PVC: The high point of futures prices continues to push upward, and the market seems to be withdrawing, with the spot range rising slightly

PVC futures analysis: January 16 V2405 contract opening price: 5855, highest price: 5897, lowest price: 5846, position: 834282, settlement price: 5873, yesterday settlement: 5846, up: 27, daily trading volume: 579834 lots, precipitated capital: 3.434 billion, capital outflow: 55.95 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.15 |

Price 1.16 |

Rise and fall |

Remarks |

|

North China |

5480-5520 |

5480-5540 |

0/20 |

Send to cash remittance |

|

East China |

5610-5670 |

5630-5680 |

20/10 |

Cash out of the warehouse |

|

South China |

5620-5680 |

5650-5700 |

30/20 |

Cash out of the warehouse |

|

Northeast China |

5500-5650 |

5500-5650 |

0/0 |

Send to cash remittance |

|

Central China |

5550-5600 |

5550-5600 |

0/0 |

Send to cash remittance |

|

Southwest |

5470-5570 |

5470-5620 |

0/50 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price range consolidation, transaction has not changed for the time being. Compared with the valuation, North China rose 20 yuan / ton, East China increased 10-20 yuan / ton, South China increased 20-30 yuan / ton, Northeast China was stable, Central China was stable, and Southwest China rose 50 yuan / ton. The ex-factory prices of upstream PVC production enterprises mostly remain stable, and individual enterprises make up prices sporadically. The narrow operating price of futures has risen slightly, and the price offer in some parts of the spot market has risen slightly, with a limited increase, and some areas still maintain the range. Spot market price and point price offer are available, point price supply for the time being no price advantage, a low price a small amount of transactions. The basis offer has been slightly adjusted, including 05 contract in East China-(200-250), 05 contract in South China-(150-250), 05 contract in North China-(520-580), 05 contract in Southwest China-(250). On the whole, there is a small negotiation in the spot part, and the purchasing enthusiasm in the lower reaches is low.

From the perspective of futures: & the price of the nbsp; PVC2405 contract began to rise slightly at the opening of the night trading, and the upward trend remained good in the night trading. Prices weakened after hitting a high of 5897 in early trading, giving up some of their gains in the afternoon but then rose in late trading. 2405 contracts range from 5846 to 5897 throughout the day, with a spread of 51. 055.The contract reduced its position by 16197 hands and has held 834282 positions so far. The 2409 contract closed at 5970, with 68885 positions.

PVC Future Forecast:

Futures: PVC2405 contract price operation has been reducing positions recently, from the current time node tends to consider the departure of some funds to wait and see, especially before the festival with the passage of time in the gradual shortening of the remaining trading days, no matter under the stimulation of market accidents, there is a certain pressure, so the market from a high position of Yu 940000 to the current more than 830000 hands. The operation of futures prices has shown a quadruple small rise since its low of 5754. Technical level shows that the Bollinger belt (13, 13, 2) three-track opening further narrowed, in the short term we still maintain the previous judgment, the price operation or storage continues to slightly upward performance observation range of 5900-5950.

Spot aspect: 's current two-city operation is mainly a narrow range of small increases in the near future, futures prices together with the spot market tentatively a small upward, not much from the fundamentals, and not enough to support the two cities prices reversal market, but the downward space narrowed. At present, the unit valuation of PVC is on the low side, and from the perspective of expectation in the medium and long term, bad time in exchange for certain profits has also become the consensus of the whole industrial chain, so recently, no matter intermediate merchants or downstream products enterprises have different hoarding voices, and some upstream enterprises also choose to accumulate inventory within the low price range. Oil prices fell slightly in the outer disk, and investors locked in profits after a sharp rise in oil prices, as the conflict in the Middle East did not have a significant impact on supply. Some tanker owners avoided the Red Sea and a number of tankers changed course. Goldman Sachs expects the US to start cutting interest rates in March, followed by the European Central Bank and the Bank of England. On the whole, the spot market may still be promoted by a small margin in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.15 |

Price 1.16 |

Rate of change |

|

V2405 collection |

5862 |

5880 |

18 |

|

|

Average spot price in East China |

5640 |

5655 |

15 |

|

|

Average spot price in South China |

5650 |

5675 |

25 |

|

|

PVC2405 basis difference |

-222 |

-225 |

-3 |

|

|

V2409 collection |

5964 |

5970 |

6 |

|

|

V2405-2409 close |

-102 |

-90 |

12 |

|

|

PP2405 collection |

7352 |

7375 |

23 |

|

|

Plastic L2405 collection |

8101 |

8172 |

71 |

|

|

V--PP basis difference |

-1490 |

-1495 |

-5 |

|

|

Vmure-L basis difference of plastics |

-2239 |

-2292 |

-53 |

|

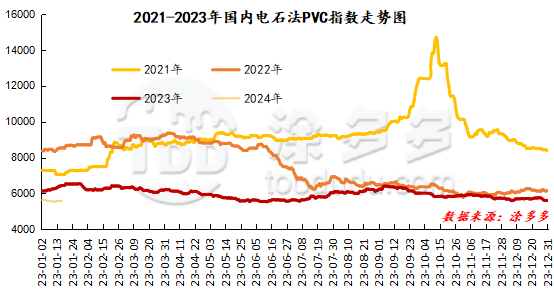

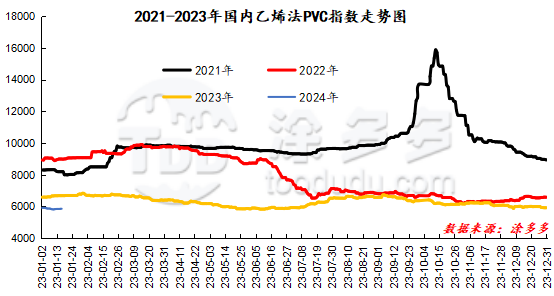

China PVC Index: according to Tudoduo data, the spot index of China's calcium carbide PVC rose 14.3 or 0.256 per cent to 5604.79 on January 16. The ethylene method PVC spot index is 5861.71, up 3.76, the range is 0.064%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 256.92.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.15 warehouse orders |

1.16 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,665 |

2,665 |

0 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,066 |

2,066 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

544 |

544 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,546 |

5,546 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,793 |

2,773 |

-20 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,853 |

4,853 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,427 |

21,547 |

120 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,684 |

3,684 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

64 |

64 |

0 |

|

PVC subtotal |

|

57,988 |

58,088 |

100 |

|

Total |

|

57,988 |

58,088 |

100 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.