Daily Review of Urea: Downstream purchasing more goods at bargain prices, replenishment and export benefits are not obvious for the time being (January 8)

China Urea Price Index:

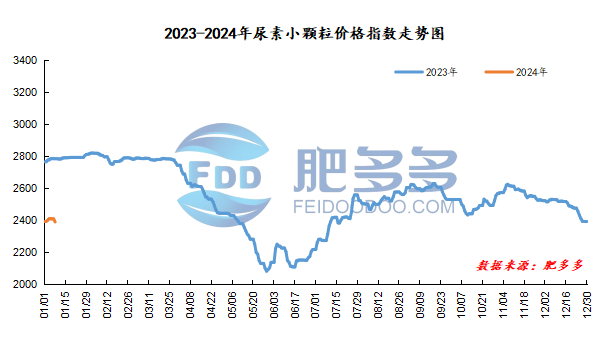

According to Feiduo data, the urea small pellet price index on January 8 was 2,388.32, a decrease of 19.09 from last Friday, a month-on-month decrease of 0.79%, and a year-on-year decrease of 14.22%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2150, the highest price is 2150, the lowest price is 2048, the settlement price is 2090, and the closing price is 2048. The closing price is 112 lower than the settlement price of the previous trading day, down 5.19% month-on-month. The fluctuation range of the whole day is 2048-2150; the basis of the 05 contract in Shandong is 262; the 05 contract has increased its position by 9536 lots today, with 173,300 lots held so far.

Spot market analysis:

Today, China's urea market prices have been consolidated downward. Factory quotations are mostly stable and their mentality is relatively firm. Some manufacturers 'quotations have been slightly lowered to give profits.

Specifically, prices in Northeast China have stabilized at 2,380 - 2,420 yuan/ton. Prices in North China fell to 2,160 - 2,420 yuan/ton. Prices in East China fell to 2,300 - 2,380 yuan/ton. Prices in South China fell to 2,450 - 2,500 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,280 - 2,450 yuan/ton, and the price of large particles fell to 2,470 - 2,500 yuan/ton. Prices in the northwest region are stable at 2,350 - 2,360 yuan/ton. Prices in Southwest China are stable at 2,350 - 2,800 yuan/ton.

Market outlook forecast:

In terms of factories, factories have more orders pending, inventories have dropped, current offers are relatively firm, prices in some factories have stabilized and declined, and the overall willingness to support prices is strong. On the market side, affected by the decline in market prices and high resistance to high prices in the market, the transaction of new orders in the market has slowed down recently. Companies have limited ability to chase high prices, and market transactions have been relatively flat. On the demand side, agriculture is in the off-season of fertilizer use, and only some areas in Central China have demand for topdressing for wheat; downstream compound fertilizer shipments are poor, and factories are cautious in receiving goods. The current start-up has dropped slightly, and the demand for compound fertilizer companies is relatively stable. In terms of printing and labeling, the latest shipping date for this tender is February 29, with a total of 21 suppliers, with a total supply of 2.7173 million tons. The lowest CFR on the West Coast is US$316.8/ton and the lowest CFR on the East Coast is US$329.4/ton. Current export controls still exist, coupled with low international prices, Chinese companies are weak in their willingness to participate in this printed and branded export. It is expected that the positive impact of printed and branded exports will have little impact on the Chinese market in the short term.

On the whole, currently urea business owners are executing pending orders, and downstream purchases are more on dips and replenishment is not obvious for the time being. It is expected that the urea market price will continue to consolidate and operate in a short period of time, making it difficult to move upwards.