PVC: The futures price closed sideways at a low position, and the position was lightened. The spot continued to be consolidated in a narrow range.

PVC futures analysis: January 3 V2405 contract opening price: 5913, highest price: 5948, lowest price: 5875, position: 859255, settlement price: 5911, yesterday settlement: 5897, down: 14, daily trading volume: 729268 lots, precipitated capital: 3.579 billion, capital outflow: 33.15 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.2 |

Price 1.3 |

Rise and fall |

Remarks |

|

North China |

5480-5560 |

5500-5570 |

20/10 |

Send to cash remittance |

|

East China |

5640-5720 |

5640-5730 |

0/10 |

Cash out of the warehouse |

|

South China |

5680-5730 |

5680-5730 |

0/0 |

Cash out of the warehouse |

|

Northeast China |

5550-5750 |

5550-5750 |

0/0 |

Send to cash remittance |

|

Central China |

5550-5680 |

5560-5700 |

10/20 |

Send to cash remittance |

|

Southwest |

5550-5600 |

5550-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices do not change much, more regions maintain wait-and-see. Valuation comparison: North China rose 10-20 yuan / ton, East China rose 10 yuan / ton, South China and Northeast China were stable, Central China rose 10-20 yuan / ton, and Southwest China was stable. The ex-factory price of upstream PVC production enterprises has been raised by 30-50 yuan per ton, and most enterprises have maintained stable quotations. The futures price trend is slightly stronger in the afternoon, so the overall quotation in the spot market does not change much, basically in the morning, and the basis offer does not change much. Although the point price and the one-bite price coexist, the point price source has no price advantage for the time being. Among them, East China basis offer 05 contract-(220-270-330), South China 05 contract-(200), North 05 contract-(600-640) Southwest 05 contract-(260), the terminal hanging order enthusiasm is poor, bargain replenishment, some areas wait-and-see atmosphere is strong, the spot market trading atmosphere is light.

Futures point of view: PVC2405 contract night trading narrow range volatility, futures price volatility is relatively small. Prices rose slightly after the start of morning trading, followed by intraday shocks, and continued to rise for the second time in the afternoon, but the extent of the second rise was small. 2405 contracts range from 5876 to 5948 throughout the day, with a spread of 72. 05 contracts with an increase of 11629 positions and 859255 positions so far. The 2409 contract closed at 6046, with 54443 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2405 contract futures is in line with our expectations, trading sideways in the low range, but the price closed slightly higher at the end of the day, showing a certain position reduction trend. First of all, from the overall commodity point of view, at the close of midday trading, the main contracts of Chinese futures rose and fell differently. The container transport index (European line) rose by 23%, glass by more than 4%, coking coal and urea by more than 3%, pulp, iron ore, soda ash, coke and alumina by more than 2%. In terms of decline, SC crude oil fell by more than 2%, liquefied petroleum gas (LPG), bean one, butadiene rubber (BR) and caustic soda fell by nearly 2%. Among the many star varieties, the attention of PVC has declined. From the current trend of futures price operation, we think that it will still be arranged sideways in the low range in the short term, and continue to observe the performance of the range 5880-5980.

Spot aspect: & the operation of the nbsp; spot market continues to be weak and the state of low valuation continues. At present, the fundamental variables of PVC are few, but from the point of view of chlor-alkali enterprises, in view of the continuous fermentation of the Red Sea time, the start of alumina has been affected, the price of the product in the two markets has risen sharply, on the contrary, it is relatively bearish and caustic soda, the recent caustic soda whether spot or futures show a relatively weak situation, thus affecting the overall chlor-alkali profits, although PVC is willing to raise the price, but the restriction of helpless demand is still relatively obvious. In the outer disk, international oil prices continued to decline as the New year oil price rise triggered by renewed tensions in the Red Sea evaporated as supply concerns eased and expectations of interest rate cuts in 2024 weakened. In addition, demand growth and compliance with the additional production cuts announced by OPEC in the first quarter are back in focus. On the whole, China's PVC spot market will continue to sort out slightly in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.2 |

Price 1.3 |

Rate of change |

|

V2405 collection |

5920 |

5945 |

25 |

|

|

Average spot price in East China |

5680 |

5685 |

5 |

|

|

Average spot price in South China |

5705 |

5705 |

0 |

|

|

PVC2405 basis difference |

-240 |

-260 |

-20 |

|

|

V2409 collection |

6028 |

6046 |

18 |

|

|

V2405-2409 close |

-108 |

-101 |

7 |

|

|

PP2405 collection |

7492 |

7477 |

-15 |

|

|

Plastic L2405 collection |

8223 |

8196 |

-27 |

|

|

V--PP basis difference |

-1572 |

-1532 |

40 |

|

|

Vmure-L basis difference of plastics |

-2303 |

-2251 |

52 |

|

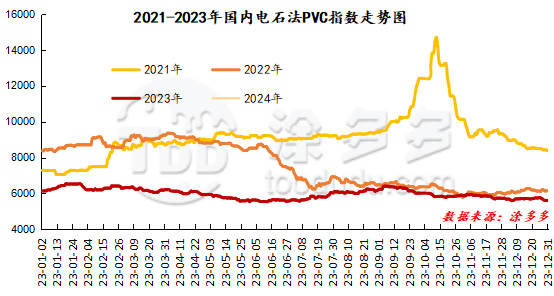

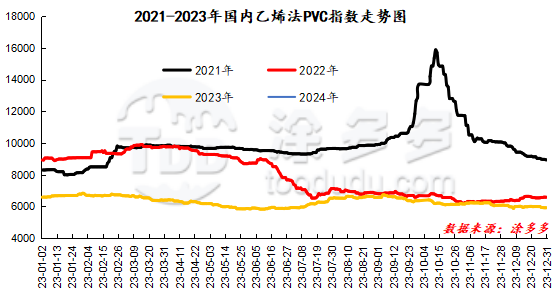

China PVC Index: according to Tudoduo data, the spot index of China calcium Carbide PVC rose 6.44, or 0.114%, to 5639.6 on January 3. The ethylene method PVC spot index is 5915.4, up 1.47, the range is 0.025%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 275.8.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.2 warehouse receipt quantity |

1.3 warehouse receipt volume |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,245 |

2,245 |

0 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,282 |

1,282 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

782 |

1,195 |

413 |

|

|

Zhenjiang Middle and far Sea |

782 |

1,195 |

413 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,806 |

4,806 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,032 |

4,032 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

20,344 |

20,458 |

114 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,495 |

3,495 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

470 |

470 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

687 |

687 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

52,094 |

52,621 |

527 |

|

Total |

|

52,094 |

52,621 |

527 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.