Daily Review of Urea: Supply is expected to increase, and operators are cautious in purchasing needs (January 23)

China Urea Price Index:

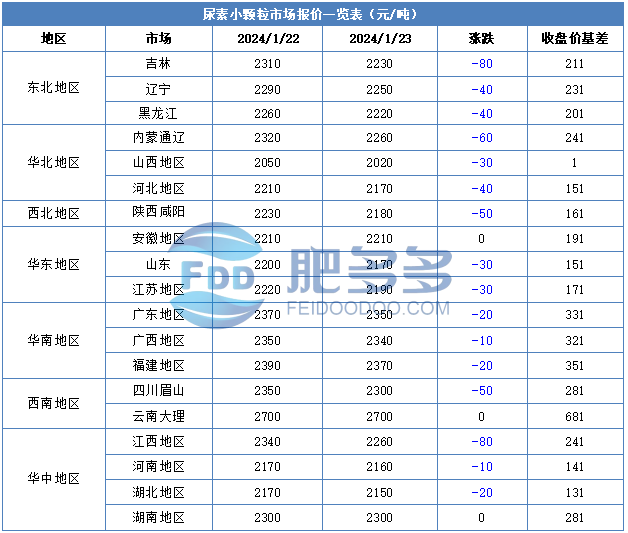

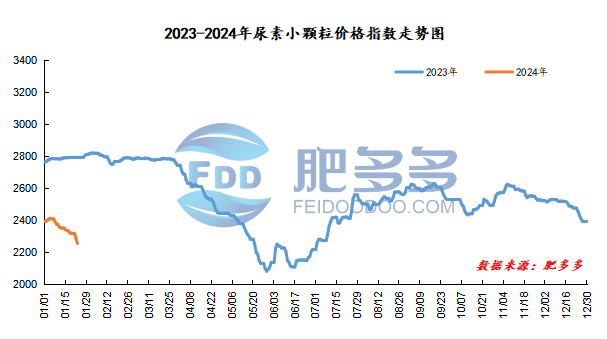

According to calculations from Feiduo data, the urea small pellet price index on January 23 was 2,252.73, a decrease of 31.64 from yesterday, a month-on-month decrease of 1.38%, and a year-on-year decrease of 19.33%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2036, the highest price is 2052, the lowest price is 2015, the settlement price is 2034, and the closing price is 2019. The closing price is 33 lower than the settlement price of the previous trading day, down 1.61% month-on-month. The fluctuation range of the whole day is 2015-2052; the basis of the 05 contract in Shandong is 151; the 05 contract has increased its position by 18265 lots today, and the position held so far is 197,800 lots.

Spot market analysis:

Today, China's urea market prices continued to decline, and manufacturers 'quotations continued to be lowered. However, the market's new orders were sluggish and did not improve, and the market was weak for a short time.

Specifically, prices in Northeast China fell to 2,210 - 2,260 yuan/ton. Prices in North China fell to 2020-2260 yuan/ton. Prices in East China fell to 2,160 - 2,220 yuan/ton. Prices in South China fell to 2,330 - 2,390 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,150 - 2,380 yuan/ton, and the price of large particles fell to 2,210 - 2,300 yuan/ton. Prices in Northwest China fell to 2,180 - 2,190 yuan/ton. Prices in Southwest China fell to 2,250 - 2,800 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers continue to lower their quotations for orders received before the Spring Festival. Current market prices continue to drop. Most factories have introduced relevant order-receiving policies for downstream customers, and actual market transactions are low. In terms of the market, the current market transactions have not improved. Low-priced sources of goods continue to test the market, and the market temporarily continues to be weak and downward. In terms of supply, supply is still expected to increase in the short term. Parking companies will gradually recover in the early part of this week, and supply pressure in the industry will gradually emerge. On the demand side, agriculture continues to maintain periodic bargain hunting, and the attitude towards reserve demand remains cautious; in industry, the start-up of compound fertilizer factories continues to decline, the willingness to buy goods is not strong, and the overall market demand performance is flat.

On the whole, the current urea market is affected by the increase in supply, and the downstream is less enthusiastic to get goods. Most of them adopt a cautious wait-and-see attitude. It is expected that the urea market price will stabilize and fall sharply in a short period of time, and the market will be consolidated and operating.