Daily review of urea: Poor demand performance, factories continue to reduce prices and collect orders (January 18)

China Urea Price Index:

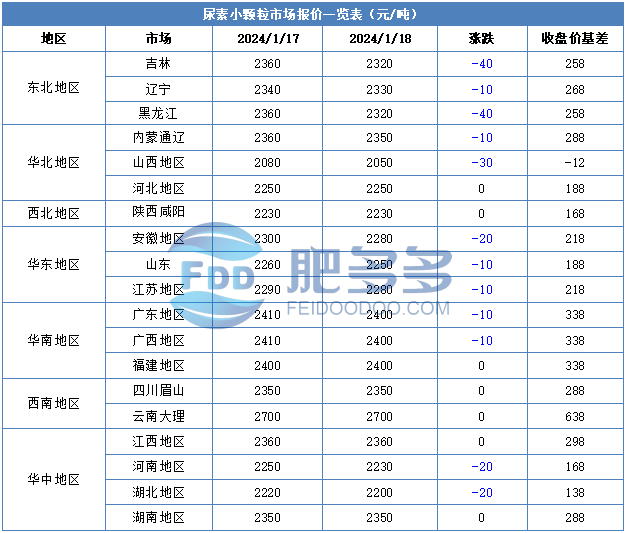

According to calculations from Feiduo data, the urea small pellet price index on January 18 was 2,318.32, a decrease of 12.27 from yesterday, a month-on-month decrease of 0.53%, and a year-on-year decrease of 16.98%.

Urea futures market:

Today, the opening price of the urea UR405 contract is 2046, the highest price is 2077, the lowest price is 2023, the settlement price is 2051, and the closing price is 2062. The closing price is 9 higher than the settlement price of the previous trading day, up 0.44% month-on-month. The fluctuation range of the whole day is 2023-2077; the basis of the 05 contract in Shandong is 188; the 05 contract has reduced its position by 8969 lots today, and the position held so far is 175,300 lots.

Spot market analysis:

Today, China's urea market prices continued to decline, with company ex-factory prices stabilizing and falling slightly. Most of them were consolidated and quoted before the Spring Festival, and the focus of market transactions continued to move downward.

Specifically, prices in Northeast China fell to 2,300 - 2,340 yuan/ton. Prices in North China fell to 2,050 - 2,360 yuan/ton. Prices in East China fell to 2,230 - 2,290 yuan/ton. Prices in South China fell to 2,390 - 2,420 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,200 - 2,420 yuan/ton, and the price of large particles fell to 2,380 - 2,400 yuan/ton. Prices in the northwest region are stable at 2,230 - 2,240 yuan/ton. Prices in Southwest China are stable at 2,300 - 2,800 yuan/ton.

Market outlook forecast:

In terms of factories, most factories still have support for advance orders in the early stage. The current quotations are stable, new orders in the market are generally completed, and pressure to collect orders before the Spring Festival still exists. In the market, the transaction atmosphere continues to be deadlocked and light, with a strong wait-and-see atmosphere on the floor. Overall trading confidence is weak, and most of the players are mainly in a small number of cases who just need to follow up. On the supply side, there are still early maintenance equipment that has been restored one after another, and the industry's daily output is gradually recovering. The supply side is expected to be abundant. On the demand side, in agriculture, the pace of procurement has gradually slowed down after centralized procurement in some regions. The current follow-up sentiment is a little cautious, and a small amount of follow-up needs to be maintained. In the industry, goods delivery in the upstream and downstream is not good, and the sustainability of the just-need has weakened. The mentality of receiving goods is cautious and the purchasing atmosphere is sluggish.

Overall, the current purchasing atmosphere in the urea market has returned to a downturn, with prices rising slightly in the early stage, and downstream acceptance willingness being low. It is expected that the urea market price will continue to stabilize and fall sharply in the short term.