Daily review of urea: Supply growth continues to increase, downstream demand follows up and is flat (January 22)

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on January 22 was 2,284.36, a decrease of 31.82 from last Friday, a month-on-month decrease of 1.37%, and a year-on-year decrease of 18.20%.

Urea futures market:

Today, the opening price of the urea UR405 contract is 2050, the highest price is 2087, the lowest price is 2030, the settlement price is 2052, and the closing price is 2048. The closing price is 23% lower than the settlement price of the previous trading day, down 1.11% month-on-month. The fluctuation range of the whole day is 2030-2087; the basis of the 05 contract in Shandong is 152; the 05 contract has increased its position by 5066 lots today, and the position held so far is 179,500 lots.

Spot market analysis:

Today, China's urea market prices continued to decline, market supply gradually increased, downstream demand did not improve, and prices were under pressure downward.

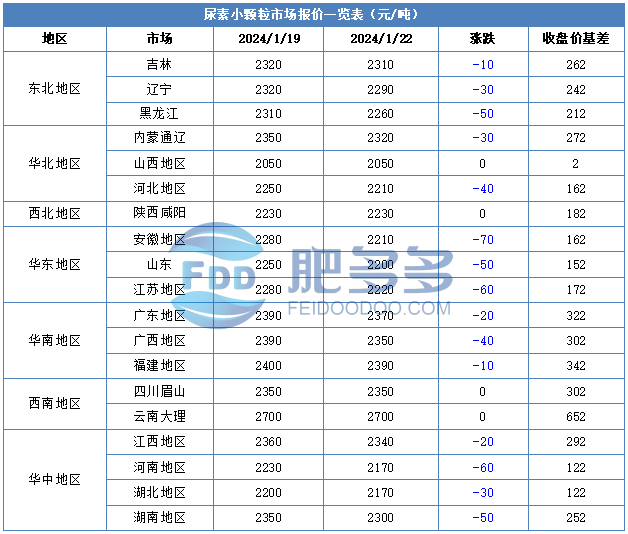

Specifically, prices in Northeast China fell to 2,260 - 2,320 yuan/ton. Prices in North China fell to 2,050 - 2,330 yuan/ton. Prices in East China fell to 2,180 - 2,240 yuan/ton. Prices in South China fell to 2,340 - 2,400 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,160 - 2,380 yuan/ton, and the price of large particles fell to 2,240 - 2,320 yuan/ton. Prices in the northwest region are stable at 2,230 - 2,240 yuan/ton. Prices in Southwest China are stable at 2,300 - 2,800 yuan/ton.

Market outlook forecast:

In terms of factories, most factories continue to cut their quotations to attract orders. The Spring Festival holiday is approaching. Most urea factories still face the pressure of advance receipts during the Spring Festival. Some factories have plans to increase advance receipts, and market transaction prices are expected to continue to fall. On the market side, affected by expectations of increased supply, market purchasing sentiment is more cautious, and the trading atmosphere continues to be dull. Internationally, affected by the tightening of urea supply in the area east of the Suez Canal, the prices of small particles in Southeast Asian markets have shown an upward trend, and international urea prices have mostly been consolidated upwards. On the supply side, gas companies continued to recover one after another this week, and Nissan rebounded significantly. On the demand side, demand support is relatively limited. Agricultural demand continues to be in need of fertilizer preparation. The start of industrial compound fertilizer factories is still low. Downstream operators are pessimistic about the future outlook.

On the whole, the current increase in urea market supply continues, the market is holding a wait-and-see attitude, and factories are receiving orders at low prices. It is expected that the urea market price will continue to stabilize and fall sharply in the short term.