PVC: The futures price was tested back with the prefix "6", and the market continued to fall.

PVC futures analysis: December 27th V2405 contract opening price: 6069, highest price: 6088, lowest price: 6003, position: 750163, settlement price: 6036, yesterday settlement: 6085, down: 49, daily trading volume: 848302 lots, precipitated capital: 3.159 billion, capital inflow: 157 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.26 |

Price 12.27 |

Rise and fall |

Remarks |

|

North China |

5640-5680 |

5600-5630 |

-40/-50 |

Send to cash remittance |

|

East China |

5790-5820 |

5730-5770 |

-60/-50 |

Cash out of the warehouse |

|

South China |

5780-5860 |

5730-5840 |

-50/-20 |

Cash out of the warehouse |

|

Northeast China |

5550-5800 |

5550-5780 |

0/-20 |

Send to cash remittance |

|

Central China |

5670-5750 |

5630-5650 |

-40/-100 |

Send to cash remittance |

|

Southwest |

5600-5660 |

5600-5650 |

0/-10 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices continue to decline, the spot market operation atmosphere is weak. Compared with the valuation, it fell by 40-50 yuan / ton in North China, 50-60 yuan / ton in East China, 20-50 yuan / ton in South China, 20 yuan / ton in Northeast China, 40-100 yuan / ton in Central China and 10 yuan / ton in Southwest China. Upstream PVC production enterprises factory price reduction of 20-50 yuan / ton, including off-site warehouse quotations, individual enterprises are still stable prices wait and see. Futures futures prices fell, the spot market traders offered a lower price than yesterday, high-price offer is difficult to close. After the futures price went down, the spot price advantage increased, including East China basis offer 05 contract-(250-300-350), South China 05 contract-(150-220), North 05 contract-(620), Southwest 05 contract-(260). Although the futures price downside point offer has advantages, but the downstream product enterprises hang order point is low, the overall market whether it is a single price or point price is not good. Most of the actual transactions still have a small negotiation. Downstream procurement is not high, still intend to wait and see.

Futures point of view: PVC2405 contract night trading opened to maintain a narrow range of volatility, but the late night price fell significantly. After the start of morning trading, the futures price runs in a narrow range of low first line, and there is no big change in the afternoon, which is still dominated by small-scale consolidation. 2405 contracts range from 6003 to 6088 throughout the day, with a spread of 85. 05. The contract increased its position by 43685 hands, and has held 750163 positions so far. The 2401 contract closed at 5768, with 68663 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures first of all from the transaction point of view, of which open 24.5% compared with 25.4% more, the futures price after the downside there is a certain single resistance, today's disk volume increased by more than 44000 hands, long and short both sides have positions to enter. The trend of the futures price continued yesterday's downward trend, making the technical level of the closing line changed, the daily line-level KD line showed a dead fork, the MACD white line turned to a shorter distance between the two lines, the futures price showed a negative column through the middle track, and the technical level showed that the Bollinger belt (13,13,2) turned down. Futures prices as a whole show a weak trend, as we expected, in the test range of 6000-6030. Continue to observe the performance of the next range 5950-6030 in the short term.

Spot: first of all, the current fundamentals of China's PVC are still weak. In the continuous change of positions and months, the movement of funds has affected the spot market, and the weak fundamentals of the spot market can not boost the confidence of the futures market, so the two comparisons are counterproductive. At present, the fundamentals of PVC are still the consensus of the industrial chain, and the rise caused by the incident is relatively short, and it is difficult for PVC to have a good fundamental performance in the short-term and medium-term market, so the suppression of the market is also relatively obvious, while the spot market buys down but does not buy up, and the wait-and-see mentality of the high price transaction is not smooth downstream also forms shackles. And in the pre-festival supply and demand game under the high inventory is always difficult to effectively digest, in the short term, the PVC spot market still continues the trend of small consolidation.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.26 |

Price 12.27 |

Rate of change |

|

V2405 collection |

6069 |

6015 |

-54 |

|

|

Average spot price in East China |

5805 |

5750 |

-55 |

|

|

Average spot price in South China |

5820 |

5785 |

-35 |

|

|

PVC2405 basis difference |

-264 |

-265 |

-1 |

|

|

V2409 collection |

6169 |

6116 |

-53 |

|

|

V2405-2409 close |

-100 |

-101 |

-1 |

|

|

PP2405 collection |

7601 |

7632 |

31 |

|

|

Plastic L2405 collection |

8282 |

8330 |

48 |

|

|

V--PP basis difference |

-1532 |

-1617 |

-85 |

|

|

Vmure-L basis difference of plastics |

-2213 |

-2315 |

-102 |

|

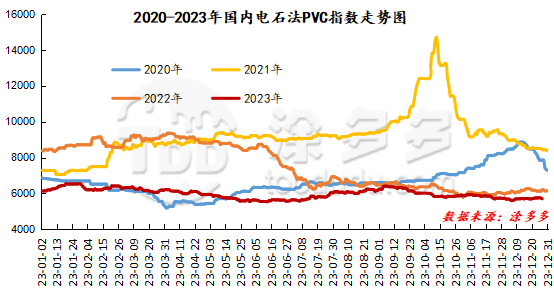

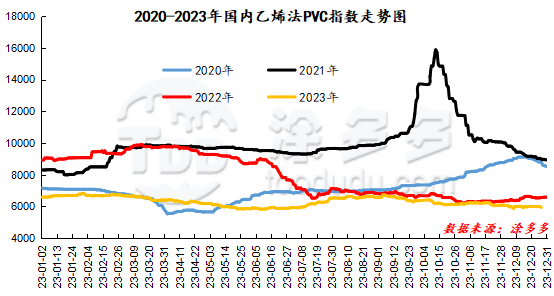

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot Index fell 43.12, or 0.751%, to 5699.83 on December 27th. The ethylene method PVC spot index was 5941.31, down 53.77%, with a range of 0.897%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 241.48.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.26 warehouse orders |

12.27 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,245 |

2,245 |

0 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,282 |

1,282 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

584 |

584 |

0 |

|

|

Zhenjiang Middle and far Sea |

584 |

584 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,806 |

4,806 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

3,607 |

3,607 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

19,494 |

19,554 |

60 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,495 |

3,495 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

470 |

470 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

687 |

687 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

50,621 |

50,681 |

60 |

|

Total |

|

50,621 |

50,681 |

60 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.