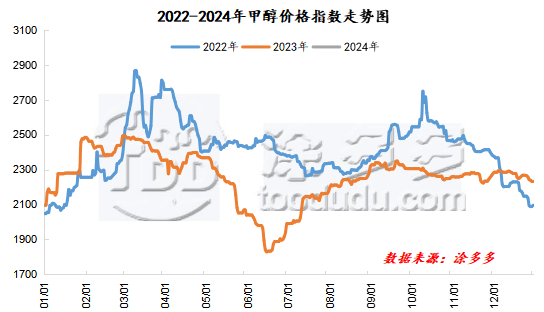

Methanol: The fundamentals are weak and the methanol period is now weak and volatile

On January 2, the methanol market price index was 2217.39, 14.75 lower than the previous working day, and 0.66% lower than the previous working day.

Summary of today's prices:

Guanzhong: 2230-2260 (0), North Route: 1890-1920 (- 30), Lunan: 2420 (0), Henan: 2290-2305 (- 10), Shanxi: 2120-2250 (- 60), Port: 2435-2450 (0)

Freight:

North Route-Northern Shandong 260-370 (- 30 Uniqmer Mel 10), Southern Route-Northern Shandong 260-340 (- 10 Maxime 10), Shanxi-Northern Shandong 130-190 (0max 0), Guanzhong-Southwest Shandong 180-210 (0max 0)

Spot market: today, methanol market prices continue to be weak, futures trading down more than 2% after the shock operation, the port spot market trading atmosphere is general, the market mindset is general, the market wait-and-see mood is obvious, the first day back after the festival, there is no centralized replenishment phenomenon in the downstream market. Specifically, the market prices in the main producing areas are adjusted in a narrow range, with the quotation on the southern route around 2030 yuan / ton and the northern line around 1890-1920 yuan / ton, and the futures market is low and fluctuating, suppressing the enthusiasm of downstream and traders to enter the market to a certain extent. and the current downstream market demand performance is general, methanol consumption has been reduced. Market prices in Shandong, the main consumer area, fell within a narrow range, with 2420 yuan / ton in southern Shandong and 2260 yuan / ton in northern Shandong, which was 40 yuan / ton lower than the previous working day. at present, the market demand downstream of the terminal is limited, under the consumption of rigid demand, and the trading atmosphere is general in the market. coupled with the shock of the futures market, negative market sentiment, but the current low inventory operation of manufacturers, manufacturers still maintain price sentiment. North China market quotation narrow adjustment, Hebei quotation 2270-2350 yuan / ton today, downstream demand follow-up is limited, factory shipments are general, factories in order to reduce inventory pressure, more profit shipments. The quotation in Shanxi region has been running steadily, and the quotation has been lowered to 2120-2250 yuan / ton today. At present, the mindset of the operators in the market is poor, and the market quotation has been lowered along with it.

Port market: methanol futures consolidated after falling today. Spot purchase on demand, the transaction is limited. Paper goods in the morning low pick-up active, arbitrage shipments, the basis is strong; afternoon trading decreased, slightly stalemate. The overall deal is OK. Taicang main port transaction price: spot transaction: 2410-2430, base spread 05: 15: 1 transaction: 2410-2430, base difference 05: 15: 1 medium transaction: 2415-2425, base difference 05: 20: 1 transaction: 2420-2445, basis difference 05: 25 pound: 352 transaction: 2430-2440, basis difference 05: 40pm 45.

|

Area |

2024/1/2 |

2023/12/29 |

Rise and fall |

|

The whole country |

2217.39 |

2232.15 |

-14.76 |

|

Northwest |

1890-2260 |

1920-2260 |

-30/0 |

|

North China |

2120-2350 |

2180-2350 |

-60/0 |

|

East China |

2435-2570 |

2435-2570 |

0/0 |

|

South China |

2395-2570 |

2430-2600 |

-35/-30 |

|

Southwest |

2180-2600 |

2180-2600 |

0/0 |

|

Northeast China |

2250-2350 |

2250-2350 |

0/0 |

|

Shandong |

2260-2420 |

2300-2420 |

-40/0 |

|

Central China |

2290-2580 |

2300-2600 |

-10/-20 |

Future forecast: recently, many places in the Chinese market are affected by weather warning, and the demand for methanol in the downstream market has been reduced, coupled with the weak volatility of the futures market, which suppresses the mentality of the industry to a certain extent, and on the first day of New Year's Day's price return, there is no centralized replenishment operation in the downstream market, and manufacturers' quotations fall under the influence of the contradiction between supply and demand. At present, the coal price at the raw material end is weak, the methanol bottom support is insufficient, coupled with the poor performance of methanol itself, it is expected that the methanol market price will continue to be weak in the short term, but in the later stage, we should pay close attention to the on-site transportation and downstream demand follow-up.