PVC: Although the futures price rose above the mark at a high point, it was open and suppressed the retracement, and the spot market weakened slightly

PVC futures analysis: January 17 V2405 contract opening price: 5878, highest price: 5904, lowest price: 5857, position: 829758, settlement price: 5878, yesterday settlement: 5873, up: 5, daily trading volume: 543689 lots, precipitated capital: 3.403 billion, capital outflow: 30.82 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.16 |

Price 1.17 |

Rise and fall |

Remarks |

|

North China |

5480-5540 |

5510-5550 |

30/10 |

Send to cash remittance |

|

East China |

5630-5680 |

5630-5680 |

0/0 |

Cash out of the warehouse |

|

South China |

5650-5700 |

5630-5680 |

-20/-20 |

Cash out of the warehouse |

|

Northeast China |

5500-5650 |

5470-5620 |

-30/-30 |

Send to cash remittance |

|

Central China |

5550-5600 |

5550-5600 |

0/0 |

Send to cash remittance |

|

Southwest |

5470-5620 |

5470-5620 |

0/0 |

Kuti / send to |

PVC spot market: mainstream transaction prices in China's PVC market continue to be sorted out in a small range, weakening slightly in some areas. Valuation comparison: North China rose 10-30 yuan / ton, East China was stable, South China fell 20 yuan / ton, Northeast China fell 30 yuan / ton, and Central China and Southwest China were stable. The ex-factory prices of upstream PVC production enterprises mostly remain stable, and most of the first-generation contracts are signed with basic quantity, and some enterprises with lower quotations in the previous period are raised by 20 yuan / ton. After the futures market rose, it weakened slightly, the spot market price and point price offer coexisted, one price offer fell slightly in some areas, and there were not many transactions at one price. Trader basis offer part of the slightly stronger, including East China basis offer 05 contract-(200-250), South China 05 contract-(150-250), North 05 contract-(520-580), Southwest 05 contract-(250), on the whole, there is no obvious improvement in downstream purchasing enthusiasm, actual single transactions are rare, and the trading atmosphere in the spot market is weak.

From a futures point of view: & the night opening price of the nbsp; PVC2405 contract continued to form a small push, rising to a high of 5904. However, after the start of morning trading, the price continued to fluctuate slightly and weakened, finishing in a narrow range in the afternoon to the end. 2405 contracts range from 5857 to 5904 throughout the day, with a price difference of 47. 05. The position of the contract has been reduced by 4524 hands, and 829758 positions have been held so far. The 2409 contract closed at 5950, with 70003 positions.

PVC Future Forecast:

Futures: & the pressure level above the operation of nbsp; PVC2405 contract prices appears in the range of 5900-5950 as we expected. On the one hand, in view of the spot sales pressure combined with new orders to enter the insurance policy, on the other hand, how to return the more than 100000 hands who left the market. In terms of transaction, 25.6% of the blank opening is compared with 20.1% more, and there is still a certain empty mood in the transaction. The technical level shows that the Bollinger belt (13, 13, 2) three tracks are still narrowing, although the continuous narrow fluctuation trend of futures prices has a small breakthrough, but the narrowing range leads to a narrowing of the distance between the three tracks. The daily KD line and MACD line show a golden fork trend, we still maintain the previous judgment, observe the pressure performance in the range of 5900-5950, and the support of 5750-5800 below.

Spot aspect: In view of the small upward trend of the market since the low point this week, the spot market price has also increased in varying degrees with a small rhythm. Although it has weakened in some areas today, the overall price trend has risen slightly during the week, and the transaction is poor. The upward price of futures has not led to a better trading performance, although there are voices of hoarding goods from traders and downstream enterprises at present. However, in view of the current prices, there are still few decisive sales. At present, there are not many variable factors in the level of supply and demand, high inventory is still a constraint, and the weakness of demand in the game of supply and demand is more obvious. Therefore, even if the prices of the two markets go up, the range is still limited. On the outer disk, there are signs of escalation of tensions in the Middle East. The US military has launched a new strike against four Houthi anti-ship ballistic missiles in Yemen. Tensions in the Red Sea have disrupted the global transport of goods through this key trade route. On the whole, it is difficult for the PVC spot market to get rid of the situation of small consolidation in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.16 |

Price 1.17 |

Rate of change |

|

V2405 collection |

5880 |

5859 |

-21 |

|

|

Average spot price in East China |

5655 |

5655 |

0 |

|

|

Average spot price in South China |

5675 |

5655 |

-20 |

|

|

PVC2405 basis difference |

-225 |

-204 |

21 |

|

|

V2409 collection |

5970 |

5950 |

-20 |

|

|

V2405-2409 close |

-90 |

-91 |

-1 |

|

|

PP2405 collection |

7375 |

7315 |

-60 |

|

|

Plastic L2405 collection |

8172 |

8140 |

-32 |

|

|

V--PP basis difference |

-1495 |

-1456 |

39 |

|

|

Vmure-L basis difference of plastics |

-2292 |

-2281 |

11 |

|

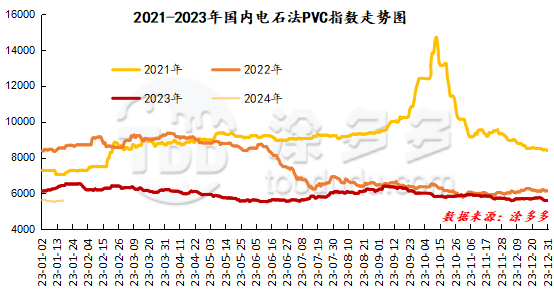

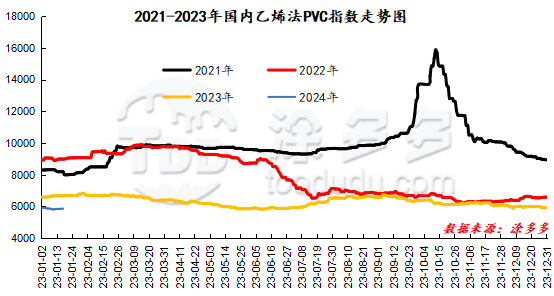

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot index fell 2.11, or 0.038%, to 5602.68 on January 17. The ethylene method PVC spot index was 5840.54, down 21.17, with a range of 0.361%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 237.86.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.16 warehouse orders |

1.17 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,665 |

2,665 |

0 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,066 |

2,066 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

544 |

544 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,546 |

5,546 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,793 |

2,773 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,853 |

4,853 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,427 |

21,547 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,684 |

3,684 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

64 |

64 |

0 |

|

PVC subtotal |

|

57,988 |

58,088 |

0 |

|

Total |

|

57,988 |

58,088 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.