530-5590 |

5530-5590 |

0/0 |

Send to cash remittance |

|

Southwest |

5460-5630 |

5460-5630 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price range collation, regional price adjustment. Compared with the valuation, North China rose 10-30 yuan / ton, East China 20-30 yuan / ton, South China 20 yuan / ton, Northeast China 50 yuan / ton, and Central China and Southwest China stable. The factory price of upstream PVC production enterprises has been reduced by 30-50 yuan / ton, including simultaneous price reduction in remote storage, but there are still some enterprises that wait and see to stabilize prices, and there are few contracts signed in the first generation. The quotations of traders in various regions of the spot market are slightly lower than those of yesterday, while some market prices have risen slightly, and there are differences in price adjustment. On the whole, the market low price has decreased, while the high price has not changed much. The spot market base price is mainly quoted, and the basis does not change much, including East China basis offer 05 contract-(220-250), South China 05 contract-(150-220), North 05 contract-(480-550), Southwest 05 contract-(250). The enthusiasm of purchasing spot in the lower reaches is not high, and there are not many orders, and the trading atmosphere in the spot market is light.

From the perspective of futures: & the night futures price of nbsp; PVC2405 contract has risen slightly since its low, but the overall increase is not big. After the start of morning trading, futures fluctuated on the basis of night trading, followed by two small increases in intraday trading, and afternoon prices fell slightly from their highs. 2405 contracts range from 5785 to 5847 throughout the day, with a spread of 62. 05 contracts with an increase of 23114 positions and 776217 positions so far. The 2409 contract closed at 5941, with 94010 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures still show a trend of increasing positions. In intraday trading, the opening of 23.2% more than the short opening of 24.2%, the enthusiasm of low-order entry has been weakened, and there are multiple orders to resist low-level entry. The technical level shows that the opening of the upper rail in the Bolin belt (13, 13, 2) is obvious downward, and the lower rail is flat, and the high point of the future price just approaches the pressure position of the middle rail without breaking through, and presents a positive pillar with a long upper shadow line. Daily-level KD line and MACD line continue to cross, on the whole, the current weak fundamentals are still difficult to support significant changes in futures prices, we still maintain the previous point of view, observing the performance of the low range of 5740-5800.

Spot aspect: From the current time node to late February, from the point of view of the changes in the futures price, it once again presents the characteristics of constantly confirming the bottom and continuing the rhythm before the festival, although the weak fundamentals have become a consensus. However, the current prices of the two cities continue to shrink downwards. On the one hand, from a spot point of view, demand is still expected to recover in the medium term, on the other hand, with the spring inspection, there is a trend of supply reduction. However, how this concept of time is expected to land is still unknown, so although the Social inventory Bureau is at a high level, it shows a certain upward trend in comparison or in the middle line. Today, Taiwan's Formosa Plastics PVC exports rose US $30 in March shipments, Taiwan export FOB FOB US $750, CIF India CFR US $820, CIF Chinese mainland CFR US $795, Southeast Asia CIF CFR US $790. On the whole, the PVC spot market currently has insufficient variables and will maintain a trend of small shocks in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 2.19 |

Price 2.20 |

Rate of change |

|

V2405 collection |

5781 |

5816 |

35 |

|

|

Average spot price in East China |

5600 |

5625 |

25 |

|

|

Average spot price in South China |

5650 |

5660 |

10 |

|

|

PVC2405 basis difference |

-181 |

-191 |

-10 |

|

|

V2409 collection |

5902 |

5941 |

39 |

|

|

V2405-2409 close |

-121 |

-125 |

-4 |

|

|

PP2405 collection |

7497 |

7376 |

-121 |

|

|

Plastic L2405 collection |

8230 |

8142 |

-88 |

|

|

V--PP basis difference |

-1716 |

-1560 |

156 |

|

|

Vmure-L basis difference of plastics |

-2449 |

-2326 |

123 |

|

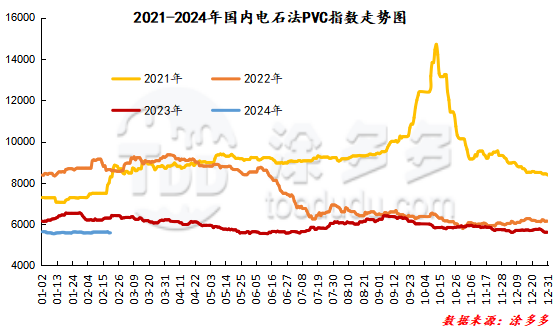

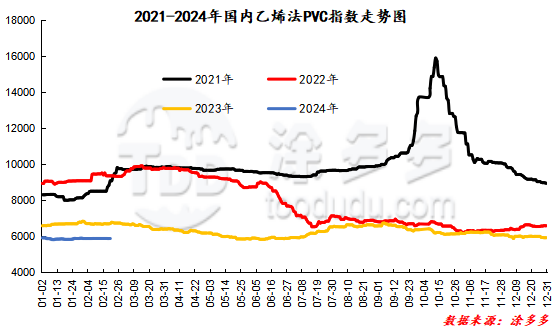

China PVC Index: according to Tudoduo data, the spot index of China's calcium carbide PVC rose 15.34 or 0.275% to 5596.42 on February 20. The ethylene PVC spot index was 5872.81, down 5.15, with a range of 0.088%. The calcium carbide index rose, the ethylene index decreased, and the ethylene-calcium carbide index spread was 276.39.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

2.19 warehouse orders |

2.20 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,425 |

2,425 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

903 |

903 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,326 |

5,326 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,723 |

2,723 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,790 |

4,790 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,600 |

21,600 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,678 |

3,678 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,494 |

1,494 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,747 |

1,687 |

-60 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

58,131 |

58,071 |

-60 |

|

Total |

|

58,131 |

58,071 |

-60 |

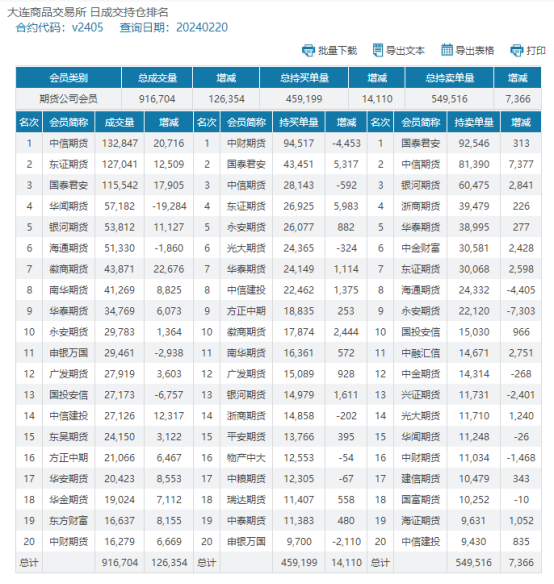

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.