Methanol: Futures market is strong and volatile, spot prices are mixed

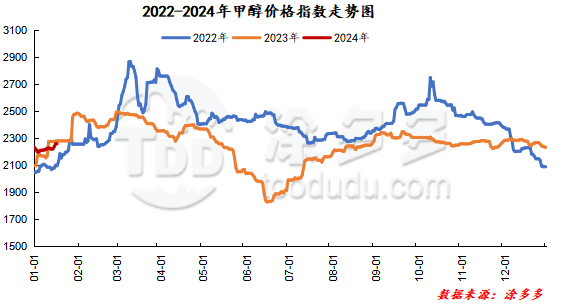

On January 22nd, the methanol market price index was 2259.66, which was 9.29 higher than that of the previous working day and 0.16% lower than the previous working day.

Outer disk dynamics:

On January 19th, methanol closed:

China CFR 278-283 US dollars / ton, down 6 US dollars / ton

Us FOB 95-96 cents per gallon, up 1 cent per gallon

Southeast Asia CFR 349.5-350.5 US dollars / ton, Ping

European FOB 261.75-262.75 euros / ton, down 6.50 euros / ton.

Summary of today's prices:

Guanzhong: 2160-2200 (0), North Line: 2010-2030 (10), Lunan: 2380 (0), Henan: 2300-2330 (10), Shanxi: 2200-2270 (0), Port: 2445-2490 (5)

Freight:

North Route-Northern Shandong 300-370 (30max 0), Southern Route-Northern Shandong 280-320 (0max 0), Shanxi-Northern Shandong 170-200 (0max 0), Guanzhong-Southwest Shandong 160-210 (0max 0)

Spot market: today, the price of methanol in the spot market is mixed, the futures market is highly volatile, and the spot quotation at the port is running at a high level, which forms a certain support for the mentality of the operators in the market, and the inventory pressure of the manufacturers in the main production areas is not great at present. the mentality of the industry still exists. Specifically, the market price in the main producing areas fell narrowly, with the quotation for the southern route around 2080 yuan / ton and the northern line around 2010-2030 yuan / ton, which was 10 yuan / ton lower than that of the previous working day. At present, the overall inventory of manufacturers is mostly low, and there is no inventory pressure in the short term. However, there is still a demand for shipment before the Spring Festival, the favorable support is limited, and the new price in Guanzhong area has been raised. The second quotation of Changqing methanol has been raised by 50 yuan / ton this week: large price 2250 yuan / ton factory cash exchange, small order quotation 2260 yuan / ton factory cash exchange. The market prices in Shandong, the main consumer area, are adjusted in a narrow range, with 2380 yuan / ton in southern Shandong, stable at the low end, and 2410-2420 yuan / ton in northern Shandong. The futures market is firm and upward, driving market prices higher, and the mentality of operators has a certain support. North China market quotation narrow adjustment, Hebei quotation 2300-2330 yuan / ton today, to maintain the early stage, a strong wait-and-see mood at the beginning of the week, the overall market trading atmosphere is general. Shanxi region quotation narrow adjustment, today's quotation stable to 2200-2270 yuan / ton, downstream manufacturers accept goods cautiously, the market transaction atmosphere is limited.

Port market: methanol futures fluctuated after the upside today. Spot offers are few; paper goods are sold every time they are high, and rigid demand buys within the month, with a strong basis; forward arbitrage buying, the spread is slightly weaker, and the price difference between 1 and 2 is widened. The atmosphere of the talks weakened in the afternoon. The overall transaction is active throughout the day. Taicang main port transaction price: 1 deal: 2440-2490, base difference 05: 80, base difference: 90, transaction price: 2430-2470, base difference: 05, 60: 65, transaction price: 2420-2460, basis difference: 05: 50.

|

Area |

2024/1/22 |

2024/1/19 |

Rise and fall |

|

The whole country |

2259.66 |

2250.37 |

9.29 |

|

Northwest |

2010-2240 |

2030-2200 |

-20/40 |

|

North China |

2200-2330 |

2200-2330 |

0/0 |

|

East China |

2445-2610 |

2440-2530 |

5/80 |

|

South China |

2430-2530 |

2400-2500 |

30/30 |

|

Southwest |

2200-2650 |

2200-2650 |

0/0 |

|

Northeast China |

2250-2400 |

2250-2400 |

0/0 |

|

Shandong |

2370-2420 |

2380-2420 |

-10/0 |

|

Central China |

2300-2650 |

2290-2650 |

10/0 |

Future forecast: recently, some areas of the Chinese market are affected by the cooling and snowfall weather, and the freight price has been raised. To a certain extent, the ex-factory price of the squeeze operators, with the approach of the Spring Festival holiday, there is a certain demand for preparation before the Spring Festival holiday. However, considering the current high position of raw material inventory of downstream manufacturers, the overall enthusiasm of entering the market and replenishing stock is general, and with the follow-up return of some methanol plants in the southwest and northwest. The gap between supply and demand in the market may be further expanded. At present, before the Spring Festival holiday, the upstream steadily discharged the stock, the downstream rigid demand for stock, and the overall transaction atmosphere of the market was OK. It is expected that the short-term methanol market price will fluctuate in a narrow range, but in the later stage, we still need to pay close attention to the macro and coal prices, the operation of the plant in the field and the downstream pre-festival stock.