PVC: The futures price support level has worked slightly. Both long and short sides have opened equal positions, and the spot is adjusted slightly flexibly.

PVC futures analysis: January 2 V2405 contract opening price: 5880, highest price: 5928, lowest price: 5856, position: 870884, settlement price: 5897, yesterday settlement: 5906, down: 9, daily trading volume: 523889 lots, precipitated capital: 3.609 billion, capital inflow: 86.83 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.29 |

Price 1.2 |

Rise and fall |

Remarks |

|

North China |

5450-5550 |

5480-5560 |

30/10 |

Send to cash remittance |

|

East China |

5630-5690 |

5640-5720 |

10/30 |

Cash out of the warehouse |

|

South China |

5670-5720 |

5680-5730 |

10/10 |

Cash out of the warehouse |

|

Northeast China |

5550-5750 |

5550-5750 |

0/0 |

Send to cash remittance |

|

Central China |

5550-5560 |

5550-5680 |

0/20 |

Send to cash remittance |

|

Southwest |

5500-5570 |

5550-5600 |

50/30 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price range is mainly sorted out, and the price is adjusted flexibly. Compared with the valuation, North China rose 10-30 yuan / ton, East China 10-30 yuan / ton, South China 10 yuan / ton, Northeast China stable, Central China 20 yuan / ton, Southwest China 30-50 yuan / ton. Upstream PVC production enterprises mostly maintain stable ex-factory prices, individual enterprises in order to stimulate the source of shipments a small large discount. The futures market first fell and then rose, and the spot market traders' early price offer changed little compared with last Friday, and the market point price and the market price coexisted, and the basis offer was slightly stronger. Among them, East China basis offer 05 contract-(250-270-330), South China 05 contract-(150-200), North 05 contract-(600-640), Southwest 05 contract-(260), spot price supply has price advantage in the morning However, the lower order price in the lower reaches leads to few actual transactions, the afternoon futures upstream, the point price advantage disappears, the downstream purchasing enthusiasm is not high, and the trading atmosphere in the spot market is weak.

Futures point of view: PVC2405 contract prices fell slightly after the start of early trading, and then bottomed out. Futures prices rose to repair the decline in early trading, and continued to shake above 5900 after rising in the afternoon until the end of the day. 2405 contracts range from 5856 to 5928 throughout the day, with a spread of 72. 05 contracts with an increase of 15026 positions and 870884 positions so far. The 2409 contract closed at 6028, with 52489 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures run as we expected, showed a certain support performance around 5850, did not effectively fall below this position and then the price bottomed out and rebounded, in terms of trading, long and short positions are neck and neck, of which 24.4% short opening ratio opened 24.9% more. The technical level shows that although the three tracks of the Bolin belt (13, 13, 2) are still open, the downward direction of the middle rail is obvious, and the KD line and MACD line at the daily level still show dead forks. The first trading day of 2024 closed at noon, and the main contracts of Chinese futures were mixed. At present, the short-term PVC futures may still test the low range position, we still maintain the previous judgment, the operation of the futures price may still need to observe the performance of the 5870-5980 range.

Spot aspect: The opening price of the first day after the festival bottomed out and rebounded. Judging from the trend of the market, the operation of the futures price was OK, but the spot market showed a certain weakness, especially in terms of transaction, although the first day point price and a mouthful price coexisted, but the spot market was in a state of poor transaction, on the one hand, the order was on the low side in the morning, on the other hand, the price had no great reference significance. Therefore, although the rebound in futures prices did not drive the atmosphere of the spot market. From the point of view of the two major products of chlor-alkali enterprises, caustic soda is driven by alumina to show a certain strong trend, but the fundamentals of PVC are weak. Although the loss of individual products is relatively obvious and the valuation is low, the demand and real estate constraints are always difficult to improve. Especially in the period before the Spring Festival, there are no additional factors to stimulate, the two cities may still show a weak trend, the overall short-term spot prices of PVC may still continue the trend of small fluctuations.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.29 |

Price 1.2 |

Rate of change |

|

V2405 collection |

5879 |

5920 |

41 |

|

|

Average spot price in East China |

5660 |

5680 |

20 |

|

|

Average spot price in South China |

5695 |

5705 |

10 |

|

|

PVC2405 basis difference |

-219 |

-240 |

-21 |

|

|

V2409 collection |

5987 |

6028 |

41 |

|

|

V2405-2409 close |

-108 |

-108 |

0 |

|

|

PP2405 collection |

7560 |

7492 |

-68 |

|

|

Plastic L2405 collection |

8280 |

8223 |

-57 |

|

|

V--PP basis difference |

-1681 |

-1572 |

109 |

|

|

Vmure-L basis difference of plastics |

-2401 |

-2303 |

98 |

|

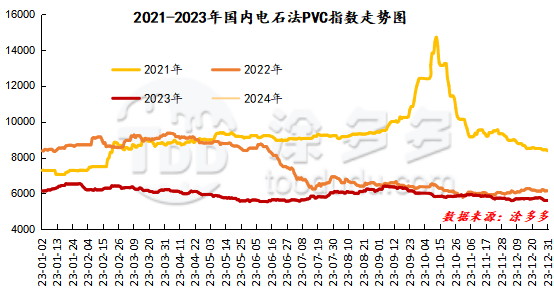

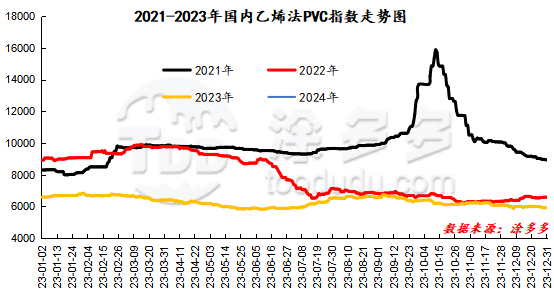

China PVC Index: the spot index of China's calcium carbide PVC rose 23.28, or 0.415%, to 5633.16 on January 2, according to Tudor data. The PVC spot index of ethylene method was 5913.93, down 8.39%, with a range of 0.142%. The calcium carbide index rose, the ethylene index decreased, and the ethylene-calcium carbide index spread was 280.77.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.29 warehouse orders |

1.2 warehouse receipt quantity |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,245 |

2,245 |

0 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,282 |

1,282 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

584 |

782 |

198 |

|

|

Zhenjiang Middle and far Sea |

584 |

782 |

198 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,806 |

4,806 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,032 |

4,032 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

19,970 |

20,344 |

374 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,495 |

3,495 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

470 |

470 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

687 |

687 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

51,522 |

52,094 |

572 |

|

Total |

|

51,522 |

52,094 |

572 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.