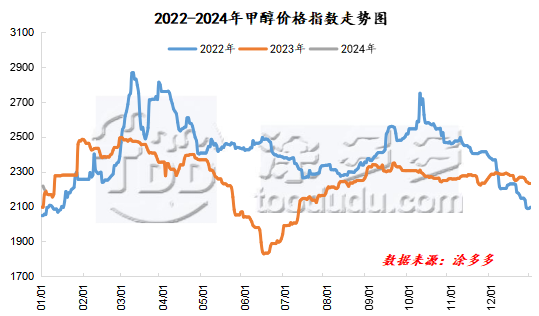

Methanol: Futures rebound from low and spot market continues to be weak

On January 3, the methanol market price index was 2198.28, down 19.11 from yesterday and 0.86 per cent lower than yesterday.

Outer disk dynamics:

Methanol closed on January 2:

China CFR 286-288 US dollars / ton, down 4 US dollars / ton

Us FOB 97-98 cents per gallon, flat

Southeast Asian CFR 337.5-338.5 US dollars / ton, down 2.50 US dollars / ton

European FOB 299-300EUR / ton, flat.

Summary of today's prices:

Guanzhong: 2170-2220 (- 60), North Route: 1880-1930 (- 10), Lunan: 2380 (0), Henan: 2275-2285 (- 15), Shanxi: 2120-2250 (0), Port: 2410-2430 (- 25)

Freight:

North Route-North Shandong 270-380 (10ax 10), South Route-North Shandong 280-340 (20pm 0), Shanxi-North Shandong 120-200 (- 10max 10), Guanzhong-Southwest Shandong 180-210 (0max 0)

Spot market: today, the methanol market price continues to be weak, the futures market has rebounded slightly, and the port spot quotation has been raised along with the market, but the overall trading atmosphere in the market is limited. At present, the weakness of terminal downstream demand is still the main factor dragging down the market price. Specifically, the market prices in the main producing areas have been adjusted in a narrow range, with quotations on the southern route around 1950 yuan / ton and the northern route around 1880-1930 yuan / ton, methanol futures have stabilized, the market trading atmosphere has warmed up, and some manufacturers have stopped selling. Market prices in Shandong, the main consumer area, fell in a narrow range, with 2380 yuan / ton in southern Shandong and 2250-2280 yuan / ton in northern Shandong. Due to the lower prices in the northwest and other peripheral areas, the market price in northern Shandong has been dragged down, and the current inventory of raw materials in downstream factories is relatively high. the demand for methanol is limited. North China market quotation narrow adjustment, Hebei quotation today 2250-2300 yuan / ton, downstream bargain into the market rigid demand to buy, the shipping speed of some manufacturers slowed down compared with the previous period. The quotation in Shanxi region is running steadily, and the quotation is stable to 2120-2250 yuan / ton today, and the attitude of the operators in the field is not good.

Port market: methanol futures fluctuated in a narrow range today. Spot a small amount of rigid demand, arbitrage and unilateral shipments, buying cautious, weak basis. There was less trading in the afternoon, and the stalemate became more apparent. The deal is light. Taicang main port transaction price: 1 transaction price: 1 transaction: 2400-2420, base difference 05: 12, base difference 05: 20, transaction price: 2415-2435, basis difference: 05: 25, transaction price: 2430-2445, basis difference: 05: 35: 40.

|

Area |

2024/1/3 |

2024/1/2 |

Rise and fall |

|

The whole country |

2198.28 |

2217.39 |

-19.11 |

|

Northwest |

1880-2220 |

1890-2260 |

-10/-40 |

|

North China |

2120-2300 |

2120-2350 |

0/-50 |

|

East China |

2410-2550 |

2435-2570 |

-25/-20 |

|

South China |

2405-2550 |

2395-2570 |

10/-20 |

|

Southwest |

2220-2600 |

2180-2600 |

40/0 |

|

Northeast China |

2220-2350 |

2250-2350 |

-30/0 |

|

Shandong |

2250-2380 |

2260-2420 |

-10/-40 |

|

Central China |

2275-2580 |

2290-2580 |

-15/0 |

Future forecast: recently, the overall supply performance of the Chinese market is abundant. At present, Zhongxin and Dahua units have been ignited, but Huayu 1.2 million ton methanol plant began to carry out planned maintenance today to maintain low-load production. The daily output has dropped from 3000 tons / day to 1000 tons / day, the market supply has been reduced, and there is some support in the market price in the region, but at present, the performance of the terminal downstream market is still poor, and it is nearing the end of the year. With the expectation that the terminal downstream demand may continue to weaken, it will be difficult for the demand side to bring favorable support to the methanol market in the short term. In the port market, the inventory was significantly removed during the week, among which the inventory reduction in East China was the most obvious, mainly because the shipping closure during the foggy weather affected the entry speed of the Yangtze River Estuary, and the consumption of rigid demand downstream was stable. At present, the futures market has rebounded slightly, the enthusiasm of some operators in the market to enter the market and replenish the stock has slightly increased, manufacturers' shipments are smooth, and the short-term methanol market price is expected to adjust within a narrow range. However, in the later stage, it is necessary to pay close attention to the on-site transportation and downstream demand follow-up.