Daily Review of Urea: Low-price transactions in the market have improved under the game of manufacturers (December 20)

China Urea Price Index:

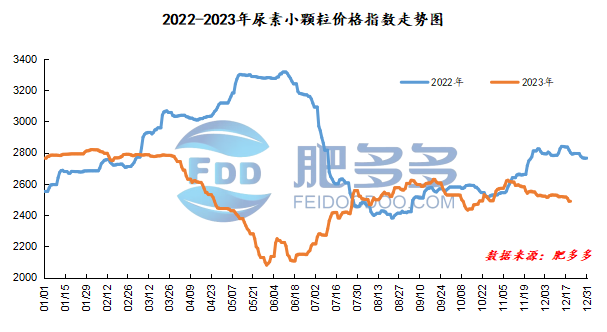

According to Feiduo data, the urea small pellet price index on December 20 was 2,485.45, a decrease of 3.32 from yesterday, a month-on-month decrease of 0.13% and a year-on-year decrease of 11.24%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2181, the highest price is 2185, the lowest price is 2144, the settlement price is 2164, and the closing price is 2166. The closing price is 44 lower than the settlement price of the previous trading day, down 0.18% month-on-month. The fluctuation range of the whole day is 2144-2185; the basis of the 05 contract in Shandong is 284; the 05 contract has increased its position by 7760 lots today, and so far, it has held 153,900 lots.

Spot market analysis:

Today, prices in China's urea market are mixed. After a large-scale price cut in the urea market yesterday, downstream bargain-hunting purchases are better, and low-end prices in the market are slightly adjusted.

Specifically, prices in Northeast China fell to 2,470 - 2,510 yuan/ton. Prices in North China fell to 2,280 - 2,510 yuan/ton. Prices in the northwest region are stable at 2,410 - 2,420 yuan/ton. Prices in Southwest China are stable at 2,450 - 2,800 yuan/ton. Prices in East China fell to 2,420 - 2,480 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,400 - 2,600 yuan/ton, and the price of large particles stabilized at 2,510 - 2,620 yuan/ton. Prices in South China have increased by 2,540 - 2,620 yuan/ton.

Market outlook forecast:

In terms of factories, the factory's current factory quotations remain relatively firm under the support of a new round of orders acquisitions. Yesterday, low-price transactions in the market were good. Some low-priced companies slightly raised their quotations, increasing their willingness to hold prices. In terms of the market, recent market conditions have loosened and downward, downstream purchasing sentiment has been sluggish, and some areas have been affected by rain and snow weather, which has restricted cargo transportation. As a result, corporate inventories continue to be exhausted, and the mentality of operators has become more cautious. The number of days Chinese companies advance orders has dropped. In terms of supply, the current market supply continues to decline, but the overall Nissan is still higher than the same period last year. The positive impact of supply reduction has not significantly supported market prices. On the demand side, downstream compound fertilizer companies have also been affected by costs, and their production plans have been reduced one after another. Some compound fertilizer factories have begun to have parking plans. At this stage, most replenishment is mainly based on small amounts that are just needed.

On the whole, the urea market is currently having difficulty accepting high-priced transactions, but low-end transactions have increased. It is expected that the urea market price will continue to be deadlocked and consolidated in a short period of time.