PVC: Futures maintained an upward trend throughout the day, with the high sideways range slightly expanding, and spot operations slightly differentiated

PVC futures analysis: December 20 V2405 contract opening price: 5990, highest price: 6066, lowest price: 5973, position: 668561, settlement price: 6026, yesterday settlement: 6006, up: 20, daily trading volume: 783722 lots, precipitated capital: 2.835 billion, capital inflow: 44.53 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.19 |

Price 12.20 |

Rise and fall |

Remarks |

|

North China |

5600-5640 |

5690-5620 |

-10/-20 |

Send to cash remittance |

|

East China |

5690-5790 |

5710-5810 |

20/20 |

Cash out of the warehouse |

|

South China |

5760-5830 |

5750-5850 |

-10/20 |

Cash out of the warehouse |

|

Northeast China |

5500-5700 |

5500-5700 |

0/0 |

Send to cash remittance |

|

Central China |

5640-5660 |

5690-5710 |

50/50 |

Send to cash remittance |

|

Southwest |

5560-5680 |

5580-5700 |

20/20 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices rose slightly, the market operation atmosphere is slightly differentiated. Compared with the valuation, North China fell 10-20 yuan / ton, East China rose 20 yuan / ton, South China's high end rose 20 yuan / ton, the low end fell 10 yuan / ton, Northeast China temporarily stable, Central China rose 50 yuan / ton, Southwest region rose 20 yuan / ton. The ex-factory prices of upstream PVC production enterprises tentatively increased by 30-50 yuan per ton, and most enterprises maintained stable ex-factory prices. Futures showed a good upward trend, spot market traders quoted prices in the morning most stable, or even part of the decline, a slight increase of 20-30 yuan / ton in the afternoon. The supply advantage of spot price decreases after the futures price goes up, but there is still a point price offer, including East China basis offer 05 contract-(220-280-320), South China 05 contract-(150-180), North 05 contract-(550-580), Southwest 05 contract-(260). It is difficult to close a deal with a high offer in the morning session, and some real orders are discussed in a small way. After the price rose in the afternoon, the trading atmosphere further weakened.

Futures perspective: PVC2405 contract night trading experienced a small range of shocks, followed by a small rise in futures prices. After the start of morning trading, the futures price rose further, the afternoon price was still strong, and continued to rise slightly to close at the high in late trading. 2405 contracts range from 5973 to 6066 throughout the day, with a spread of 93. 05 contracts with an increase of 3697 positions and 668561 positions so far. The 2401 contract closed at 5879, with 198995 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures show a good upward trend throughout the day, although the volatility is still in a high horizontal state compared with the previous period, but the one-day upward trend is still driving the spot market. 05 the contract itself continues to show a small increase in positions, but the position volume has changed little today, and the opening volume of long and short sides is about the same, of which the open volume is 23.8% more than 23.5%. At the close of midday, most of the main contracts of Chinese futures rose, the container shipping index (European line) rose by 10%, ethylene glycol (EG) rose more than 3%, styrene (EB) rose nearly 3%, and methanol rose more than 2%. PVC main contract also follows the overall emergence of a better trend, as a whole, we still maintain the previous point of view, continue to observe the upper position within the range of 6050-6100 pressure performance.

Spot aspect: First of all, in terms of fundamentals, the start-up load of the PVC plant is still high, and the seasonal accumulation of demand in the fourth quarter is now the norm, so under the circumstances that these factors have not changed, the main force of PVC futures has a small upward trend following the overall commodity sentiment, which guides the spot market price, which is also confirmed by the rise in spot prices in the afternoon. But the weakening of trading can also be seen that spot sales pressure is greater. In addition, the price of calcium carbide in the cost port of PVC calcium carbide method has been rising slightly recently, and the cost support is obvious, which also leads to further reduction of profits or further expansion of losses in PVC of calcium carbide method. There is also great pressure on PVC production enterprises, and the situation of low valuation of individual products continues. In the outer disk, oil prices rose further and continued to be supported by concerns about supply disruptions caused by attacks on ships in the Red Sea. On the whole, the pace of small adjustment in the spot market remains unchanged in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.19 |

Price 12.20 |

Rate of change |

|

V2401 collection |

5995 |

6057 |

62 |

|

|

Average spot price in East China |

5740 |

5760 |

20 |

|

|

Average spot price in South China |

5795 |

5800 |

5 |

|

|

PVC2401 basis difference |

-255 |

-297 |

-42 |

|

|

V2405 collection |

6083 |

6140 |

57 |

|

|

V2401-2405 closed |

-88 |

-83 |

5 |

|

|

PP2401 collection |

7458 |

7577 |

119 |

|

|

Plastic L2401 collection |

8122 |

8205 |

83 |

|

|

V--PP basis difference |

-1463 |

-1520 |

-57 |

|

|

Vmure-L basis difference of plastics |

-2127 |

-2148 |

-21 |

|

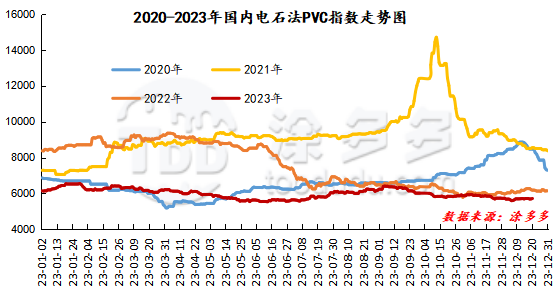

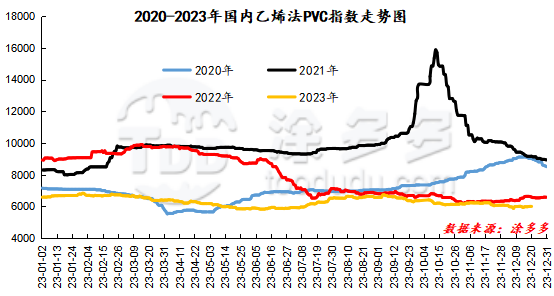

China PVC Index: the spot index of China's calcium carbide PVC rose 22.26, or 0.391%, to 5719.13 on December 20, according to Tudor data. The ethylene PVC spot index was 6005.06, down 1.03, with a range of 0.017%. The calcium carbide index rose, the ethylene index decreased, and the ethylene-calcium carbide index spread was 285.93.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.19 warehouse orders |

12.20 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,005 |

2,245 |

240 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,042 |

1,282 |

240 |

|

Polyvinyl chloride |

Cosco sea logistics |

584 |

584 |

0 |

|

|

Zhenjiang Middle and far Sea |

584 |

584 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,806 |

4,806 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

3,607 |

3,607 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

18,405 |

18,405 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,595 |

3,495 |

-100 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

470 |

470 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

487 |

487 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

49,192 |

49,332 |

140 |

|

Total |

|

49,192 |

49,332 |

140 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.