Daily Review of Urea: Weak market operation and difficult to change the atmosphere before the holiday (February 6)

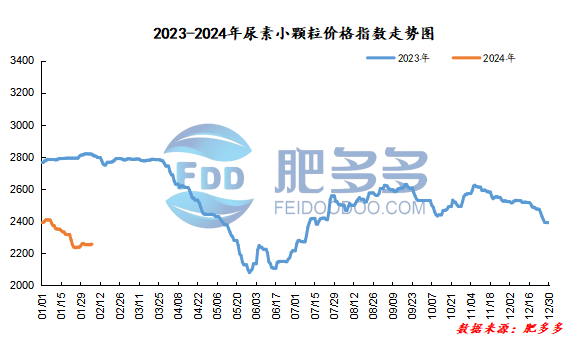

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on February 6 was 2,256.82, which was the same as yesterday, down 19.77% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR405 contract: 2146, the highest price: 2162, the lowest price: 2123, the settlement price: 2144, the closing price increased by 15 compared with the settlement price of the previous trading day, up 0.70% month-on-month, and the fluctuation range throughout the day is 2123-2162; the basis of the 05 contract in Shandong is 32; the 05 contract has increased its position by 4457 lots today, and the position held so far is 178,300 lots.

Spot market analysis:

Today, China's urea market prices are stable, corporate quotations are slightly consolidated, and the market continues steadily.

Specifically, prices in Northeast China have stabilized at 2,190 - 2,270 yuan/ton. Prices in North China rose to 2,070 - 2,280 yuan/ton. Prices in East China rose to 2,170 - 2,240 yuan/ton. Prices in South China are stable at 2,350 - 2,400 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,190 - 2,380 yuan/ton, and the price of large particles has stabilized at 2,240 - 2,320 yuan/ton. Prices in Northwest China rose to 2,220 - 2,230 yuan/ton. Prices in Southwest China are stable at 2,230 - 2,600 yuan/ton.

Market outlook forecast:

In terms of factories, most manufacturers have completed advance receipt of holiday orders. Under the support of waiting, among the current pre-shipment orders, the factory quotation has stabilized slightly, and has adjusted within a narrow range. In terms of the market, the market has also entered a festive atmosphere and is temporarily in a state of priceless and no market. The current market is basically stable. On the supply side, Nissan continues to rebound, and supply continues to be abundant despite weak demand. On the demand side, downstream operators have been delisted on vacations one after another. Currently, only farmers need sporadic replenishment, and the demand side is operating in a weak position.

On the whole, the weak market situation before the year was difficult to change, and prices were mostly stable. It is expected that the urea market price will continue to be stable in the short term.