PVC: Futures prices showed five consecutive negative declines, technical closing lines were short, and the spot market continued to decline

PVC futures analysis: December 29th V2405 contract opening price: 5923, highest price: 5946, lowest price: 5873, position: 855858, settlement price: 5906, yesterday settlement: 5959, down: 53, daily trading volume: 812753 lots, precipitated capital: 3.522 billion, capital inflow: 68.82 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.28 |

Price 12.29 |

Rise and fall |

Remarks |

|

North China |

5500-5570 |

5450-5550 |

-50/-20 |

Send to cash remittance |

|

East China |

5650-5720 |

5630-5690 |

-20/-30 |

Cash out of the warehouse |

|

South China |

5700-5740 |

5670-5720 |

-30/-20 |

Cash out of the warehouse |

|

Northeast China |

5550-5750 |

5550-5750 |

0/0 |

Send to cash remittance |

|

Central China |

5570-5580 |

5550-5560 |

-20/-20 |

Send to cash remittance |

|

Southwest |

5550-5620 |

5500-5570 |

-50/-50 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices still fell again, the market atmosphere is not good. Compared with the valuation, it fell 20-50 yuan / ton in North China, 20-30 yuan / ton in East China, 20-30 yuan / ton in South China, stable in Northeast China, 20 yuan / ton in Central China and 50 yuan / ton in Southwest China. Upstream PVC production enterprises factory price part of the reduction of 20-50 yuan / ton, some enterprises happen to wait and see prices on Friday. The futures market is weak again, and the market is not operating well. The price offered by traders in the spot market in the morning is lower than that of yesterday, but it is difficult to make an actual deal. After the futures price has gone down, the spot price is relatively active, and the purchasing enthusiasm of the lower reaches has been improved. Part of the basis offer is slightly stronger. Among them, East China basis offer 05 contract-(250-300-350), South China 05 contract-(200), North 05 contract-(600-650), Southwest 05 contract-(260), as a whole, most of the downstream intended to purchase pre-sale sources, low prices compared with the previous period increased, the spot market trading atmosphere is OK.

From the perspective of futures: & the night price of nbsp; PVC2405 contract is mainly arranged in a narrow range, and the fluctuation of the futures price is lack of certain direction. Futures prices weakened slightly after the start of morning trading and fluctuated in a small range at low levels in the afternoon. 2405 contracts range from 5873 to 5946 throughout the day, with a spread of 73. 05 contracts with an increase of 24361 positions and 855858 positions so far. The 2401 contract closed at 5599, with 28004 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2405 contract futures continued to increase positions and fell, and the short opening was relatively obvious. In terms of transaction, 26.3% of them opened more than 22.7%. The recent operation of futures prices began to show a five-streak decline at the high, and today's low pierced the lower rail support level, which did not work, and did not change significantly after finishing in the low and narrow range for a long time in the afternoon. New Year's Day small holiday comes on Friday and there is no night plate, the plate still showed a trend of increasing positions, thus it can be seen that the current air mood is relatively strong. At the technical level, it shows that the middle rail of the Bolin belt (13, 13, 2) is downward, and the KD line and MACD line of the daily line are all dead forks. In the short term, the operation of the forward price observes the support performance of 5850 in the front low direction.

Spot aspect: period falls continuously in the two cities, the overall operation atmosphere of the spot market is slightly tired, but the point price in the low range is OK, and the inquiry enthusiasm of part of the forward pre-sale source is also increased, so the rigid demand of the spot market exists, the situation of low PVC valuation is also the consensus of the industry chain, and the long-term downward market, PVC unit loss is more obvious. However, the fundamentals of high inventory and weak PVC caused by the game of supply and demand are always difficult to break, and the poor performance of real estate data restricts the overall rebound peak of PVC. On the outer disk, international oil prices fell 3 per cent, and more shipping companies said they were ready to resume routes to the Red Sea, easing fears of supply disruptions due to rising tensions in the Middle East. On the whole, it is difficult to have better variable factors for the weak fundamentals of PVC in the short term, and the spot price of PVC may still be low, but the lower space may be limited.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.28 |

Price 12.29 |

Rate of change |

|

V2405 collection |

5933 |

5879 |

-54 |

|

|

Average spot price in East China |

5685 |

5660 |

-25 |

|

|

Average spot price in South China |

5720 |

5695 |

-25 |

|

|

PVC2405 basis difference |

-248 |

-219 |

29 |

|

|

V2409 collection |

6040 |

5987 |

-53 |

|

|

V2405-2409 close |

-107 |

-108 |

-1 |

|

|

PP2405 collection |

7619 |

7560 |

-59 |

|

|

Plastic L2405 collection |

8291 |

8280 |

-11 |

|

|

V--PP basis difference |

-1686 |

-1681 |

5 |

|

|

Vmure-L basis difference of plastics |

-2358 |

-2401 |

-43 |

|

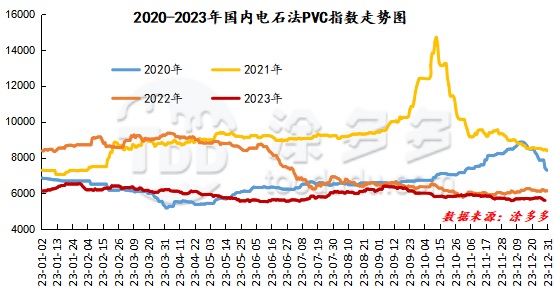

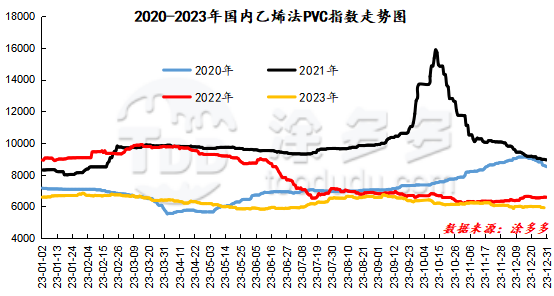

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 27.16, or 0.482%, to 5609.88 on December 29th. The ethylene PVC spot index was 5922.32, down 11.88, or 0.2%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 312.44.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.28 warehouse orders |

12.29 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,245 |

2,245 |

0 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,282 |

1,282 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

584 |

584 |

0 |

|

|

Zhenjiang Middle and far Sea |

584 |

584 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,806 |

4,806 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

3,607 |

4,032 |

425 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

19,791 |

19,970 |

179 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,495 |

3,495 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

470 |

470 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

687 |

687 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

50,918 |

51,522 |

604 |

|

Total |

|

50,918 |

51,522 |

604 |

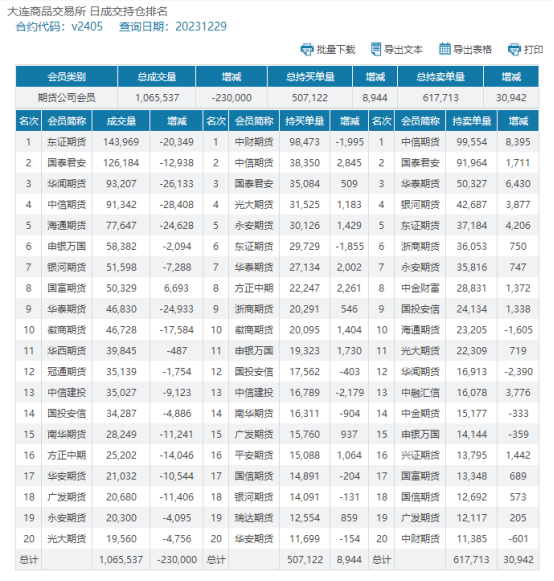

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.