PVC: Short-term futures prices suppress Masukang. On Black Friday, spot transaction prices weaken

PVC futures analysis: January 5 V2405 contract opening price: 5891, highest price: 5896, lowest price: 5814, position: 917324, settlement price: 5843, yesterday settlement: 5913, down: 70, daily trading volume: 802385 lots, precipitated capital: 3.74 billion, capital inflow: 156 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.4 |

Price 1.5 |

Rise and fall |

Remarks |

|

North China |

5510-5540 |

5450-5480 |

-60/-60 |

Send to cash remittance |

|

East China |

5630-5690 |

5580-5630 |

-50/-60 |

Cash out of the warehouse |

|

South China |

5680-5720 |

5650-5680 |

-30/-40 |

Cash out of the warehouse |

|

Northeast China |

5500-5680 |

5500-5650 |

0/-30 |

Send to cash remittance |

|

Central China |

5590-5700 |

5570-5650 |

-20/-50 |

Send to cash remittance |

|

Southwest |

5500-5600 |

5480-5600 |

-20/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices slightly lower, the spot market weakening. Compared with the valuation, it fell by 60 yuan / ton in North China, 50-60 yuan / ton in East China, 30-40 yuan / ton in South China, 30 yuan / ton in Northeast China, 20-50 yuan / ton in Central China and 20 yuan / ton in Southwest China. Upstream PVC production enterprises factory prices down 20-30-50 yuan / ton, some enterprises temporarily stable quotations, but happen to be Friday generation contracts signed not much. The futures price continued to weaken and showed a certain downward trend. The trader's price offer was lower than that of yesterday, and it was difficult for the high price to have an actual transaction. After the futures price went down, the supply price advantage of the point price was reflected, and the basis offer changed little. Among them, the basis difference offer 05 contract in East China-(200-250-320), South China 05 contract-(150-200), North 05 contract-(550-600-630), Southwest 05 contract-(260) After the downward price of futures, the purchasing enthusiasm of the lower reaches has been improved, but the purchase order prices of some enterprises are still on the low side, and trading in the spot market has improved slightly.

Futures point of view: PVC2405 contract night trading price began to weaken, the overall decline is relatively obvious. After the start of morning trading, the futures price continued to fluctuate at a relatively low level, and it was still mainly arranged at a low level in the afternoon, and was in a weak situation throughout the day. 2405 contracts range from 5814 to 5896 throughout the day, with a spread of 82. 05 contracts with an increase of 48337 positions and 917324 positions so far. The 2409 contract closed at 5928, with 61082 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures run to break the low horizontal market mode, the low point refreshes and approaches the lower rail support level, the technical level shows that the opening of the third rail of the Bollinger belt (13, 13, 2) expands, the lower rail of the middle rail is obvious, and the KD line and MACD line of the daily level show a dead-fork trend, so the overall technical level shows the short trend of futures prices, increasing positions by more than 48000 hands on Friday. In terms of trading, the short opening of 29.0% is compared with the increase of 22.2%, and the last position has not been closed, considering that the market is also dominated by short positions. On the whole, we think that the short-term price or still continue to take the postgraduate entrance examination under the rail support position, observe the performance in the range of 5750-5800.

Spot aspect: The downward price of the futures and current markets weakens the market atmosphere again. On the one hand, the downward point price of the futures price improves, the spot market buys down, but the spot market does not buy up. On the other hand, the continuous short-opening suppression makes the atmosphere of the two cities bearish. At present, the spot market may face greater pressure, resulting in an analysis of the views of later generations. Some people are more bearish, but some lead to the sound of bottom reading. The supply and demand level is still good production, demand constraints and the fundamentals of seasonal accumulation lead to the increase of short chips. Under the current time node, the introduction of macro and policy ports may be insufficient, so it is difficult for PVC to perform well before the Spring Festival without external stimulation. In the outer disk, international oil prices fell in volatile trading, as the sharp increase in gasoline and distillate depots in the United States exceeded the decline in crude oil stocks than expected positive support for the market. On the whole, in the short term, the PVC spot market may still be dominated by small-scale consolidation.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.4 |

Price 1.5 |

Rate of change |

|

V2405 collection |

5891 |

5824 |

-67 |

|

|

Average spot price in East China |

5660 |

5605 |

-55 |

|

|

Average spot price in South China |

5700 |

5665 |

-35 |

|

|

PVC2405 basis difference |

-231 |

-219 |

12 |

|

|

V2409 collection |

5999 |

5928 |

-71 |

|

|

V2405-2409 close |

-108 |

-104 |

4 |

|

|

PP2405 collection |

7450 |

7377 |

-73 |

|

|

Plastic L2405 collection |

8146 |

8127 |

-19 |

|

|

V--PP basis difference |

-1559 |

-1553 |

6 |

|

|

Vmure-L basis difference of plastics |

-2255 |

-2303 |

-48 |

|

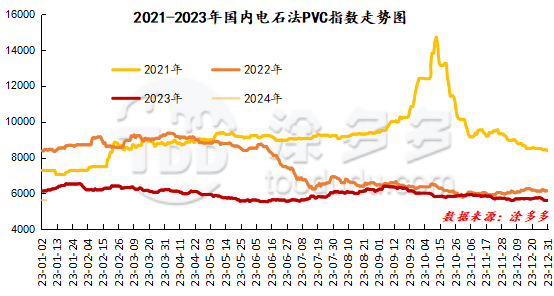

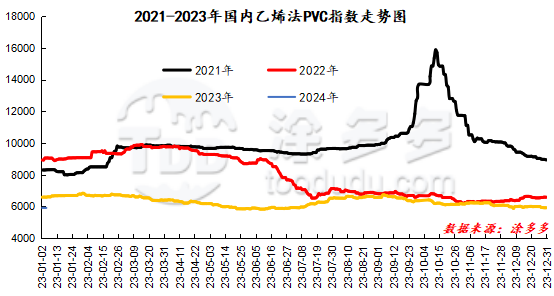

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot Index fell 42.68, or 0.759%, to 5582.2 on January 5. The ethylene PVC spot index was 5871.51, down 39.74, or 0.672%, while the calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 289.31.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.4 warehouse receipt volume |

1.5 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,245 |

2,245 |

0 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,282 |

1,282 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,195 |

1,195 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,195 |

1,195 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,806 |

4,806 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,092 |

4,655 |

563 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

20,458 |

20,458 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,495 |

3,495 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

0 |

84 |

84 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

470 |

570 |

100 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

687 |

687 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

52,681 |

53,428 |

747 |

|

Total |

|

52,681 |

53,428 |

747 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.