Daily Review of Urea: Industry supply continues to improve and downstream follow-up continues slowly (January 24)

China Urea Price Index:

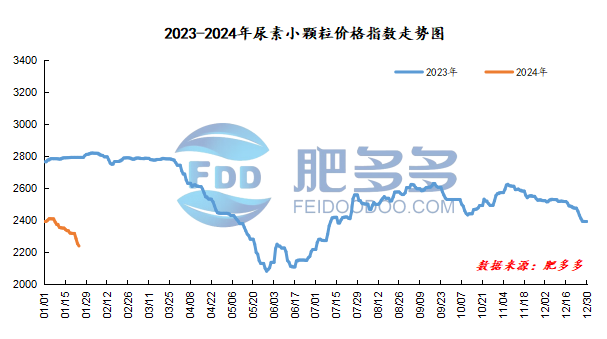

According to calculations from Feiduo data, the urea small pellet price index on January 24 was 2,237.55, a decrease of 15.18 from yesterday, a month-on-month decrease of 0.67%, and a year-on-year decrease of 19.88%.

Urea futures market:

Today, the opening price of urea UR405 contract: 2017, the highest price: 2086, the lowest price: 1996, the settlement price: 2034, the closing price: 2085. The closing price increased by 51 compared with the settlement price of the previous trading day, and the month-on-month increase by 2.51%. The fluctuation range throughout the day is 1996-2086; the basis of the 05 contract in Shandong region is 75; the 05 contract has increased its position by 3299 lots today, and the position held so far is 201,100 lots.

Spot market analysis:

Today, China's urea market prices continued to fall, and factory quotations continued to consolidate downwards. However, the market trading atmosphere was still weak, and prices continued to be weak in the short term.

Specifically, prices in Northeast China fell to 2,190 - 2,250 yuan/ton. Prices in North China fell to 2020-2260 yuan/ton. Prices in East China fell to 2,140 - 2,200 yuan/ton. Prices in South China fell to 2,320 - 2,380 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,130 - 2,380 yuan/ton, and the price of large particles fell to 2,180 - 2,250 yuan/ton. Prices in the northwest region are stable at 2,180 - 2,190 yuan/ton. Prices in Southwest China fell to 2,225 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers in some mainstream regions continue to reduce their quotations and receipts, but the transaction of new orders has not improved significantly. The price reduction and receipts in mainstream regions are poor, and the company's inventory has increased, and current shipments are under pressure. In terms of the market, the sentiment of the industry is weak and volatile. Although the current market price continues to fall, the market has not shown any obvious signs of improvement in follow-up, and the number of new orders has fallen short of expectations. On the supply side, industry supply is still continuing to increase. Currently, supply is relatively abundant. The supply side has a negative impact and prices are under upward pressure. On the demand side, downstream operating rates are operating at a low level, follow-up on raw materials continues to be slow, procurement mentality is relatively cautious, and the current market trading focus continues to move downward.

On the whole, the current urea market price continues to fall, and most manufacturers tend to wait and see when purchasing. If the price continues to drop, it may usher in a certain amount of downstream demand to follow up. It is expected that the urea market price will continue to stabilize and fall sharply in the short term.