Daily Review of Urea: The overall market atmosphere is short and supply is weak and positive (December 27)

China Urea Price Index:

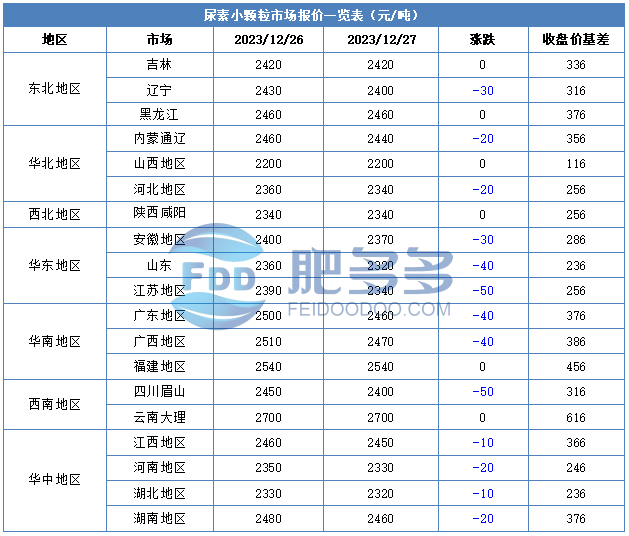

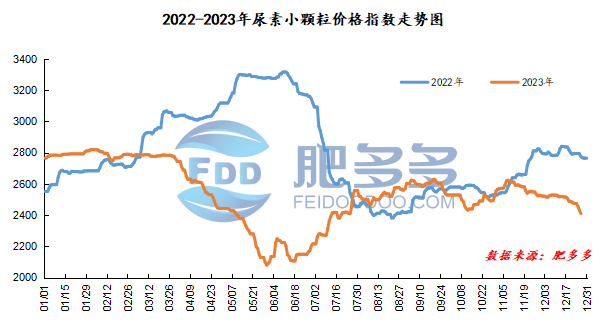

According to calculations from Feiduo data, the urea small pellet price index on December 27 was 2,409.82, a decrease of 20.45 from yesterday, a month-on-month decrease of 0.84% and a year-on-year decrease of 13.20%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2080, the highest price is 2100, the lowest price is 2070, the settlement price is 2089, and the closing price is 2084. The closing price has increased by 44 compared with the settlement price of the previous trading day, up 0.19% month-on-month. The fluctuation range of the whole day is 2070-2100; the basis of the 05 contract in Shandong is 236; the 05 contract has increased its position by 2645 lots today, with 185,900 lots held so far.

Spot market analysis:

Today, China's urea market prices continued their downward trend. The market was weak and demand was limited. Factory quotations were under pressure and downward, and actual transaction prices continued to fall.

Specifically, prices in Northeast China fell to 2,390 - 2,470 yuan/ton. Prices in North China fell to 2,200 - 2,450 yuan/ton. Prices in the northwest region are stable at 2,340 - 2,350 yuan/ton. Prices in Southwest China fell to 2,350 - 2,800 yuan/ton. Prices in East China fell to 2,300 - 2,380 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,310 - 2,550 yuan/ton, and the price of large particles stabilized at 2,410 - 2,480 yuan/ton. Prices in South China fell to 2,450 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers continue to reduce their orders, while follow-up of new orders is limited. Most manufacturers accept orders at low prices. The current company's advance receipt estimate remains at 4.76 days, and the number of days in advance receipt has increased slightly compared with the previous period, making factory quotations under pressure. In terms of the market, the market trading atmosphere continues to operate weakly, low-end market prices continue to emerge, the price center of gravity continues to explore, and the overall market atmosphere is empty. On the supply side, market supply continues to operate weakly, and Nissan has dropped to a low level, forming a certain weak positive support for the market. On the demand side, downstream demand is limited, and most of the goods entering the market are mainly reserved, and follow-up is slow. The demand side mentality is still cautious and the focus is on wait-and-see; compound fertilizer production costs are under pressure, operating rates are declining, and enthusiasm for urea procurement has dropped accordingly. The market is not good and the atmosphere is sluggish.

Overall, the current supply of urea market is weak and positive, but the downstream has not made a significant purchase response to this. The overall market atmosphere is empty. It is expected that the urea market price will continue to maintain a stable and downward consolidation in the short term.