Methanol: Futures market is strong and volatile, spot price range adjustment

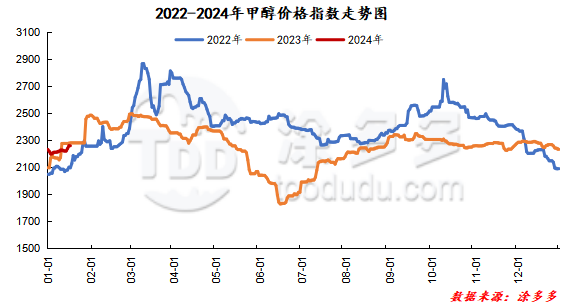

On January 31, the methanol market price index was 2276.36, down 3.98 from yesterday and 0.17% from the previous month.

Outer disk dynamics:

Methanol closed on January 30th:

China CFR 290-295USD / ton, Ping

Us FOB 95-96 cents per gallon, flat

Southeast Asia CFR 346.5-247.5 US dollars / ton, Ping

European FOB 263.75-264.75 euros / ton, up 0.25 euros / ton.

Summary of today's prices:

Guanzhong: 2230-2250 (30), North Route: 2000-2010 (- 10), Lunan: 2430-2450 (0), Henan: 2310-2340 (- 20), Shanxi: 2200-2300 (0), Port: 25602580 (10)

Freight:

North Route-Northern Shandong 340-420 (10amp 0), Southern Route-Northern Shandong 330-420 (10max 20), Shanxi-Northern Shandong 200-260 (0max 10), Guanzhong-Southwest Shandong 160-210 (0max 0)

Spot market: today, the price range of methanol market is adjusted, with the approach of the Spring Festival holiday, terminal factories stop work one after another for holidays, and most of the raw material stocks in some downstream factories are in an adequate state, and there are no favorable factors on the demand side. the trading atmosphere is general. Specifically, the market price in the main producing areas is adjusted narrowly, with the quotation on the southern route around 2030 yuan / ton and the northern line around 2000-2010 yuan / ton, which is 10 yuan / ton lower than that of yesterday. At present, the pre-festival warehouse of manufacturers is relatively smooth, and most enterprise inventories have fallen to a low level. There is a certain support for the mentality of operators, but with the Spring Festival approaching, the pre-holiday stock preparation of downstream factories is nearing the end, and there are expectations of snow in the Chinese market recently, and some manufacturers have reduced prices. Market prices in Shandong, the main consumer area, are adjusted in a narrow range, with 2430-2450 yuan / ton in southern Shandong and 2470-2480 yuan / ton in northern Shandong. At present, downstream stock has basically entered the end, and it is difficult for demand to improve significantly in the short term. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2340-2430 yuan / ton today, with a low-end increase of 40 yuan / ton. at present, the number of transport vehicles in the field may gradually decrease, freight prices may be expected to be raised, and downstream replenishment is active. Shanxi quotation is adjusted in a narrow range, and today's quotation is stable to 2200-2300 yuan / ton.

Port market: methanol futures are highly volatile today. Spot rigid demand negotiations; long-term arbitrage shipments, arbitrage and unilateral receiving simultaneous follow-up, the basis is high. The overall deal is OK. Taicang main port transaction price: spot transaction: 2560-2580, base difference 05: 90, base difference: 2580-2585, base difference: 05: 105, transaction price: 2585, base difference: 05: 100, transaction price: 2535-2570, basis difference: 05: 75: 90, transaction: 2510-2540, basis difference: 05: 60, 65.

|

Area |

2024/1/31 |

2024/1/30 |

Rise and fall |

|

The whole country |

2276.36 |

2280.34 |

-4.34 |

|

Northwest |

2000-2250 |

2010-2250 |

-10/0 |

|

North China |

2200-2430 |

2200-2450 |

0/-20 |

|

East China |

2560-2730 |

2550-2730 |

10/0 |

|

South China |

2505-2600 |

2505-2600 |

0/0 |

|

Southwest |

2200-2500 |

2200-2500 |

0/0 |

|

Northeast China |

2250-2400 |

2250-2400 |

0/0 |

|

Shandong |

2430-2480 |

2430-2480 |

0/0 |

|

Central China |

2310-2670 |

2330-2670 |

-20/0 |

Future forecast: with the Spring Festival holiday approaching, the downstream market stock has basically entered the end, at present, some downstream factory raw materials have maintained a relatively high level, the market demand is gradually decreasing, and the recent rainy and snowy weather in some parts of the Chinese market, under the influence of rising freight rates, some Chinese production enterprises have extended a narrow decline in Chinese market prices in the short term in order to keep the goods out of stock. However, under the influence of tight supply in the port area, the spot quotation may still maintain a high level. generally speaking, it is expected that the short-term methanol market price may continue the regional trend, but in the later stage, we need to pay close attention to the macro and coal prices. the operation of the plant in the field and the stock before the downstream festival.