PVC: Futures increased positions by 110,000 lots, causing trouble or fighting for territory, and spot prices weakened slightly

PVC futures analysis: December 18 V2405 contract opening price: 6051, highest price: 6075, lowest price: 5960, position: 649222, settlement price: 6011, yesterday settlement: 6027, down: 16, daily trading volume: 979582 lots, precipitated capital: 2.723 billion, capital inflow: 442 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.15 |

Price 12.18 |

Rise and fall |

Remarks |

|

North China |

5600-5650 |

5600-5630 |

0/-20 |

Send to cash remittance |

|

East China |

5730-5800 |

5690-5760 |

-40/-40 |

Cash out of the warehouse |

|

South China |

5800-5840 |

5760-5820 |

-40/-20 |

Cash out of the warehouse |

|

Northeast China |

5550-5750 |

5500-5700 |

-50/-50 |

Send to cash remittance |

|

Central China |

5690-5710 |

5640-5660 |

-50/-50 |

Send to cash remittance |

|

Southwest |

5560-5680 |

5560-5680 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices weakened and began to perform poorly at the beginning of the week. Compared with the valuation, it fell by 20 yuan / ton in North China, 40 yuan / ton in East China, 20-40 yuan / ton in South China, 50 yuan / ton in Northeast China and 50 yuan / ton in Central China. Southwest China is stable for the time being. The ex-factory price of upstream PVC production enterprises was reduced by 50 yuan / ton individually, and most enterprises maintained wait-and-see, but there were few contracts signed on Monday. The main change in futures 05 contract shock weakened, the spot market traders in all regions of the price offer slightly lower than last Friday, but after the futures price downward, the point price supply part has a price advantage. The basis narrowed slightly, including East China basis offer 05 contract-(220-260-320), South China 05 contract-(150-180), North 05 contract-(550-580), Southwest 05 contract-(260). On the whole, the downstream procurement is not high, most enterprises choose to wait and see temporarily, the intention to take the price is low, the actual transaction is rare, and the trading atmosphere in the spot market is not good.

Futures point of view: PVC2405 contract completed the main change, Friday night trading opened that is slightly weaker. Prices fell significantly in early trading on Monday, with a deep downward trend after falling below the prefix, and afternoon prices were sorted out in a relatively low and narrow range. 2405 the contract fluctuates from 5960 to 6075 throughout the day, with a spread of 115,01and an increase of 111228 positions in the contract, with 649222 positions so far. The 2401 contract closed at 5824, with 264864 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures significantly increase positions, first of all, the main force to complete the replacement of 2405 contracts to become the main force, but become the main force on the first day to increase the position Yu 110000 hands, of which open 28.0% compared to open 28.5%, from the trading volume point of view, many short positions are quite large positions. However, the trend of the futures price shows a downward trend throughout the day, the technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) is flat, the low point of the price breaks through the position of the middle rail, and the high point continues to approach the upper track. the distance between the three tracks narrows in a continuous horizontal state. Futures as a whole closed in the negative column cross star, in the short term, the futures price after the change of the main force or still facing the trend of horizontal trading between the upper and middle orbits, observe the performance of the 05 contract within the range of 5950-6100.

Spot: first closed at noon, the main Chinese futures contracts fluctuated, most Chinese commodities completed the main change, 2405 contracts due to a longer distance or there is more uncertainty. After the contract has become the main contract, the volume of the futures price has greatly increased, and the long and short positions have entered the market, which has caused the competition for the futures price. it can also be seen that there are different views on the trend of forward contracts in the market. In terms of PVC fundamentals, Taiwan Formosa Plastics PVC for January shipments fell by US $30 / ton, CIF mainland price of US $745 (CFR) and CIF India price of US $770 (CFR). Send US $740 (CFR) to Southeast Asia, and the price decline of Formosa Plastics is slightly negative to some extent. In addition, calcium carbide prices rose slightly over the weekend, but the overall boost to PVC was limited. After the completion of the change of the main force, the weakening trend of 05 contracts is still affecting the spot market. On the whole, spot market prices may face certain adjustment shocks in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.15 |

Price 12.18 |

Rate of change |

|

V2401 collection |

5911 |

5992 |

81 |

|

|

Average spot price in East China |

5765 |

5725 |

-40 |

|

|

Average spot price in South China |

5820 |

5790 |

-30 |

|

|

PVC2401 basis difference |

-146 |

-267 |

-121 |

|

|

V2405 collection |

6058 |

6078 |

20 |

|

|

V2401-2405 closed |

-147 |

-86 |

61 |

|

|

PP2401 collection |

7496 |

7452 |

-44 |

|

|

Plastic L2401 collection |

8103 |

8111 |

8 |

|

|

V--PP basis difference |

-1585 |

-1460 |

125 |

|

|

Vmure-L basis difference of plastics |

-2192 |

-2119 |

73 |

|

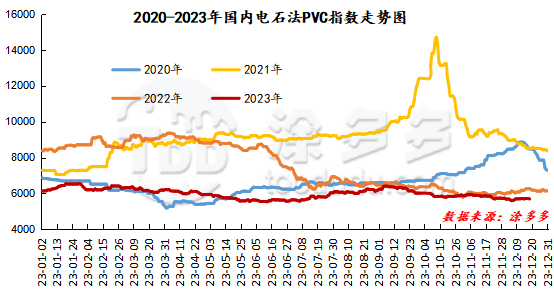

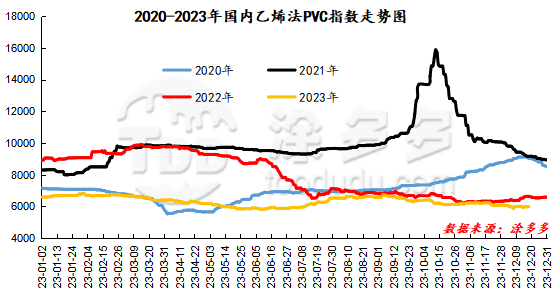

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC fell 27.17, or 0.475%, to 5690.25 on December 18. The ethylene PVC spot index was 5999.22, up 14.69, with a range of 0.254%, while the calcium carbide index decreased, the ethylene index rose, and the ethylene-calcium carbide index spread was 308.97.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.15 warehouse orders |

12.18 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,892 |

1,892 |

0 |

|

|

Guangzhou materials |

850 |

850 |

0 |

|

|

China Central Reserve Nanjing |

1,042 |

1,042 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

584 |

584 |

0 |

|

|

Zhenjiang Middle and far Sea |

584 |

584 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,806 |

4,806 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

3,087 |

3,267 |

180 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

18,405 |

18,405 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,595 |

3,595 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

470 |

470 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

487 |

487 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

48,559 |

48,739 |

180 |

|

Total |

|

48,559 |

48,739 |

180 |

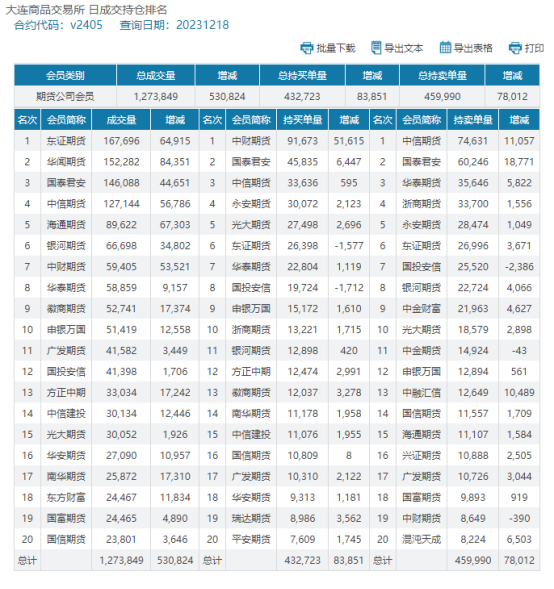

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.