PVC: Futures price fluctuations are extremely narrow. Continue to leave the market and adjust flexibly.

PVC futures analysis: January 19 V2405 contract opening price: 5854, highest price: 5874, lowest price: 5835, position: 808203, settlement price: 5856, yesterday settlement: 5835, up: 21, daily trading volume: 568188 lots, precipitated capital: 3.322 billion, capital outflow: 36.78 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.18 |

Price 1.19 |

Rise and fall |

Remarks |

|

North China |

5500-5520 |

5500-5550 |

0/30 |

Send to cash remittance |

|

East China |

5580-5660 |

5600-5660 |

20/0 |

Cash out of the warehouse |

|

South China |

5600-5650 |

5590-5630 |

-10/-20 |

Cash out of the warehouse |

|

Northeast China |

5450-5600 |

5450-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5530-5580 |

5530-5580 |

0/0 |

Send to cash remittance |

|

Southwest |

5420-5600 |

5420-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices are mainly adjusted flexibly and arranged in different regions. Compared with the valuation, North China rose 30 yuan / ton, East China increased 20 yuan / ton, South China fell 10-20 yuan / ton, and Northeast, Central and Southwest regions were stable. Upstream PVC production enterprises temporarily stable ex-factory prices, individual enterprises slightly reduced 20 yuan / ton to promote transactions. The futures price fluctuates in a narrow range, and the spot market price and the basis offer coexist, and the change is small. The fluctuation range of the futures price makes the point price source have no price advantage for the time being, in which the East China base difference offer 05 contract-(200-250), the South China 05 contract-(150-250), the North 05 contract-(520-580), the Southwest 05 contract-(250), on the whole, the spot market spot price is lower. There are some urgent supply of goods at low prices in the market, and most of the transactions are based on low prices. The purchasing enthusiasm of the lower reaches is not high for the time being, and some of them wait and see for the time being.

Futures point of view: PVC2405 contract night trading opening price to the end of the night trading, are mainly fluctuating in a small range. After the beginning of early trading, the futures price rose slightly, but the overall strength was not strong enough, and then continued to open the mode of narrow operation, and the price closed slightly higher in late trading. 2405 contracts range from 5835 to 5874 throughout the day, with a price difference of 39. 05. The contract reduced its position by 10064 hands and has held 808203 positions so far. The 2409 contract closed at 5969, with 71517 positions.

PVC Future Forecast:

Futures: & the volatility of the nbsp; PVC2405 contract price is extremely narrow, the fluctuation range is only 39 points, the overall direction of the whole day is not clear, the market continues to show a wait-and-see market to reduce positions and leave the market, and the air level has slightly increased, of which 25.3% is flat compared to 22.4%. First of all, extremely narrow fluctuations make the technical level of the closing line lose guidance, on the other hand, the narrow range of fluctuations leads to poor capital participation, and there is a trend of continuous departure. The overall futures price continues to focus on the middle track. Considering from the current time node, we still maintain the previous judgment, there is pressure above the futures price and there is support under it, and we continue to observe the performance of 5750-5800 and 5900-5950.

Spot: from the current spot market, the digestion speed of the spot is slower, the spot price is lower, and the spot price does not have the advantage, the spot transaction is more light, and the forward pre-sale price is not lower than the current urgent pick-up source price. From this, we can see that there are still some expectations for the post-holiday market, and there are still some expectations in the industrial chain. from the frequency of narrow adjustment in the current two cities, first of all, the current ex-factory price of the port of the production enterprise is already at a low level. the state of unit loss and low valuation continues, and then the mentality of middlemen and downstream hoarding is also constantly entangled. Therefore, the current two markets rise and fall in a dilemma. Oil prices rose in the outer disk as US crude oil inventories fell more than expected last week and the IEA (International Energy Agency) raised its demand growth forecast for this year. On the whole, the spot market price will still operate in a narrow range.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.18 |

Price 1.19 |

Rate of change |

|

V2405 collection |

5864 |

5872 |

8 |

|

|

Average spot price in East China |

5620 |

5630 |

10 |

|

|

Average spot price in South China |

5625 |

5610 |

-15 |

|

|

PVC2405 basis difference |

-244 |

-242 |

2 |

|

|

V2409 collection |

5959 |

5969 |

10 |

|

|

V2405-2409 close |

-95 |

-97 |

-2 |

|

|

PP2405 collection |

7348 |

7356 |

8 |

|

|

Plastic L2405 collection |

8179 |

8203 |

24 |

|

|

V--PP basis difference |

-1484 |

-1484 |

0 |

|

|

Vmure-L basis difference of plastics |

-2315 |

-2331 |

-16 |

|

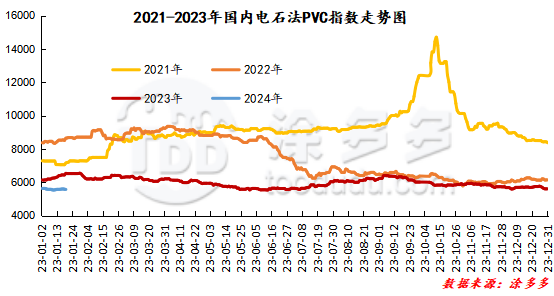

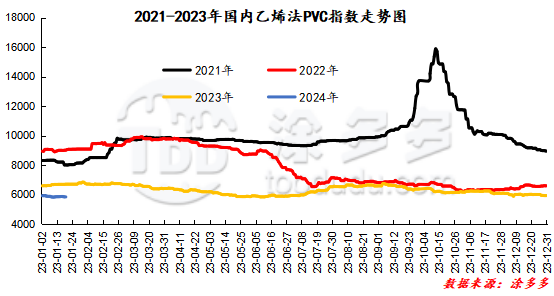

China PVC Index: the spot index of China's calcium carbide PVC rose 2.78, or 0.05%, to 5577.43 on January 19, according to Tudor data. The ethylene method PVC spot index is 5831.59, down 0, the range is 0%, the calcium carbide method index rises, the ethylene method index is stable, and the ethylene method-calcium carbide method index spread is 254.16.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.18 warehouse orders |

1.19 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,665 |

2,645 |

-20 |

|

|

Guangzhou materials |

963 |

943 |

-20 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,066 |

2,066 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

544 |

544 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,546 |

5,546 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,773 |

2,753 |

-20 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,853 |

4,658 |

-195 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,547 |

21,547 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,684 |

3,684 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

64 |

0 |

-64 |

|

PVC subtotal |

|

58,088 |

57,789 |

-299 |

|

Total |

|

58,088 |

57,789 |

-299 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.