Daily Review of Urea: Consolidation of Weak Market Operation and Price Shock (January 25)

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on January 25 was 2,233.00, a decrease of 4.55 from yesterday, a month-on-month decrease of 0.20%, and a year-on-year decrease of 20.04%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2075, the highest price is 2115, the lowest price is 2070, the settlement price is 2089, and the closing price is 2100. The closing price has increased by 66 compared with the settlement price of the previous trading day, and the month-on-month increase is 3.24%. The fluctuation range of the whole day is 2070-2115; the basis of the 05 contract in Shandong is 30; the 05 contract has increased its position by 3525 lots today, and the position held so far is 204,600 lots.

Spot market analysis:

Today, China's urea market prices continued to decline, and corporate quotations fluctuated within a narrow range. Some companies had better goods at low-priced sources, and market activity increased slightly.

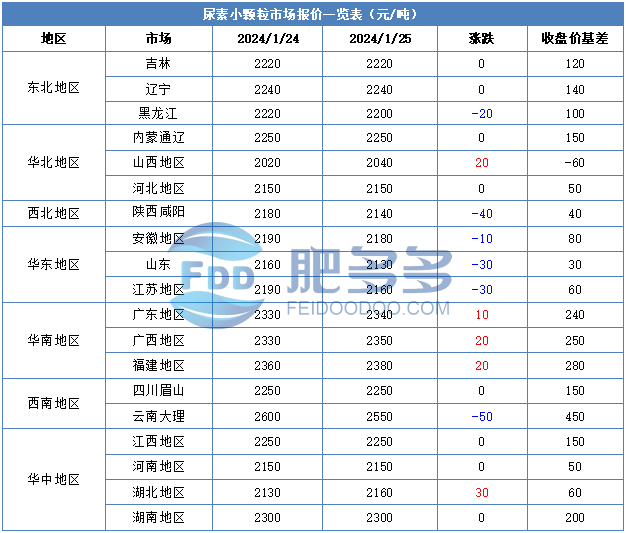

Specifically, prices in Northeast China have stabilized at 2,190 - 2,250 yuan/ton. Prices in North China rose to 2,040 - 2,260 yuan/ton. Prices in East China fell to 2,120 - 2,200 yuan/ton. Prices in South China rose to 2,330 - 2,400 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,140 - 2,380 yuan/ton, and the price of large particles has stabilized at 2,180 - 2,250 yuan/ton. Prices in Northwest China fell to 2,140 - 2,150 yuan/ton. Prices in Southwest China fell to 2,225 - 2,600 yuan/ton.

Market outlook forecast:

In terms of factories, factories in some regions have received better low-end quotations recently. Currently, low-end quotations continue to be accepted. As the Spring Festival holiday approaches, most factories have plans to advance receipts. Factory quotations continue to decline, but transactions are average. In terms of the market, the market continues to operate weakly and steadily, the overall trading atmosphere is relatively weak, and the downstream is cautiously following up. On the supply side, with the continuous recovery of early maintenance companies, Nissan has rebounded one after another. The market supply is abundant and prices are under upward pressure. On the demand side, based on the fact that prices continue to fall, and most of them are reserve demand, operators just need a small amount of sporadic follow-up. Purchasing is relatively cautious and maintain follow-up on dips.

On the whole, the current urea market price continues to decline, with less demand from industry operators and more wait-and-see purchases. It is expected that the urea market price will continue to be weak and consolidated in the short term.