Polyester bottle chips: Prices remain at the bottom and fluctuate, the industry is mired in losses

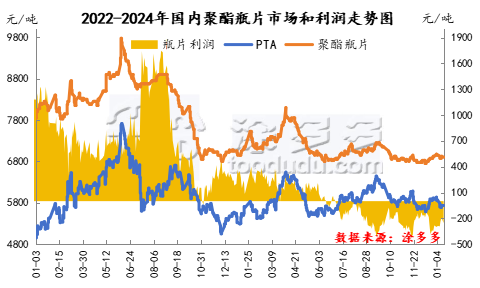

In 2023, the overall market of polyester bottle chips in China shows a pattern of first strong and then weak, and the market amplitude narrows. The market trend of polyester raw material PTA and ethylene glycol is still the leading factor of polyester PET market trend. According to Tuduo data monitoring shows: the average annual price of polyester bottle chips in East China market is 7102 yuan / ton, down 13.13% compared with 2022. The highest price appears in early April, the highest is 8100 yuan / ton, the lowest is 6750 yuan / ton in late June, and the vibration amplitude is around 1350 yuan / ton.

Since the second half of 2023, the polyester bottle chip market as a whole has hovered at the bottom, and the market price in East China has been adjusted in a narrow range of 6750-7300 yuan / ton. Among them, the average price in East China market in the second half of 2023 is 6960 yuan / ton. Throughout July, the overall market for polyester bottle chips showed a strong concussion trend. Raw material PTA market continues to rise, cost support is enhanced, mainstream bottle chip manufacturers offer up, dealers offer slightly higher. From August to September, the polyester bottle chip market as a whole showed a high fluctuation pattern. The PTA market of raw materials is weak, the cost support is insufficient, and the market price of bottle chips adjusts slightly with the cost. Recently, Sanfang Lane, China Resources Jiangyin, Bai and other new devices have been put into production, the market supply has increased significantly, while the downstream demand is relatively weak, the market is mainly cautious and wait-and-see, weak supply and demand suppresses the market. In October, the market for polyester bottles began to wobble and weaken. The international crude oil market fell, polyester raw material PTA market continued to weaken, lack of cost support, mainstream bottle chip manufacturers offer downward, market offer tends to be low-end. In November, the polyester bottle market remained low and volatile. In December, the market for polyester bottle chips remained volatile. Polyester raw materials PTA and ethylene glycol market pull up, the cost end to the market to boost, bottle chip market offer increased accordingly. By the end of the year, the spot price in the market rose to 6900-7000 yuan / ton.

In 2023, the international crude oil price is high and firm, the market fluctuation intensifies, the overall price of polyester raw material PTA and ethylene glycol market increases, the production cost pressure of polyester enterprises increases, while dragged down by the weak supply and demand, the rising range of China's polyester market is limited, so the production profits of polyester enterprises shrink. Polyester bottle chips due to a large number of production capacity, market supply is loose, market prices remain low, so enterprise production profits fall in a straight line. In 2022, the overall profitability of Chinese polyester bottle chip enterprises increased significantly, with the average profit of Chinese enterprises at 733 yuan / ton, while in 2023, the average annual profit of polyester bottle chip was-13 yuan / ton, down 101.77% from the previous year.

In the first half of 2023, China's polyester bottle chips follow the polyester raw material PTA market and fluctuate in a low and narrow range, so the enterprise profit has been hovering between 100,400 yuan / ton, of which the average production profit of polyester bottle chips in the first half of the year is 200.91 yuan / ton. After June, with the continued weakness of the polyester bottle market, corporate profits shrank sharply, to the second half of the year, enterprise production continued to be in a loss situation. The average production profit of polyester bottle chips in the second half of the year is-208 yuan / ton.

Since 2023, China's polyester bottle chip industry has re-entered a period of rapid capacity growth. In 2023, the production capacity of polyester bottle chips has increased by 4.6 million tons, with an increase of 37.17%. In 2024, Sanfang Lane, Yisheng and other major bottle chip manufacturers will continue to expand their production capacity, coupled with the active input of new enterprises such as Anhui Haoyuan, Xinjiang Yipu, Fuhai and other new enterprises, polyester bottle chip production capacity will face greater excess pressure, so in the time of redistribution of supply and demand in the industry, the profit of polyester bottle chips in China may remain low for a period of time.