PVC: The futures price rose strongly at the end of the session, successfully turning red and rising, and the spot price was mainly adjusted flexibly

PVC futures analysis: January 23rd V2405 contract opening price: 5840, highest price: 5920, lowest price: 5831, position: 774546, settlement price: 5868, yesterday settlement: 5863, up: 5, daily trading volume: 751629 lots, precipitated capital: 3.209 billion, capital outflow: 67.4 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.22 |

Price 1.23 |

Rise and fall |

Remarks |

|

North China |

5500-5550 |

5500-5550 |

0/0 |

Send to cash remittance |

|

East China |

5600-5660 |

5580-5650 |

-20/-10 |

Cash out of the warehouse |

|

South China |

5580-5650 |

5550-5620 |

-30/-30 |

Cash out of the warehouse |

|

Northeast China |

5450-5600 |

5400-5550 |

-50/-50 |

Send to cash remittance |

|

Central China |

5530-5580 |

5530-5580 |

0/0 |

Send to cash remittance |

|

Southwest |

5420-5600 |

5400-5600 |

-20/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices continue to be mainly flexible adjustment by a small margin. The comparison of valuation shows that North China is stable, East China is down 10-20 yuan / ton, South China is down 30 yuan / ton, Northeast China is down 50 yuan / ton, Central China is stable, Southwest China is down 20 yuan / ton. The ex-factory price of upstream PVC production enterprises basically remained stable, and there was no obvious price fluctuation. The operation of the futures market is slightly stronger, and the price offered by traders in various regions has not changed much in the morning compared with yesterday, and some tentative increases have been made in the afternoon, but the acceptance in the lower reaches is limited. The basis offer does not change much, including East China 05 contract-(200-250), South China 05 contract-(150-250), North 05 contract-(520-600), Southwest 05 contract-(250). In the spot market, no matter in terms of price or point price, the transaction is light, especially after the price advantage of the point price source disappears in the afternoon, the transaction becomes less and less smooth, the purchasing enthusiasm of the lower reaches is low, and some of them wait and see temporarily.

Futures point of view: PVC2405 contract night trading opened, the price began to rise in a small range of volatility. After the beginning of morning trading, futures prices were arranged in a narrow range on the basis of night trading, with little change during the period, and prices rose in the afternoon, especially at the end of the day. 2405 contracts range from 5831 to 5920 throughout the day, with a spread of 89. 05. The contract has reduced its position by 28064 hands and has held 774546 positions so far. The 2409 contract closed at 6016, with 71507 positions.

PVC Future Forecast:

Futures: & the operating high of the nbsp; PVC2405 contract price showed an obvious small breakthrough in the late trading period. First of all, the late trading high successfully rose above the 5900 highest point 5920, and the high point of the futures price approached the upper track position of the Bollinger belt (13, 13, 2), and turned upward. Secondly, there was a certain amount of trading on the disk, with 23.2% more opening than 20.4% empty. PVC fundamentals appear a little positive factors, breaking the narrow horizontal market state, to the long-lost horizontal market waiting for a trace of volatility, the daily level of KD line and MACD two-line distance expansion. Overall look at the short-term price fluctuations or continue to take the postgraduate entrance examination on the track position, continue to observe the performance in the range of 5900-5950.

Spot aspect: The rise of futures late in the afternoon in the spot market triggered a tentative rise in some prices. from the perspective of the spot market, the price advantage disappeared after the price rose, and when the point price was not good, the inquiry enthusiasm of the spot demand to the spot price was also not high, so although the atmosphere between the two markets improved in the afternoon, it did not lead to a change in spot transactions. PVC fundamentals, according to some business feedback export order performance, and Taiwan Formosa Plastics February pre-sale quotation raised 20 U.S. dollars / ton, China's main port CFR reported to 765 U.S. dollars / ton, India CIF reported to 790 U.S. dollars / ton, Southeast Asia CFR reported 760 U.S. dollars / ton, Formosa Plastics supply is less than the daily norm. In the lacklustre market, this increase shows a certain positive. In the short term, the spot market price may be slightly stronger, but the range may be limited.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.22 |

Price 1.23 |

Rate of change |

|

V2405 collection |

5832 |

5919 |

87 |

|

|

Average spot price in East China |

5630 |

5615 |

-15 |

|

|

Average spot price in South China |

5615 |

5585 |

-30 |

|

|

PVC2405 basis difference |

-202 |

-304 |

-102 |

|

|

V2409 collection |

5932 |

6016 |

84 |

|

|

V2405-2409 close |

-100 |

-97 |

3 |

|

|

PP2405 collection |

7429 |

7467 |

38 |

|

|

Plastic L2405 collection |

8270 |

8265 |

-5 |

|

|

V--PP basis difference |

-1597 |

-1548 |

49 |

|

|

Vmure-L basis difference of plastics |

-2438 |

-2346 |

92 |

|

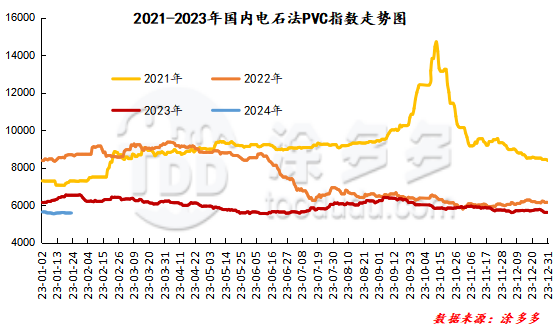

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 15.07% to 5563.47 on January 23, down 0.27%. The ethylene PVC spot index was 5833.98, up 1.03, with a range of 0.018%, while the calcium carbide index decreased, the ethylene index rose, and the ethylene-calcium carbide index spread was 270.51.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.22 warehouse orders |

1.23 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,125 |

2,125 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

603 |

603 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,546 |

5,546 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,753 |

2,753 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,658 |

4,658 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,266 |

21,266 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,684 |

3,684 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

57,567 |

57,567 |

0 |

|

Total |

|

57,567 |

57,567 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.