PVC: Futures prices continue to break through the high point of departure, technical closing, and spot transactions move upwards

PVC futures analysis: January 24th V2405 contract opening price: 5919, highest price: 5950, lowest price: 5904, position: 730889, settlement price: 5928, yesterday settlement: 5868, up: 60, daily trading volume: 625735 lots, precipitated capital: 3.041 billion, capital outflow: 168 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.23 |

Price 1.24 |

Rise and fall |

Remarks |

|

North China |

5500-5550 |

5510-5580 |

10/30 |

Send to cash remittance |

|

East China |

5580-5650 |

5660-5730 |

80/80 |

Cash out of the warehouse |

|

South China |

5550-5620 |

5600-5670 |

50/50 |

Cash out of the warehouse |

|

Northeast China |

5400-5550 |

5450-5620 |

50/70 |

Send to cash remittance |

|

Central China |

5530-5580 |

5550-5620 |

20/40 |

Send to cash remittance |

|

Southwest |

5400-5600 |

5490-5650 |

90/50 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices slightly higher, regional quotations slightly upward. Compared with the valuation, North China rose 10-30 yuan / ton, East China 80 yuan / ton, South China 50 yuan / ton, Northeast China 50-70 yuan / ton, Central China 20-40 yuan / ton, and Southwest China 50-90 yuan / ton. The factory price of upstream PVC production enterprises began to raise quotations ranging from 20-30-50-80 yuan / ton, and each enterprise decided according to its own situation, including simultaneous price increases in remote libraries. The operation of futures is slightly stronger, and the price offer of traders is generally higher than that of yesterday. With the rise of the futures price, the spot price advantage disappears, but there is still a basis offer and does not change much. Among them, East China basis offer 05 contract-(200-250), South China 05 contract-(150-250), North 05 contract-(520-600), Southwest 05 contract-(250). Although the focus of the spot market transaction has moved up, but the overall trading is limited, a small amount of spot price transaction atmosphere is general.

Futures point of view: PVC2405 contract night trading price to the end of the night trading, are in the trend of narrow volatility. After the start of morning trading, the price rose slightly, the range was limited, and then continued to sort out high and small, and the afternoon trend remained unchanged. 2405 contracts range from 5904 to 5944 throughout the day, with a price difference of 44.05.The contract has reduced its position by 43657 hands and has held 730889 positions so far. The 2409 contract closed at 6045, with 71203 positions.

PVC Future Forecast:

Futures: & the operating range of the nbsp; PVC2405 contract price is as expected, operating within a narrow range of 5900-5950. First of all, the high point of the futures price continues to break through by a small margin on the basis of yesterday, and the high point of the futures price is still close to the upper track position of the Bollinger belt (13, 13, 2), the second touch. Secondly, the fluctuation of futures price is relatively narrow, which is more likely to be caused by the departure of short orders, in which 26.8% of positions are significantly reduced compared with 24.9%. The continuous upward trend of the futures price makes the technical closing line better, in which the KD line and MACD line at the daily line level show an obvious golden fork trend, but we still maintain the previous point of view, although the futures price has a slightly strong trend, but the range may be limited, observe how the pressure level 5950 behaves.

Spot: prices in the two cities continue to rise, as far as the spot market is concerned, the price uplink is still difficult to change the weak demand side, a small number of transactions and mainly low-price transactions, the current spot market urgent pick-up price is still low, but the long-term post-holiday pre-collection price is even higher than the current market price, the industrial chain still has certain expectations for the medium-term market. Judging from the current time node and the performance of the two cities, if the small upward trend of the futures price can be relatively stable, or even if there is a certain range of test data, it will not be too deep, and the early range of 5750-5800 may be difficult to appear. The trading time before the festival is getting shorter and shorter, although the weak demand is a consensus, but in the case of more external negative factors, it is still difficult for the prices of the two cities to show a deep downward performance. Therefore, the current spot market, in the short term, the goods are still in a small consolidation situation.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.23 |

Price 1.24 |

Rate of change |

|

V2405 collection |

5919 |

5944 |

25 |

|

|

Average spot price in East China |

5615 |

5695 |

80 |

|

|

Average spot price in South China |

5585 |

5635 |

50 |

|

|

PVC2405 basis difference |

-304 |

-249 |

55 |

|

|

V2409 collection |

6016 |

6045 |

29 |

|

|

V2405-2409 close |

-97 |

-101 |

-4 |

|

|

PP2405 collection |

7467 |

7489 |

22 |

|

|

Plastic L2405 collection |

8265 |

8287 |

22 |

|

|

V--PP basis difference |

-1548 |

-1545 |

3 |

|

|

Vmure-L basis difference of plastics |

-2346 |

-2343 |

3 |

|

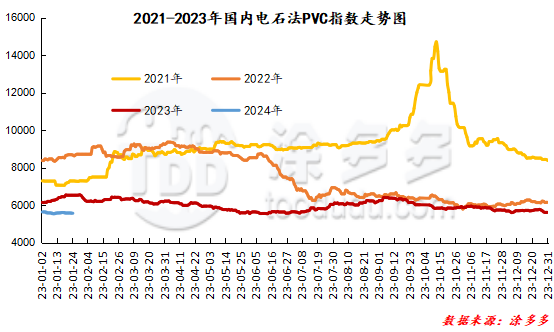

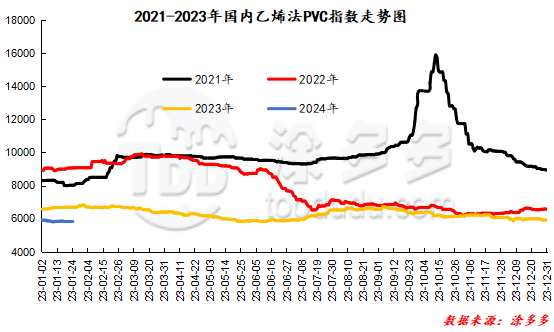

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot index rose 52.69, or 0.947%, to 5616.16 on January 24. The ethylene method PVC spot index was 5865.6, up 31.62%, with a range of 0.542%. The calcium carbide method index rose, the ethylene method index rose, and the ethylene-calcium carbide index spread was 249.44.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.23 warehouse orders |

1.24 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,125 |

2,125 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

603 |

603 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,546 |

5,546 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,753 |

2,723 |

-30 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,658 |

4,658 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,266 |

21,266 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,684 |

3,678 |

-6 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

57,567 |

57,531 |

-36 |

|

Total |

|

57,567 |

57,531 |

-36 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.