PVC: The futures price has significantly reduced its position and left the market on the sidelines. The high point is approaching the middle track, and the spot is tentatively rising slightly.

PVC futures analysis: January 15 V2405 contract opening price: 5834, highest price: 5848, lowest price: 5801, position: 892893, settlement price: 5825, yesterday settlement: 5798, up: 27, daily trading volume: 641866 lots, precipitated capital: 3.49 billion, capital outflow: 152 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.12 |

Price 1.15 |

Rise and fall |

Remarks |

|

North China |

5460-5510 |

5480-5520 |

20/10 |

Send to cash remittance |

|

East China |

5600-5650 |

5610-5670 |

10/20 |

Cash out of the warehouse |

|

South China |

5610-5680 |

5620-5680 |

10/0 |

Cash out of the warehouse |

|

Northeast China |

5500-5650 |

5500-5650 |

0/0 |

Send to cash remittance |

|

Central China |

5540-5580 |

5550-5600 |

10/20 |

Send to cash remittance |

|

Southwest |

5470-5570 |

5470-5570 |

0/0 |

Kuti / send to |

PVC spot market: Chinese PVC market mainstream transaction prices are mainly arranged in a narrow range, with tentative increases in some areas. Compared with the valuation, North China rose 10-20 yuan / ton, East China 10-20 yuan / ton, South China 10 yuan / ton, Northeast China stable, Central China 10-20 yuan / ton, and Southwest China stable. Upstream PVC production enterprises factory prices remain stable, prices have not been adjusted, some enterprises slightly increased 50 yuan / ton, coinciding with the spot market on Monday temporarily wait and see. The operation of futures is slightly stronger, and the offers of traders in various regions of the spot market are also partially maintained, and some merchants tentatively raise their quotations, but there is some room for negotiation. The basis offer does not change much, including 05 contract in East China-(200-250), 05 contract in South China-(150-220), 05 contract in North China-(500-550), 05 contract in Southwest China-(250). The turnover in the spot market on Monday is relatively light, although the spot price and one-mouth price offer coexist, but the downstream lacks purchasing enthusiasm.

From a futures perspective: the nbsp; PVC2405 contract opened slightly weaker in night trading on Friday, but fell not much and then rose in late trading. After the start of the morning session, it rose slightly again on the basis of the night market, and basically ran narrowly above 5850 in the afternoon. 2405 the contract fluctuates from 5805 to 5874 throughout the day, with a spread of 69. 05. The contract reduced its position by 42414 hands, and has held 850479 positions so far. The 2409 contract closed at 5964, with 67164 positions.

PVC Future Forecast:

Futures: PVC2405 contract price showed a slight rise, the market showed a significant reduction of more than 42000 positions, of which Duoping 26.9% vs. Kongping 25.9%, both sides left the market, in addition, there was a certain situation of new multi-order entry, of which more than 20.5% versus 19.7%. The technical level shows that the opening of the three tracks of the Bolin belt (13,13,2) narrows obviously, the KD at the daily line level shows a golden fork trend, and the distance between the two lines of the MACD line is shortened. The close-up trend at the technical level has shown a certain upward performance. And the narrowing trend is the beginning of a new round of market, so in the short term we expect the operation or deposit of futures prices to continue to show upward performance, observing the position in the direction of 5900-5950.

Spot: coincides with Monday when some production enterprises do not quote directly, but some enterprises still begin to tentatively raise prices, and under the current spot factory prices, the shipping enthusiasm of production enterprises is also weak, on the one hand, there is production pressure in the case of unit loss, on the other hand, there are still expectations for the recovery of the post-holiday spot market, so production enterprises also have inventory psychology at present. Although the pre-holiday spot transaction has always been light, but from the current time node and futures price fluctuations, the spot price continues to decline the space has narrowed. In the outer disk, the price of international crude oil futures market continued to rise as U.S.-led coalition forces launched air strikes against Houthi forces in Yemen in response to a series of attacks by Houthi forces on ships passing through the Red Sea. heightened fears of broader conflicts in the Middle East. On the whole, in the short term, PVC may take a small step towards a better situation, but the space may be limited.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.12 |

Price 1.15 |

Rate of change |

|

V2405 collection |

5827 |

5862 |

35 |

|

|

Average spot price in East China |

5625 |

5640 |

15 |

|

|

Average spot price in South China |

5645 |

5650 |

5 |

|

|

PVC2405 basis difference |

-202 |

-222 |

-20 |

|

|

V2409 collection |

5930 |

5964 |

34 |

|

|

V2405-2409 close |

-103 |

-102 |

1 |

|

|

PP2405 collection |

7266 |

7352 |

86 |

|

|

Plastic L2405 collection |

8027 |

8101 |

74 |

|

|

V--PP basis difference |

-1439 |

-1490 |

-51 |

|

|

Vmure-L basis difference of plastics |

-2200 |

-2239 |

-39 |

|

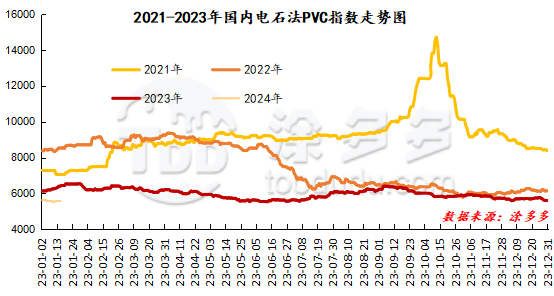

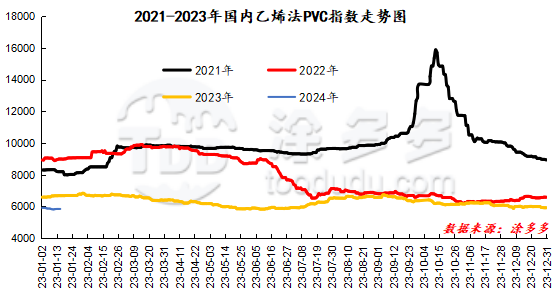

China PVC Index: according to Tudoduo data, China calcium Carbide PVC spot index rose 10.53, or 0.189%, to 5590.49 on January 15. The ethylene method PVC spot index was 5857.95, up 12.13, with a range of 0.207%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 267.46.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.12 warehouse orders |

1.15 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,245 |

2,665 |

420 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,282 |

1,702 |

420 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,737 |

2,066 |

329 |

|

|

Zhenjiang Middle and far Sea |

1,253 |

1,522 |

269 |

|

|

Middle and far sea in Jiangyin |

484 |

544 |

60 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,546 |

5,546 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,793 |

2,793 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,853 |

4,853 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,427 |

21,427 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,684 |

3,684 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

64 |

64 |

0 |

|

PVC subtotal |

|

57,239 |

57,988 |

749 |

|

Total |

|

57,239 |

57,988 |

749 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.