PVC: The short futures price rebounded again, falling below 5800, and the spot price dropped slightly

PVC futures analysis: January 9 V2405 contract opening price: 5839, highest price: 5845, lowest price: 5774, position: 929863, settlement price: 5802, yesterday settlement: 5839, down: 37, daily trading volume: 718428 lots, precipitated capital: 3.775 billion, capital inflow: 91.62 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.8 |

Price 1.9 |

Rise and fall |

Remarks |

|

North China |

5460-5490 |

5430-5470 |

-30/-20 |

Send to cash remittance |

|

East China |

5580-5630 |

5510-5600 |

-70/-30 |

Cash out of the warehouse |

|

South China |

5620-5670 |

5600-5650 |

-20/-20 |

Cash out of the warehouse |

|

Northeast China |

5500-5650 |

5470-5620 |

-30/-30 |

Send to cash remittance |

|

Central China |

5570-5640 |

5520-5590 |

-50/-50 |

Send to cash remittance |

|

Southwest |

5480-5600 |

5440-5570 |

-40/-30 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price is still weak to maintain, the market shows a slight decline. Compared with the valuation, North China rose 60 yuan / ton, East China 70 yuan / ton, South China 50-80 yuan / ton, Northeast China 50 yuan / ton, Central China 50 yuan / ton, and Southwest China 50 yuan / ton. The ex-factory prices of upstream PVC production enterprises remain stable for the time being, while both calcium carbide production enterprises and ethylene production enterprises maintain the previous price. The futures price is weak, the price offer of traders in various regions is slightly lower, the higher offer is more difficult to close the deal, and the inquiry enthusiasm of the high price is not good. After the futures price goes down, the spot price offer advantage is relatively obvious, and the basis is adjusted slightly, in which East China basis offer 05 contract-(200-260), South China 05 contract-(130-220), North 05 contract-(530-580), Southwest 05 contract-(250), on the whole, there is almost no deal in the spot market, most of them tend to hang orders at low point prices, and some enterprises have rigid demand for replenishment of goods, and how much the spot price has improved.

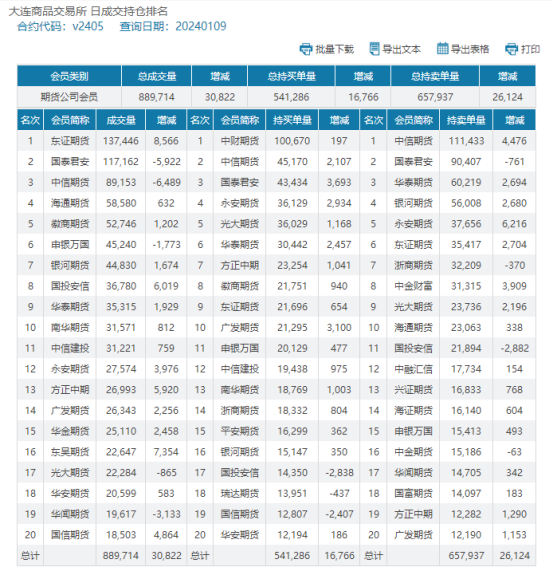

Futures point of view: PVC2405 contract night trading began to weaken and fall, the overall night market decline is obvious, and the lowest point fell below the 5800 mark. Prices rose slightly after the start of morning trading, but the overall strength was not strong enough, followed by a shock in the first line of 5800 to the end of late afternoon trading. 2405 contracts range from 5774 to 5845 throughout the day, with a price spread of 71. 05. The contract increased its position by 30168 hands, and so far it has held 929863 positions. The 2409 contract closed at 5904, with 64017 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2405 contract futures showed a slightly weaker situation, the market continued to significantly increase positions, positions once again close to the high, Tuesday increased positions Yu 30,000 hands, of which open 26.6% compared with 23.0% more. As a whole, it continued to show short-opening suppression, as mentioned in the title, the bears returned to the next city, and finally fell below the 5800 mark. The technical level shows that the three-track openings of the Bolin belt (13, 13, 2) are all downward, the KD line and MACD line at the daily level show an obvious dead-fork trend, and the technical trend lines show a certain air-to-air trend. The range of futures prices has reached our first target, and we will continue to observe the performance in the range of 5750-5800 in the short term.

Spot aspect: & the price decline of the two cities in the nbsp; period has led to an improvement in spot point price transactions to a certain extent, and the rigid demand at the demand level exists but mainly in low-level hanging orders. From the current futures level, the market is still short, and the technical closing line shows a certain short trend, which makes the overall operating atmosphere of the spot market is not good. Although there is a point price transaction, for the production enterprises, the loss of the lower spot price of PVC is more obvious, and the production cost is higher, while another major commodity caustic soda is also running poorly recently, which further aggravates the overall operation pressure of chlor-alkali enterprises. In the weak PVC pattern before the Spring Festival, another negative factor is also coming quietly, with the passage of time, downstream products enterprises gradually have a holiday or demand is more and more depressed. Therefore, from a comprehensive point of view, the spot price of PVC in the short term may still be low and narrow.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.8 |

Price 1.9 |

Rate of change |

|

V2405 collection |

5849 |

5800 |

-49 |

|

|

Average spot price in East China |

5605 |

5555 |

-50 |

|

|

Average spot price in South China |

5645 |

5625 |

-20 |

|

|

PVC2405 basis difference |

-244 |

-245 |

-1 |

|

|

V2409 collection |

5953 |

5904 |

-49 |

|

|

V2405-2409 close |

-104 |

-104 |

0 |

|

|

PP2405 collection |

7312 |

7317 |

5 |

|

|

Plastic L2405 collection |

8065 |

8025 |

-40 |

|

|

V--PP basis difference |

-1463 |

-1517 |

-54 |

|

|

Vmure-L basis difference of plastics |

-2216 |

-2225 |

-9 |

|

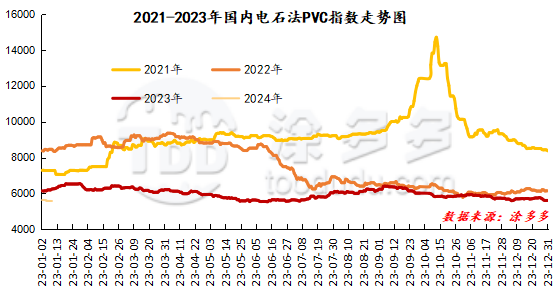

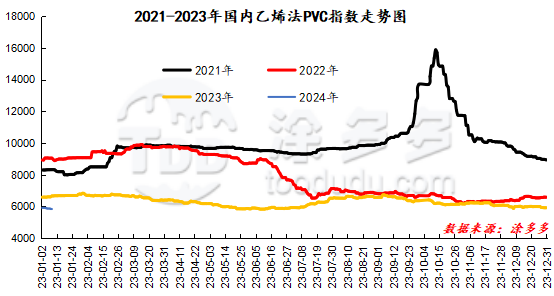

China PVC Index: according to Tudou data, the spot index of China's calcium carbide PVC fell 35.64, or 0.639%, to 5543.61 on January 9. The ethylene method PVC spot index was 5816.61, down 23.24, or 0.398%. The calcium carbide method index fell, the ethylene method index dropped, and the ethylene-calcium carbide index spread 273.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.8 warehouse order quantity |

1.9 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,245 |

2,245 |

0 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,282 |

1,282 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,195 |

1,315 |

120 |

|

|

Zhenjiang Middle and far Sea |

1,195 |

1,195 |

0 |

|

|

Middle and far sea in Jiangyin |

0 |

120 |

120 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,366 |

5,546 |

180 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,655 |

4,853 |

198 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

20,518 |

21,169 |

651 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,495 |

3,495 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

570 |

570 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

54,748 |

55,897 |

1,149 |

|

Total |

|

54,748 |

55,897 |

1,149 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.