PVC: The range of futures price fluctuations continues to be narrow and sideways. Late income is slightly weak, and spot prices are available but no market.

PVC futures analysis: February 5 V2405 contract opening price: 5813, highest price: 5848, lowest price: 5787, position: 791453, settlement price: 5813, yesterday settlement: 5818, down: 5, daily trading volume: 612901 lots, precipitated capital: 3.209 billion, capital inflow: 36.24 million.

List of comprehensive prices by region: yuan / ton

|

Area |

February fourth |

February fifth |

Rise and fall |

Remarks |

|

North China |

5470-5550 |

5470-5550 |

0/0 |

Send to cash remittance |

|

East China |

5560-5630 |

5550-5620 |

-10/-10 |

Cash out of the warehouse |

|

South China |

5620-5680 |

5620-5680 |

0/0 |

Cash out of the warehouse |

|

Northeast China |

5450-5600 |

5450-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5560-5600 |

5560-5600 |

0/0 |

Send to cash remittance |

|

Southwest |

5490-5600 |

5490-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price is temporarily stable, the spot market basically has price but no market. The comparison of valuation shows that North China is stable, East China is down 10 yuan / ton, and South China, Northeast China, Central China and Southwest China are stable. The ex-factory price of upstream PVC production enterprises has not been significantly adjusted, the price is basically stable, and the signing of first-generation contracts has basically stopped. Futures are weak and volatile, but traders in the spot market have also begun to take holidays one after another, the price offer has not changed much, the spot market atmosphere is calm and the market offer has decreased, and the spot price has not changed much at present. Among them, East China basis offer 05 contract-(180-270), South China 05 contract-(150-210), North 05 contract-(520-570), Southwest 05 contract-(250). On the whole, the spot market has entered the holiday mode, and the procurement of downstream demand-side products is limited.

From the perspective of futures: & the opening price of nbsp; PVC2405 contract rose slightly in night trading. The overall upward trend of night trading on Friday was better, but the price fell significantly in early trading on Monday and closed at a low in the afternoon. 2405 contracts range from 5787 to 5848 throughout the day, with a spread of 61. 05. the contract has reduced its position by 11632 hands and has held 791453 positions so far. The 2409 contract closed at 5902, with 79837 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2405 contract futures shows a trend of increasing positions, on the contrary, it still shows a certain increase in positions in a short time from the stop of the trading day. The low point of the futures price is once again approaching the low range, the technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) opens, the lower track of the middle track turns down obviously, and the futures price shows a fluctuation range similar to that of last Friday, and the upper shadow line is longer, and there is also a certain gap in the transaction, of which 25.3% versus 22.1% are suppressed. With the shortening of the trading day, the low performance of the futures price may affect the two cities after the festival. in the short term, we maintain the previous point of view and continue to observe the performance of the low range 5750-5800.

Spot aspect: 's current spot market first upstream production enterprises maintain factory quotations, but the first generation contracts are basically not signed, PVC production inventory is dominant, and some enterprises have a certain pre-sale volume. Traders in the spot market in various regions also began to have a holiday one after another, whether it was a price or a point price, the offer was not active, and the turnover in the spot market turned to light, only a few did not have a holiday downstream to seek bottom replenishment. At present, there are not many variables in the supply and demand level, and the overall spot market begins to gradually enter the holiday rhythm. In the outer disk, international oil prices fell as a strong US jobs report in January boosted the dollar and damped expectations that the Fed would cut interest rates soon, which could be a drag on crude oil demand. In addition, weak economic growth in China and the possibility of easing conflicts in the Middle East have also contributed to the decline in oil prices. On the whole, the spot market before the festival may gradually stagnate, with price but no market.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 2.2 |

Price 2.5 |

Rate of change |

|

V2405 collection |

5812 |

5792 |

-20 |

|

|

Average spot price in East China |

5600 |

5585 |

-15 |

|

|

Average spot price in South China |

5650 |

5650 |

0 |

|

|

PVC2405 basis difference |

-212 |

-207 |

5 |

|

|

V2409 collection |

5924 |

5902 |

-22 |

|

|

V2405-2409 close |

-112 |

-110 |

2 |

|

|

PP2405 collection |

7322 |

7316 |

-6 |

|

|

Plastic L2405 collection |

8077 |

8095 |

18 |

|

|

V--PP basis difference |

-1510 |

-1524 |

-14 |

|

|

Vmure-L basis difference of plastics |

-2265 |

-2303 |

-38 |

|

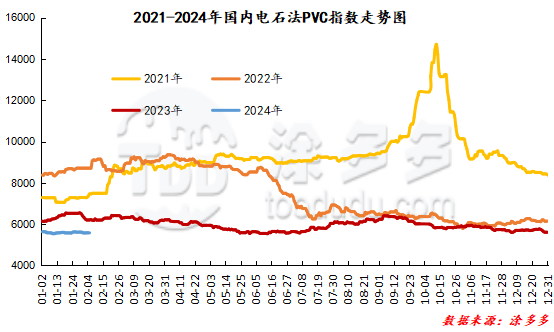

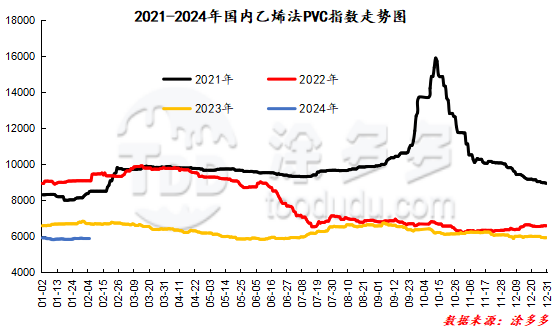

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot index fell 4.48, or 0.08%, to 5575.92 on February 5. The PVC spot index of ethylene method is 5877.54, down 0%, the range is 0%, the index of calcium carbide method is down, the index of ethylene method is stable, and the price difference between ethylene method and calcium carbide method is 301.62.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

2.2 Warehouse orders |

2.5 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,425 |

2,425 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

903 |

903 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,546 |

5,326 |

-220 |

|

Polyvinyl chloride |

Peak supply chain |

2,723 |

2,723 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,790 |

4,790 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,382 |

21,402 |

20 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,678 |

3,678 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,494 |

1,494 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

57,773 |

57,573 |

-200 |

|

Total |

|

57,773 |

57,573 |

-200 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.