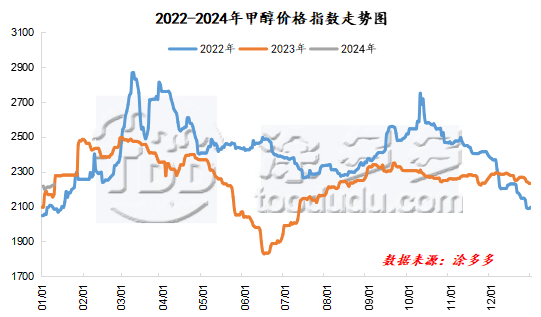

Methanol: Demand-side support weakens, and the methanol market has an obvious regional trend

On January 10th, the methanol market price index was 2227.8, up 7.28 from yesterday and 0.33% higher than yesterday.

Outer disk dynamics:

Methanol closed on January 9:

China CFR 281-283USD / ton, Ping

Us FOB 94-95 cents per gallon, down 1 cent per gallon

Southeast Asia CFR 346.5-347.5 US dollars / ton, Ping

European FOB 284.25-285.25 euros / ton, flat.

Summary of today's prices:

Guanzhong: 2130-2190 (0), North Route: 2020 (60), Lunan: 2350-2360 (0), Henan: 2240-2265 (- 20), Shanxi: 2140-2200 (0), Port: 2395-2440 (- 35)

Freight:

Northern route-200-290 (- 10amp 0), southern route-northern Shandong 250-300 (0Uniqure 10), Shanxi-northern Shandong 130-180 (- 20ppm mer 20), Guanzhong-southwestern Shandong 160-210 (0max 0)

Spot market: today, the price trend of methanol market is different, the futures market is down sharply, the price in the spot market is fluctuating, the price in the Chinese market is up in a narrow range, and the trading atmosphere in the market is general. Specifically, the market price in the main producing areas has been raised narrowly, with the quotation on the south line around 2030 yuan / ton and the price on the north line around 2020 yuan / ton. The overall supply pressure in the region is not great, manufacturers' quotations are fluctuating, and the overall trading atmosphere in the market is OK. The market price in Shandong, the main consumer area, is adjusted in a narrow range, Lunan 2350-2360 yuan / ton, low-end stable, high-end drop 20 yuan / ton, the current traditional downstream demand is still depressed, the overall enthusiasm to enter the market replenishment is general; Lubei 2280-2320 yuan / ton, lower than yesterday's 40 yuan / ton, freight prices shock down, the downstream market stage replenishment, to a certain extent, support the mentality of the industry. The market quotation in North China is adjusted narrowly. Hebei quotation today is 2250-2280 yuan / ton, which is 30 yuan / ton higher than that of yesterday. The supply in the region has increased, the performance of traditional downstream demand is poor, and the overall performance of the demand side is general. Shanxi region quotation narrow adjustment, today's quotation stable to 2140-2220 yuan / ton, the overall market transaction atmosphere is OK.

Port market: methanol futures dived today. Spot sporadic quotation, the basis is strong; paper goods bargain receiving active, arbitrage-based delivery, the basis is strong. The overall transaction is active. Taicang main port transaction price: spot transaction: 2395-2405, base difference 05: 45: 1 transaction: 2390-2395, base difference 05: 35 prime 40: transaction 1: 2345-2390, base difference 05: 28 impulse 38 transaction 2 transaction: 2360-2410, basis difference 05: 43Universe 57.

|

Area |

2024/1/10 |

2024/1/9 |

Rise and fall |

|

The whole country |

2227.80 |

2220.52 |

7.28 |

|

Northwest |

2030-2190 |

1960-2220 |

70/-30 |

|

North China |

2140-2280 |

2140-2300 |

0/-20 |

|

East China |

2395-2550 |

2430-2560 |

-35/-10 |

|

South China |

2365-2450 |

2410-2520 |

-45/-70 |

|

Southwest |

2200-2650 |

2200-2600 |

0/50 |

|

Northeast China |

2250-2350 |

2250-2350 |

0/0 |

|

Shandong |

2280-2380 |

2320-2380 |

-40/0 |

|

Central China |

2240-2560 |

2260-2580 |

-20/-20 |

Future forecast: recently, the early maintenance devices in the Chinese market have been gradually restarted, the new units in Yanzhou Guohong, Dahua and Henan have all been restarted, the start-up of the Chinese market has increased narrowly, and the restart of the 2 million-ton methanol plant in Jiutai (Tuoxian) has been delayed. there is still some support for the market supply in the main producing areas, but at present the downstream market demand is slow, the terminal market performance is poor, and Xingxing plant parking maintenance There are expectations of a reduction in market demand, a sharp decline in the futures market, and a poor mentality of market operators. Although inventories are lower this week than in the previous period, methanol consumption is difficult to increase significantly in the later period. Overall, the short-term methanol market price is expected to fluctuate mainly, but in the later stage, we need to pay close attention to the on-site transportation and downstream demand follow-up.