PVC: Futures prices continue to move sideways on the mid-track, technical closing lines are unstable, and the spot market range is sorted out

PVC futures analysis: January 22nd V2405 contract opening price: 5880, highest price: 5900, lowest price: 5823, position: 802610, settlement price: 5863, yesterday settlement: 5856, up: 7, daily trading volume: 859846 lots, precipitated capital: 3.277 billion, capital outflow: 45.46 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.19 |

Price 1.22 |

Rise and fall |

Remarks |

|

North China |

5500-5550 |

5500-5550 |

0/0 |

Send to cash remittance |

|

East China |

5600-5660 |

5600-5660 |

0/0 |

Cash out of the warehouse |

|

South China |

5590-5630 |

5580-5650 |

-10/20 |

Cash out of the warehouse |

|

Northeast China |

5450-5600 |

5450-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5530-5580 |

5530-5580 |

0/0 |

Send to cash remittance |

|

Southwest |

5420-5600 |

5420-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price range is mainly sorted out, each region is basically flexible and fine-tuned. The comparison of valuation shows that North China and East China are stable, low-end prices in South China are down 10 yuan / ton, high-end prices are up 20 yuan / ton, and Northeast, Central and Southwest regions are stable. Upstream PVC production enterprises factory prices coincided with Monday did not see a larger adjustment action, mostly stable wait-and-see. Futures are still hovering in the range, with prices offered by traders in all regions rising in the morning, but falling after the afternoon decline. The quotation of the source of urgent delivery in the spot market is lower. After the afternoon price decline, the point price supply has an advantage for the time being, but the order point of the product enterprises is generally on the low side. The basis offer has not changed much, including 05 contract in East China-(200-250), 05 contract in South China-(150-250), 05 contract in North China-(520-600), and 05 contract in Southwest China-(250). On the whole, the turnover in the spot market on Monday is light, and the inquiry and purchase intention is low.

Futures point of view: PVC2405 contract Friday night trading opening price narrow high finishing mainly, the overall night trading volatility range is relatively small. Prices fell after the start of early trading on Monday, but then rebounded to a high of 5900 and fell from their peak in the afternoon. 2405 contracts range from 5823 to 5900 throughout the day, with a spread of 77. 05. The position of the contract has been reduced by 5593 hands, and the position has been held by 802610 hands so far. The 2409 contract closed at 5932, with 72993 positions.

PVC Future Forecast:

Futures: & the operating range of nbsp; PVC2405 contract price is still around the middle track, but the recent continuous horizontal fluctuation range has narrowed, resulting in the technical level of Bollinger belt (13, 13, 2) three tracks narrowed obviously, and the daily level of KD line and MACD line two lines shortened. Recently, the market has been showing a state of reducing positions, on the one hand, funds left the market before the festival, on the other hand, the narrow adjustment of the price range has reduced the degree of participation. At present, there are not many guidelines from fundamentals and policies, so no matter how short the direction is, there is no sufficient guidance. We still maintain our early judgment, but at present, bears are cautiously involved, focusing on the performance in the range of 5750-5800 below.

Spot aspect: period the two cities have been operating in a small range of finishing state recently, the spot market price is flexible and fine-tuned, the adjustment range is even less than 50 yuan / ton. From the current time node point of view, the spot transaction is more and more weak, far from the futures source inquiry degree is OK. In terms of supply and demand, the supply is temporarily stable, and the start-up load of the PVC plant is still at a high level, but on the demand side, product companies have begun to take holidays one after another, and spot demand is even more depressed, so the prices of the two cities have not seen a better performance for a long time. But even if the shackles of fundamental demand are agreed, futures and current prices have not fallen sharply on the current basis, PVC unit valuations are low and expectations for the medium term exist. Looking at the spot market in the short term as a whole, it may still be difficult to get rid of the situation of narrow arrangement, waiting for the performance of the medium-term break.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.19 |

Price 1.22 |

Rate of change |

|

V2405 collection |

5872 |

5832 |

-40 |

|

|

Average spot price in East China |

5630 |

5630 |

0 |

|

|

Average spot price in South China |

5610 |

5615 |

5 |

|

|

PVC2405 basis difference |

-242 |

-202 |

40 |

|

|

V2409 collection |

5969 |

5932 |

-37 |

|

|

V2405-2409 close |

-97 |

-100 |

-3 |

|

|

PP2405 collection |

7356 |

7429 |

73 |

|

|

Plastic L2405 collection |

8203 |

8270 |

67 |

|

|

V--PP basis difference |

-1484 |

-1597 |

-113 |

|

|

Vmure-L basis difference of plastics |

-2331 |

-2438 |

-107 |

|

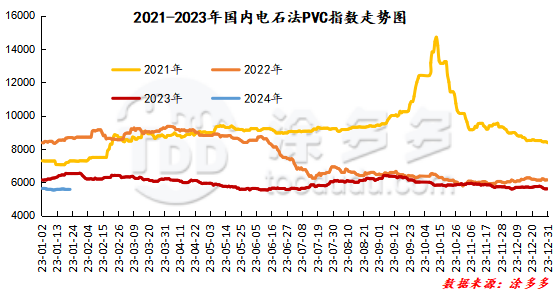

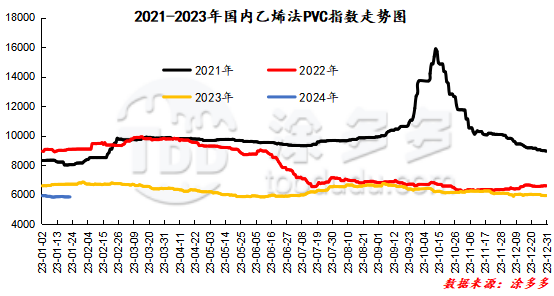

China PVC Index: according to Tudoduo data, China calcium Carbide PVC spot index rose 1.11, or 0.02%, to 5578.54 on January 22nd. The ethylene method PVC spot index is 5832.95, up 1.36, the range is 0.023%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 254.41.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.19 warehouse orders |

1.22 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,066 |

2,125 |

59 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

544 |

603 |

59 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,546 |

5,546 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,753 |

2,753 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,658 |

4,658 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,547 |

21,266 |

-281 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,684 |

3,684 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

57,789 |

57,567 |

-222 |

|

Total |

|

57,789 |

57,567 |

-222 |

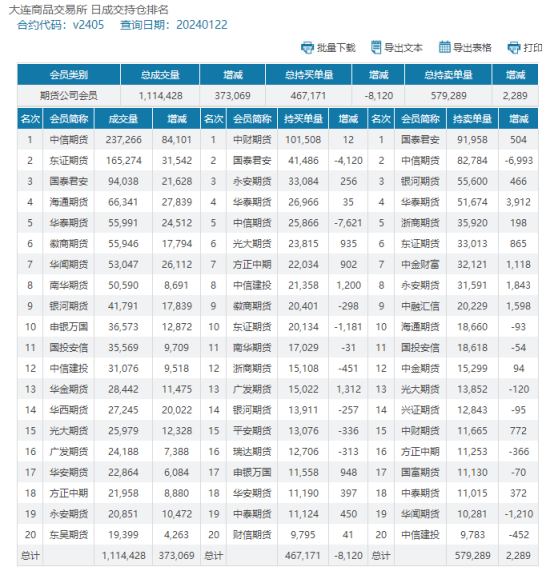

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.